With over $900 million raised by British Columbia’s tech startups, venture investment in the province stayed strong in the third quarter of this year, according to the latest data from Hockeystick and briefed.in.

“The story behind the headline is that the province continues to benefit from more mature companies raising blockbuster rounds.”

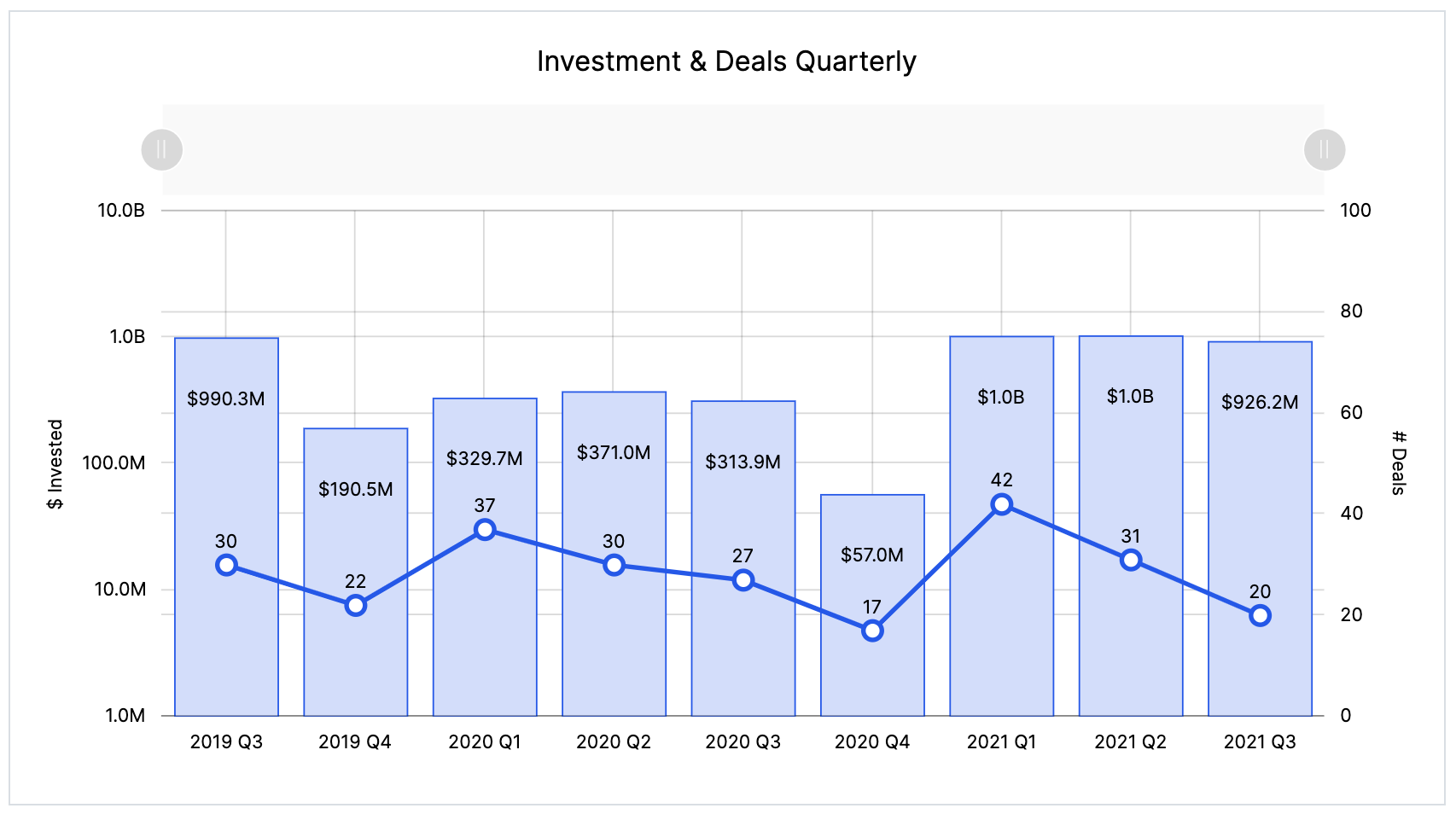

Tech startups in BC raised a total of $926.2 million in Q3, dipping slightly from the province’s landmark Q2, which saw over $1 billion raised. Though investment fell by 10 percent quarter-over-quarter, BC tech saw a 195 percent increase year-over-year. The third quarter was also BC’s fourth-highest funding quarter in the last two years, only trailing the first two quarters of 2021 and Q3 2019.

