With only five deals closed, venture funding activity in the Waterloo Region fell to a two-year low in the third quarter of 2021, according to the latest data from Hockeystick and briefed.in.

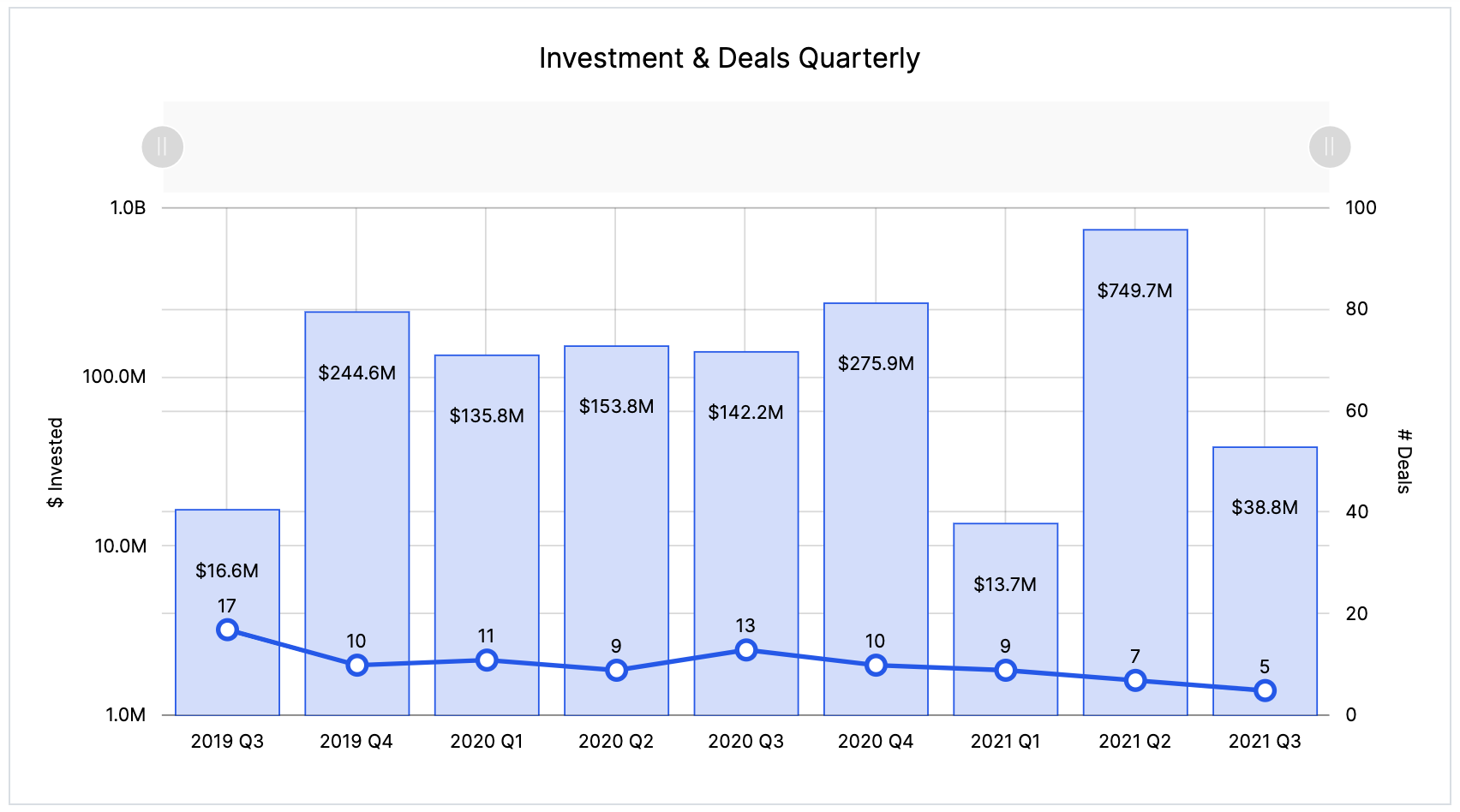

Hockeystick and briefed.in tracked a total of $38.8 million raised during Q3 2021, a 95 percent decrease from last quarter and a 73 percent decline year-over-year. The poor performance followed a record-setting Q2 for the region, which saw approximately $750 million raised.

