Since joining Float as CEO just over a year ago, Rob Khazzam has steered the Toronto-based corporate card and spend management startup from “effectively zero” to over 1,000 Canadian company customers.

The former Uber Canada general manager joined Float in 2021, when the startup had only four employees, overseeing its expansion to 42. During this period, Khazzam told BetaKit the FinTech firm has experienced “unprecedented” product-driven growth supporting some of Canada’s fastest growing startups. This growth has led to and been fuelled by $42 million CAD in funding from a group that includes Tiger Global, Golden Ventures, Susa Ventures, Michael Hyatt, and Garage Capital.

“We’ve obviously taken note that there’s a lot of excitement in the category. And we think that’s a good thing.”

-Rob Khazzam, Float

But competition in the space Float serves has been heating up. Over the past year, American players like Brex, Ramp, Jeeves have closed major funding rounds at lofty valuations. While most remain focused on the United States (US) market, some have begun to creep north of the border.

Amid this environment, Float aims to serve the businesses ignored by Canada’s large banks and win big in the Canadian market before competition can swoop in.

In an interview with BetaKit, Khazzam said he isn’t concerned, viewing the increased excitement in the corporate card and spend management sector as a positive. Despite this increase in activity, Khazzam added, “I don’t know that [the market] has materially changed.”

“We’ve obviously taken note that there’s a lot of excitement in the category,” Khazzam told BetaKit in an interview. “And we think that’s a good thing. There’s almost $3 trillion spent by businesses in Canada every year, and the vast majority of businesses don’t use anything like Float, or any of the other players that you might look at.”

For now, Khazzam says Float is trying to remain focused on how best to serve its clients and avoid getting “distracted too much by what other people are doing.”

Float is part of a wave of new companies looking to bring financial alternatives to Canadian small and medium-sized businesses (SMBs) left underserved by big banks. Founded in 2019, Float provides Visa-issued cards to Canadian SMBs that integrate directly with company bank accounts. The startup’s offering allows businesses to give employees access to both virtual and physical corporate cards and set specific limits per employee. The notion is to eliminate the need for and bookkeeping caused by out-of-pocket spending by employees. Unlike banks, Float’s cards also do not require personal guarantees from company leaders.

RELATED: Tiger Global the latest suitor of corporate card startup Float in new $37 million CAD Series A

Over the last 12 months, Float has amassed a customer base of more than 1,000 Canadian companies, including some of Canada’s fastest-growing startups like Klue, Properly, and Clutch (angels from the latter two firms have also invested in Float). Along the way, the company has increased its monthly payment volumes by an average of 68 percent, compounded monthly—including by about 50 percent in March 2022 alone.

Float initially got its start serving smaller businesses, but the company has since begun to move up market and cater to bigger firms in the 100 employee range, which has fuelled some of its growth over the past year.

“We found that those larger businesses had an even greater need for Float than the smaller ones, because they have a lot more complexity,” said Khazzam, who noted that larger companies typically spend more and have more employees spending on behalf of the business. Float rolled out its team management product with these customers in mind.

“Coming from a background where I spent time at Uber launching businesses, it’s unprecedented the growth that we’re seeing, [and] most of that has really been done without much of a sales and marketing function,” said Khazzam. “It’s all product-led growth, and it’s just the benefit of the product and the fit that customers are feeling with it.”

