In partnership with MaRS Discovery District, Communitech, and Invest Ottawa, Charles Plant, the founder of the Narwhal Project, has released the 2020 Narwhal List, a report highlighting Canada’s fastest-growing tech companies.

“The signs are positive. Things are going well.”

– Charles Plant, Narwhal Project

The Narwhal List ranks financially attractive companies according to “financial velocity.” The metric is derived by the amount of funding a firm has raised, divided by the number of years the company has existed. The report also measures the rate at which a company raises and consumes capital to support its growth.

This year’s study looked at the fundraising statistics of over 1,000 private Canadian technology businesses listed on Crunchbase and CBInsights at the end of 2019.

“The signs are positive. Things are going well,” Plant told BetaKit. “We didn’t have any Unicorns [a company valued at over $1 billion] a little while ago, and Canada is [ranked] last in the world in the number of Unicorns. We’re now, I think, on the cusp of improving that record.”

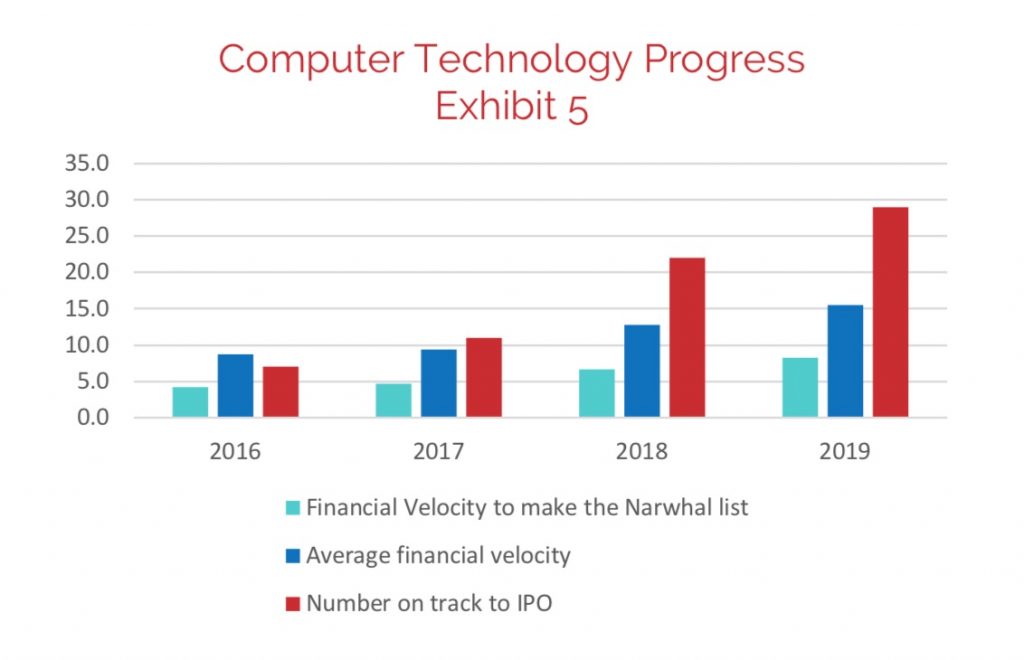

Last year, nine Narwhal companies raised rounds exceeding $131 million CAD ($100 million USD). Over the last three years, the financial velocity required to make the list and the average financial velocity of companies on the list has increased, meaning companies are moving faster in securing capital. The number of Narwhals on track to become ‘Unicorns’ has also grown from seven to 42.

The top ten Narwhals for 2020 include:

- Chinook Therapeutics

- Element AI

- Repare Therapeutics

- Enerkem

- DalCor Pharmaceuticals

- Verafin

- Fusion Pharmaceuticals

- Stormfiser Biogas

- Hootsuite

- North

Since last year, seven new firms joined the Narwhal List, replacing businesses that have not recently secured funding. Chinook Therapeutics, for example, took the top spot, having not made the list in 2019.

This year’s top 10 includes companies from a variety of sectors, including software, consumer electronics, pharmaceuticals, and renewables. Element AI, Hootsuite, and North remain high on the top 10 list. Kik Interactive, previously considered a Unicorn, lost that title after a controversial initial coin offering (ICO), the app shut down, and was later acquired by MediaLab in late 2019. Ritual also dropped from third place in July’s Narwhal update to eleventh position in 2020.

Several prominent companies graduated from the Narwhal List this year, including Lightspeed, which went public, and Bluerock Therapeutics, acquired by Bayer.

“The trend … is to keep companies private longer and to have them go public when they’re larger than they were before,” Plant said. He cited Lightspeed’s IPO as an exception, noting that the POS startup went public at a very early stage of development.

Wealthsimple was also classified as no longer eligible for the Narwhal List, due to the fact that an investor, Power Financial, owns more than half of the company.