Two Series A deals accounted for 98 percent of all reported investment raised in the Waterloo Region in Q3.

Generally, the Waterloo Region has seen large quarterly fluctuations in investment over the last year. The fourth quarter of 2020 and second quarter of 2021 represented impressive gains in investment, while funding in the first and third quarters of 2021 plunged. Jay Krishnan, Accelerator Centre CEO, said these boom-bust cycles should be expected.

“It’s not uncommon to see lumpy funding amounts in a small ecosystem,” Krishnan told BetaKit. “That is a function of the academic cycle, gestation periods of companies, and the often-changing runways that companies take to achieve scale.”

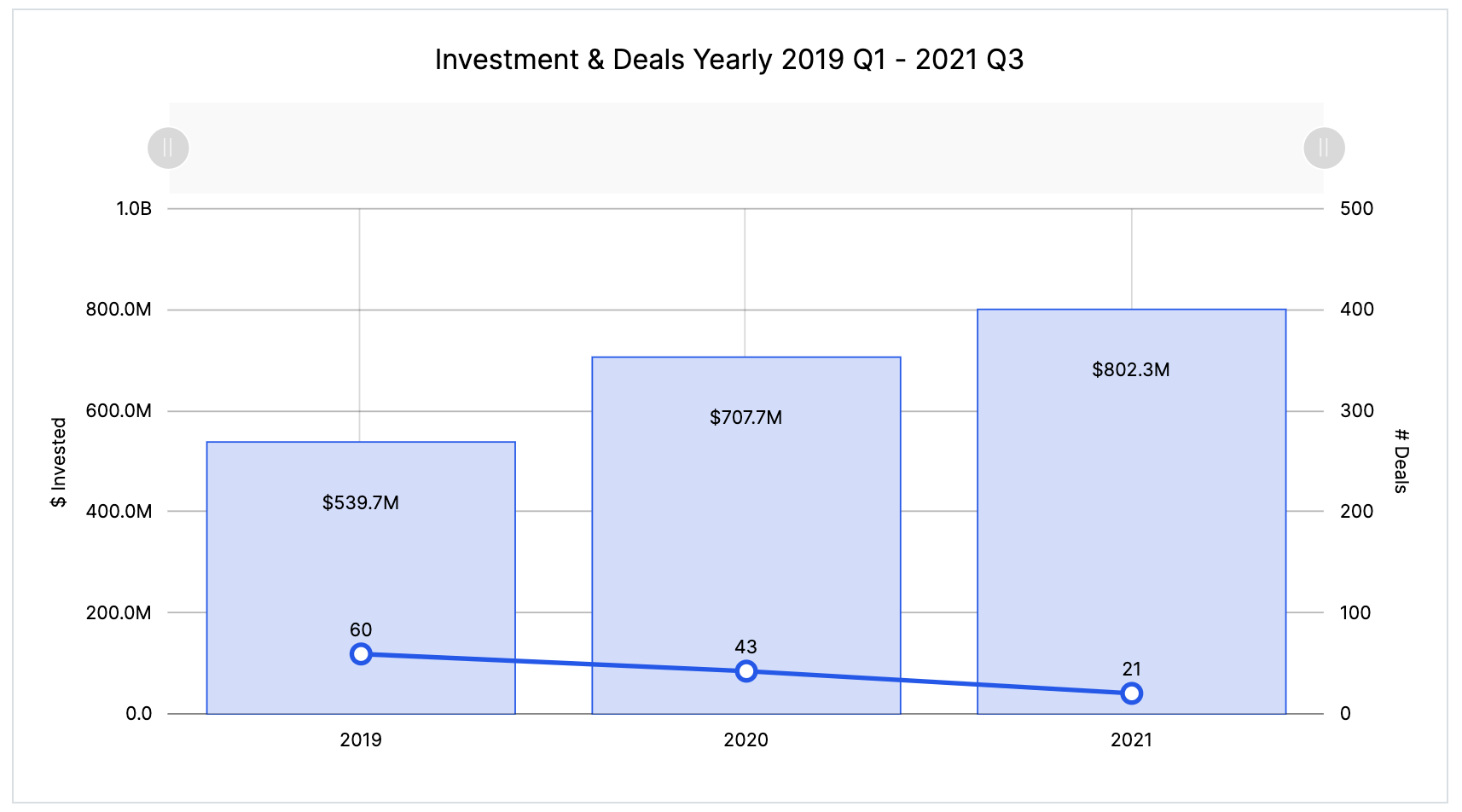

Chris Albinson, CEO of Communitech, said that when looking at Waterloo Region’s funding on a yearly basis, 2021 has been “unbelievable.” According to Hockeystick and briefed.in, investment in the ecosystem has climbed each year since 2019. As of the end of Q3, Waterloo-based startups have raised over $800 million in 2021, already beating out the total investment raised across all of 2020.

Axelar’s $31.3 million was one of the two Series A deals which accounted for 98 percent of all the reported investment raised in the Waterloo Region in Q3 2021, per Hockeystick and briefed.in. The only later-stage deal that closed in Q3 was P&P Optica’s Series B round of funding (the amount raised was not disclosed).

Rob Darling, CEO of briefed.in, noted that it is unclear whether P&P Optica’s round of funding would have moved the needle for overall investment in the region, adding that his concern is with the region’s dwindling funding activity.

Though Q2’s total investment was a high milestone, deal count in the Waterloo Region has continuously declined over the last year. Since Q3 2020, when the region saw a total of 13 deals, deal volume has consistently fallen each quarter and reached a two-year low in Q3 2021.

Deal volume in Q3 2021 represents a 29 percent decrease from Q2 2021 and a 62 percent decrease year-over-year. Krishnan said like funding, tracking deal volume on a quarterly basis may be too small a window to offer a full picture of how Waterloo’s ecosystem is faring.

“We are also an ecosystem known to give birth to companies,” Krishnan added. “So a seed-stage measure is a better lens to evaluate the performance of an ecosystem like ours.”

Seeds not sown

Although only five deals closed in Q3, the region managed to see at least one funding round at every stage up to Series B. Hockeystick and briefed.in tracked one pre-seed deal, one seed round, two Series A rounds, and one Series B round.