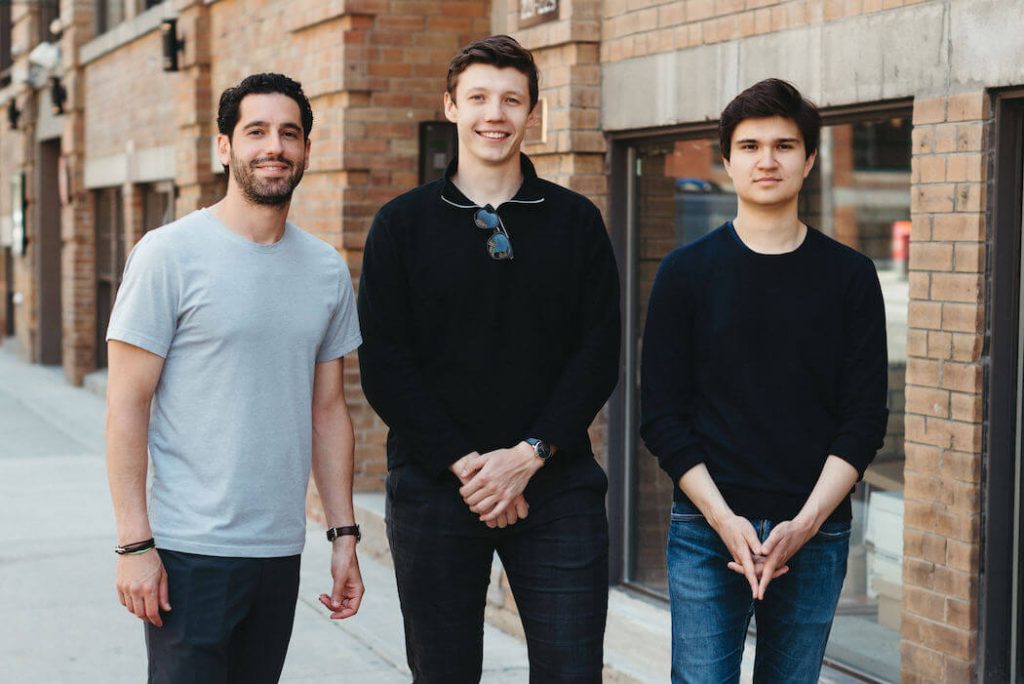

Float co-founders CEO Rob Khazzam, COO Ruslan Nikolaev, and CTO Griffin Keglevich launched the startup to make corporate credit cards less of a headache.

To support its growth, the company has also filled some key leadership roles during this time, adding former Shopify Senior Engineering Manager Ben Morris as head of engineering, Loopio and Influitive alum Mike Barrett as head of sales, ex-Top Hat VP of People and Culture Meghan Smith as head of people, and former Juno College Chief Marketing and Revenue Officer Amrita Gurney as head of marketing.

The expense management and corporate card sector has seen a lot of investment recently, as well as some consolidation; Utah-based unicorn Divvy was acquired by San Jose’s Bill.com, which provides financial software that helps SMBs manage their back-office operations.

RELATED: New York-based FinTech startup Jeeves announces $71.6 million CAD, expansion into Canada

Fortunately for Float, two of the best-capitalized players in the space aren’t currently focused on the Canadian market. New York-based Ramp’s service remains limited to United States (US) firms, while San Francisco-based Brex only serves Canadian company customers with US operations and incorporation.

Nonetheless, Canada has certainly been on Brex’s radar, at least from a talent and tech perspective, since the company opened up its first international office in Vancouver in 2020. The same could be said for Ramp, which acquired Vancouver-based Buyer last September.

In the Canadian market, Float’s startup competitors currently include New York-based Jeeves—which launched in Canada last year—and Toronto-based Caary, which secured $4.1 million in funding last summer.

Oakland-based Marqeta isn’t a direct competitor, but offers a similar service in the form of its open API card issuing and payment processing platform for FinTech companies, partnering with San Francisco-based Synctera and helping Block (formerly Square) launch its business expense card in Canada.

RELATED: Float secures $5 million seed round to make corporate credit cards less of a headache

In 2020, Toronto-based FinTech startup Wave and Ottawa retail giant Shopify both announced business bank account products for their customers, including cards. But to date, neither company has made their offering available to Canadian businesses, in favour of focusing on the US first.

Although Float’s coffers aren’t quite as deep as players like Jeeves, Brex, and Ramp, the startup has produced strong results by working very closely with its Canadian customers to ensure it’s providing what they need.

Float offers 24/7 customer support through its website chat. According to Khazzam, the company’s median response time is about five minutes. For some of its larger clients, Float has even set up dedicated Slack groups with customer’s finance teams designed to help them implement and improve Float. Khazzam described them as “almost like an informal customer advisory panel.”

Over the last 12 months, Float has grown from “effectively zero” customers to serve more than 1,000 Canadian companies.

“They ask us questions on the fly, we answer them, we do research with them on product,” said Khazzam. “We don’t build anything at Float until all of our customers—or at least most of our most engaged customers—have an opportunity to provide feedback on it.”

According to Khazzam, this approach helps Float “move really, really quickly” and not waste time building products that may not be valuable.

“A lot of [Float’s customers] are just, I’d say, product evangelists,” said Khazzam. “They’re passionate about it [and] some of them are even investors in the company because they’re so excited about what we’re doing.”

So far, this approach has served Float well. Ultimately, an army of evangelists and an informal customer advisory panel might help the startup to win big in the Canadian market.

With files from Meagan Simpson. Feature image courtesy Float.

Disclosure: Float has been a recent and ongoing advertiser on BetaKit.