Jay Rhind, partner at Vancouver-based Rhino Ventures, believes that by any measure, doubling year-over-year investment is “remarkable.”

“The story behind the headline is that the province continues to benefit from more mature companies raising blockbuster rounds,” Rhind told BetaKit. “This is a major net benefit for the long-term [health] of the ecosystem, as it should finally put to bed any concerns about category-defining companies being built and scaled in BC.”

In the first half of 2021, BC venture funding kept pace with Canada’s largest tech region, Toronto. Though the gap between the two ecosystems widened in Q3, with Toronto raising $1.6 billion, BC maintained its second place in the Canadian tech ecosystem rankings.

BC’s three largest deals accounted for approximately three-quarters of all dollars raised in the third quarter. These included Dapper Labs’ $319.1 million Series D round of funding, Blockstream’s $266 million Series B funding round, and Canada Drives’ $100 million Series B round of funding.

Ray Walia, CEO of Vancouver-based Launch Ventures and Launch Academy, said the companies receiving the most attention in the province are those with solid traction and strong growth roadmaps.

“The funding is going towards future execution, and [these] companies have proven their ability to execute,” Walia said. “There is a lot of venture funding that needs to be allocated, and it is good to see international firms recognizing the talent and execution of teams here in Canada.”

Overall, 20 deals closed in BC during Q3, a 35 percent decline from the previous quarter and a 26 percent decline year-over-year. Since the province’s deal count reached a two-year high of 42 deals in Q1 2021, activity has progressively waned. Q3 marked BC’s second-slowest quarter in terms of deal flow in the last two years.

So far this year, BC has surpassed 2020 in total investment and is 84 percent of the way to match the total deals closed in 2020.