Darling said it is difficult to draw conclusions from stage distribution in Q3 due to the low overall number of deals. However, Hockeystick and briefed.in data indicates that deal volume at the seed stage has trended downwards on a yearly basis since 2019.

Albinson noted that many seed-stage companies do not go through the trouble of reporting their deals in certain databases or announcing them publicly at all, adding that this is not necessarily unique to the Waterloo Region. Hockeystick and briefed.in have also tracked deals in other regions where elements of the round, such as funding amount or stage, were not disclosed.

Trailing Series A timeline

While the number of seed deals fell, Hockeystick and briefed.in data indicates that even fewer startups are keeping pace with the typical seed to Series A funding timeline. There are currently 21 companies in Waterloo Region that have not raised their Series A rounds in the typical 18 months after their seed round. This equates to roughly two-thirds of all seed-stage companies based in the Waterloo Region.

Albinson said this statistic doesn’t necessarily reflect the way funding cycles have shifted in recent years. “Companies are raising so much more money at the seed stage,” he noted, adding that the definitions of certain stages have changed.

In recent years, the traditional startup approach to seed funding has changed in Canada, with many more startups opting to raise two, three, or even four seed funding rounds, which has given way to new round classifications as the pre-Series A or the seed extension. This could explain why Waterloo companies may appear to be behind schedule.

Despite the lull in deal activity, the Waterloo Region’s tech ecosystem saw a few notable developments in Q3. One of these was the majority stake acquisition of network management software startup Auvik Networks in July. Local startup Miovision also acquired fellow traffic software company Traffop during the third quarter.

At least two Waterloo-based companies have either gone public or are expected to this year, including Q4 Inc., which closed the transaction this week, and D2L, which filed two weeks ago. These IPOs, as well as local startups Bridgit’s and Trusscore’s recent funding rounds, could contribute to a more active fourth quarter for the Waterloo Region.

“The message for us on the ground is to start developing a global mindset and an opportunity to attract global startup founders,” Krishnan said.

BetaKit is a Hockeystick Tech Report media partner.