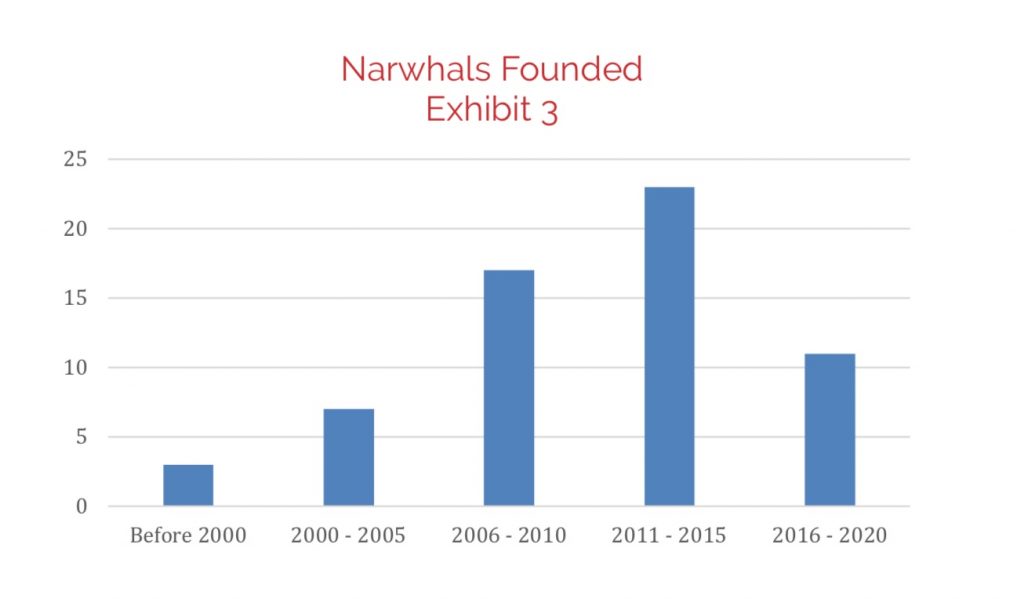

Unsurprisingly, the largest number of companies on the list are from Toronto with a substantial amount from Montreal and Vancouver as well. In terms of stage, the average year of founding for this year’s Narwhals is 2010, with more than half of those listed having been founded since then.

Later-stage companies raising massive rounds

The report also showed that later-stage companies had an impressive year. Notable investments in older companies on the Narwhal List included $358 million (all monetary figures are listed in CAD) to Nuvei out of Montreal, $330 million to Clio from Vancouver and $265 million to Toronto’s 1Password. The report noted that all of these companies are more than a decade old and none had financial velocities necessary to qualify for the Narwhal List in previous years.

“I think it’s showing that there’s more late-stage capital available to companies, and that they’ve been very successful operating under the radar with other forms of capital,” Plant told BetaKit. “So they’re now being recognized for that in achieving these huge raises.”

Computer technology booms, healthtech holds its own

The number of “computer technology” companies that raised funds totalled 22, with the average amount raised totalling $125.8 million.

Verafin, which made its first appearance as a top 10 Narwhal, holds the top spot for computer technology companies, as the largest venture deal in Canadian history, following its $515 million venture deal in September. The top ten computer technology companies also include Clio, Coveo, TouchBistro, Assent Compliance, and Dapper Labs. New entries include Coveo, which raised $227 million in November.

“We’re not seeing so many of the sales and I think what’s happening is that companies are now growing effectively, they’re getting late-stage capital so they don’t have to be sold,” Plant said of Narwhals in the computer technology sector. “That’s why we’re seeing improvement on the computer technology side of the list.”

The report revealed that the healthtech sector is not progressing as rapidly as the computer technology sector, although six healthtech narwhals are on track to IPO if they maintain their current trajectory. In the healthtech sector, notable companies on the list included Deep Genomics ($40 million), Fusion Pharmaceuticals ($26 million), and Chinook Therapeutics ($85.7 million).

For the first time, the Narwhal List includes a section on Canadian cleantech. Companies listed include Enerkem, Kineticor, Eavor, and General Fusion, a Vancouver-based startup that raised $85 million at the end of 2019. Although not on this year’s list, one large raise for Canadian cleantech included BC-based Carbon Engineering, which secured $90 million from high profile investors like Bill Gates.

“When you start to include cleantech, you start to see other patterns emerging,” Plant said. “For instance, there are four companies in Calgary now that are on the list because of cleantech. And Mississauga hits the list with two companies in cleantech. So there are pockets of sectors that are in different places in the country. And expanding to cleantech helps be able to identify those.”

When asked what these trends could signal for 2020, Plant predicted that there is still too much opportunity for private growth for many of the Narwhals to go public.

See the full 2020 Narwhal List here.