Early-stage funding takes a hit

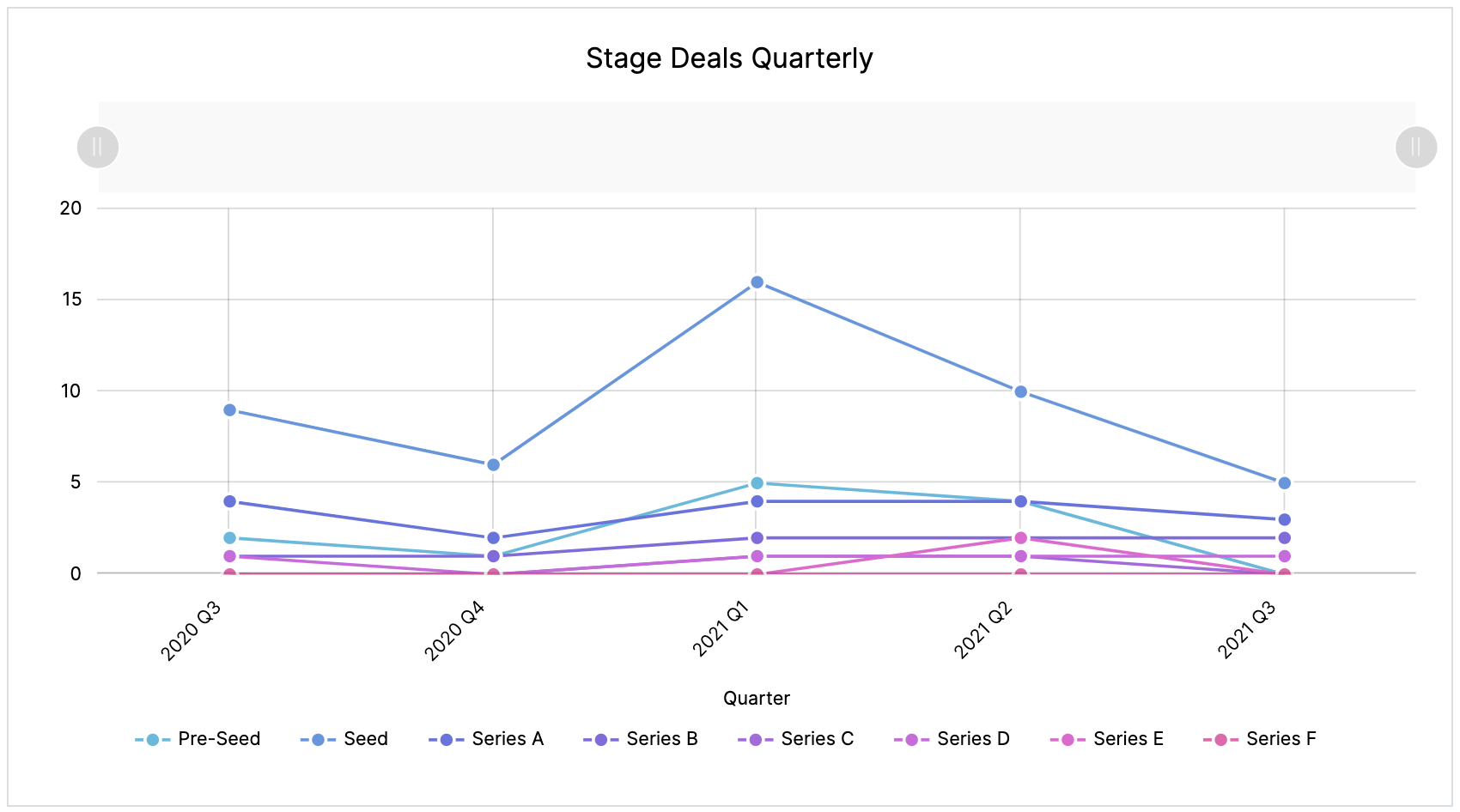

Deal volume either fell or remained the same at every funding stage in the third quarter, with the most notable decline occurring at the early stages. Hockeystick and briefed.in tracked five seed deals and zero pre-seed deals in Q3, a sharp decline from Q2 2021, which saw 10 seed deals and four pre-seed deals. Walia noted that the lack of early-stage activity in Q3 is a cause for concern.

“Success in any ecosystem is a numbers game,” he said. “The more companies that receive pre-seed and seed funding, the greater the number of companies that will grow into Series A and B companies that can become anchors in the community that draw in talent, which then, in turn, spin out to start new startups.”

Over the last two years, Hockeystick has tracked a potential funding gap in BC, specifically at what should be the widest part of an ecosystem’s growth funnel: the seed and pre-seed stages. Though the province’s first half of this year saw strong early-stage funding, it’s possible the trend made a resurgence in Q3.

“The lack of volume in angels and early-stage funds in BC willing to take the risk on early-stage companies has a direct impact on the position BC can have in particular industries,” Walia noted.

Three Series A rounds closed in BC during Q3, including WonderFi’s $17.7 million funding round, while only three deals closed in the Series B or higher stages. Rhind noted that despite the slower late-stage activity, growth capital has never been more abundant in BC.

“[Growth capital is] cheap and abundant such that even the most capital-efficient founders are tempted and competitively pressured into capital-as-a-moat-type decision making,” he added.

Loose lips sink startups

Of the 20 deals tracked by Hockeystick and briefed.in, nearly half (nine) had rounds that did not fall under a specific stage. This is a considerable share of overall deal volume, especially when compared to other Canadian tech ecosystems.

Though each company has its own reasons for not categorizing its round under a stage, it’s possible that some BC tech companies are reluctant to share details about their financing rounds. Rhind said he has noticed that some local companies are less inclined to disclose deal information, but noted it’s not clear whether this is unique to BC’s tech ecosystem.

“Part of it is that there are more ‘sleeper picks:’ companies that avoid the traditional venture treadmill and don’t associate with the stage nomenclature,” Rhind said.

Rhind added that other founders choose not to announce financing rounds at all, especially when they are insider-led. If this was the case in BC during Q3, it could explain the deal volume decline, particularly at the early stages. CEO of briefed.in Rob Darling has previously noted that it is common for early-stage companies to not disclose funding rounds.

Big things on the horizon

Outside of venture funding, BC has had a watershed year in terms of tech exits, with companies like Thinkific, Galvanize, and Copperleaf all completing eye-catching IPOs or unicorn acquisitions.

Rhind noted that valuations for tech businesses in the province remain high, and he expects late-stage funding will continue to dominate the BC tech narrative in the upcoming quarters. Walia also expects more financings and major milestones as 2021 wraps up in Q4.

“2021, with all of its turmoil, will still be a pivotal year for [BC’s] technology sector,” Walia said.

BetaKit is a Hockeystick Tech Report media partner.