Toronto tech set a new record for venture funding during the second quarter of 2021, one of several milestones smashed according to the latest data from Hockeystick and briefed.in.

“It’s an exciting time for founders, particularly those who are well suited for venture-scale businesses.”

In Q2, Toronto-based tech startups raised a total of $1.46 billion through 68 deals. Toronto saw a 28 percent increase in total investment compared to the first quarter of 2021, and a 555 percent increase since Q2 2020. The quarter was Toronto’s largest ever in terms of investment and maintained Toronto’s first-place lead in Canadian tech for both deals and dollars raised.

“Toronto’s record Q2 funding has been driven by six very large deals ranging from Series A to Series C,” said Rob Darling, CEO of briefed.in. “These top six deals equated to almost 70 percent of the total funding for Toronto in this quarter.”

Though Toronto’s tech startups raised significantly more funding than they did in Q1 of this year, there were fewer deals during Q2. Overall, Toronto saw a 14 percent decrease in deals compared to Q1 2021 and a 33 percent increase compared to Q2 2020.

Ameet Shah, partner at Toronto-based Golden Ventures, said the city’s Q2 funding results are consistent with what he is seeing on the ground.

“Every day seems to bring news of a large fundraise or exit, so it’s both a very frenetic and exciting time for all parties,” Shah told BetaKit. “It’s an exciting time for founders, particularly those who are well suited for venture-scale businesses.”

In the first half of 2021, Toronto startups have raised $2.6 billion, already surpassing all of 2020 for funding. With 146 deals closed in the first half of 2021, the city has closed 88 percent of the 186 deals closed last year.

According to Hockeystick’s data, Toronto attracted $1.5 billion in funding in 2019 and $1.1 billion in 2020. With $2.6 billion raised in the first half of 2021, the city’s startups have matched all the funding raised across the previous two years combined.

At a macro level, Shah said aggressive monetary policies, such as low-interest rates, have contributed to an influx of dollars into the system. He also noted that Toronto startups have benefited from the pandemic’s impact on how venture deals close.

“As investors get comfortable with investing remotely [and] without face-to-face meetings, more firms are becoming active in Canada,” Shah said. “This was something that was trending positively before the pandemic, and going remote-first has accelerated that.”

FinTech startups saw the most activity in Q2, with deals in this vertical accounting for 13 percent of all deals. Artificial intelligence comprised the second-highest amount of deals at 12 percent. Top deals from the second quarter included Vena Solutions’ $300 million Series C round of funding, Tenstorrent’s $245 million Series C funding round, and Ada’s $130 million Series C raise.

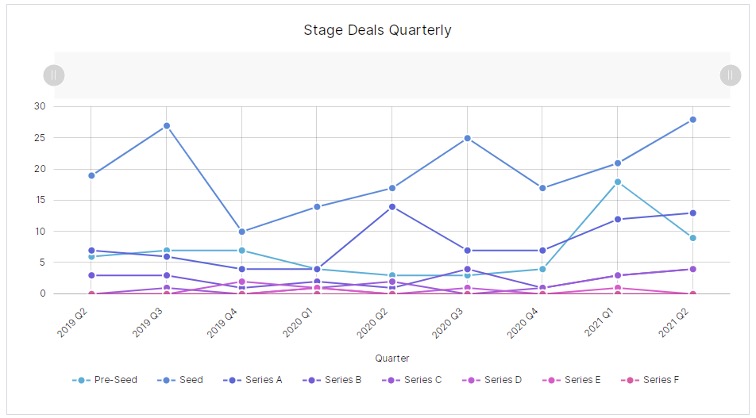

Each funding stage saw an ample number of deals in Toronto during Q2. There were 37 pre-seed and seed investments in Toronto for Q2, which equates to 54 percent of all deals, with notable rounds including WOMBO’s $7.3 million seed round of funding and Relay Platform’s $6.3 million seed round of funding.

Although the volume of early-stage deals was healthy in Q2, the average size of seed rounds dipped slightly from $3.5 million in Q1 2021 to approximately $2.7 million in Q2.

Hockeystick and briefed.in also tracked the funding timelines for tech startups in the Toronto region. According to the report, 44 companies in Toronto raised seed funding over 18 months ago and have not raised a Series A round yet (Darling noted that companies typically take 18 months on average to go from seed-stage to Series A-stage).

However, Golden Ventures partner Jamie Rosenblatt noted when companies do reach the Series A stage, the rounds are getting much bigger. He also said rounds are becoming more competitive and are closing much faster across the board.

“It’s rare to encounter an attractive opportunity that is not being looked at by multiple investors simultaneously,” Rosenblatt told BetaKit.

A total of 13 Series A deals closed in Toronto during the second quarter, comprising nearly one-fifth of total deal volume. Notable Series A deals included Waabi’s $100 million round, Adela’s $60 million raise, and Ledn’s $30 million raise.

Eight deals were classified in the Series B-or-above stage. They included Clearco’s $125 million Series C funding round, Kepler Communications’ $60 million Series B funding round, and Xanadu’s $122 million Series B funding round.

Also of note in Toronto during Q2 were six private equity deals and two announced acquisitions. In April, Ceridian acquired Ideal, and in the same month, Autodesk announced it would acquire Upchain.

IPO activity cooled down in Q2 following a go-public frenzy from Canada’s tech sector. Investor relations software company Q4 Inc, which filed to go public in May, had ambitions to raise $150 million. In late June, the company postponed its IPO and did not provide additional information on the decision.

Shah noted that despite the cooling period in Q2, the TSX and TSX-V are both on track to have their biggest years since 2010 in terms of funds raised by IPO.

Recent headlines from the Toronto tech ecosystem indicate that the city’s explosion in venture funding has not slowed down in the third quarter. FreshBooks, Deep Genomics, 1Password, and Clearco are just some of the Toronto tech companies that secured massive investments in recent weeks. Shah said his reaction is one of guarded optimism looking to the rest of 2021.

“It’s easy to suggest we’re in a bubble, but much of this growth can be attributed to the previous public [and] private investment in the ecosystem,” Shah said. “This hasn’t been an overnight success, even if it has been accelerated by recent macro trends affecting VC investment globally.”

BetaKit is a Hockeystick Tech Report media partner.