Tech startups in the Greater Toronto Area (GTA) raised more than $1 billion in venture funding over the first quarter of this year, nearly matching the dollars raised in the region across all of 2020, according to Hockeystick’s latest ecosystem report.

“Toronto was only $4 million away from matching the total investment dollars for all of 2020.”

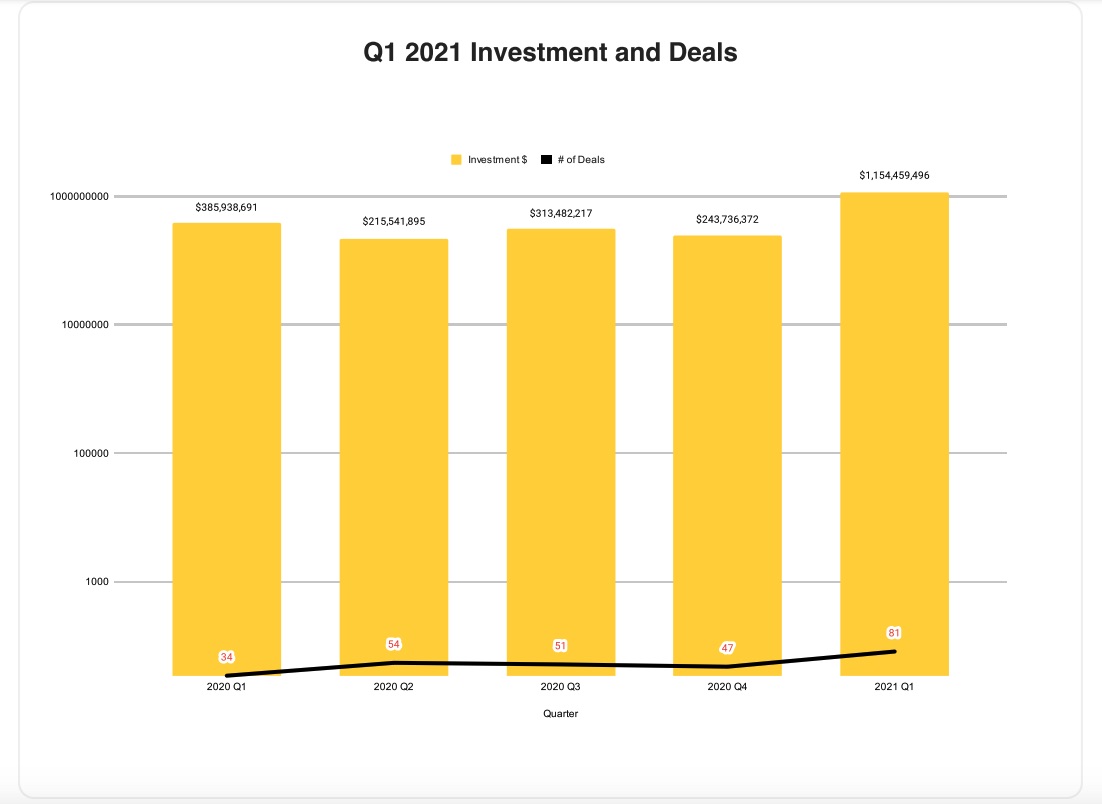

Overall, Toronto-based startups raised $1.15 billion through 81 deals in Q1 2021. The funding represents a colossal 373 percent increase in total investment compared to the fourth quarter of 2020, and a nearly 200 percent increase year-over-year. The GTA’s funding performance also represents the first time investment has surpassed the $1 billion mark in at least the last year.

Toronto venture funding had a much stronger start to this year compared to 2020. Funding and deal volume floundered in the first and second quarters of last year, but made a slight turnaround before shattering records in Q1 2021.

“Q1 2021 was an amazing quarter for the GTA,” said Rob Darling, research partner at Hockeystick. “Toronto was only $4 million away from matching the total investment dollars for all of 2020.”

Venture funding in Q1 2021 was driven by five late-stage megadeals, which accounted for approximately half of all dollars raised in the GTA. Among the largest deals were Top Hat’s $164 million investment and Prodigy Education’s $159 million Series B round. The EdTech sector has seen major gains since the onset of the COVID-19 pandemic and resultant disruptions to education.

“These companies were already fast growing before the pandemic, but the further digital transformation of education as a result of the pandemic has certainly fueled their growth in the past year,” Darling said of Top Hat and Prodigy Education.

Top Hat, which offers an active learning platform targeted toward higher education, has evolved rapidly over the past year as the education landscape has been forced to change due to COVID-19. After pulling in a $72 million Series D round last year, Top Hat acquired three traditional publishers, including the purchase of Nelson Education’s post-secondary textbook business.

Prodigy Education, which offers an e-learning platform and math-focused games for elementary and middle school students, claimed it saw usage of its platform grow as the demand for remote learning solutions grew over the last year.

The two large deals reflect the significant impact tech companies have had on the education sector in the last year, and signal that companies in this sector have the ability to pull in significant investment.

“While the pandemic may have been the catalyst for further growth, the education sector’s dependence on technology is only going to continue to grow in order to meet the expectations of the next generation of students and teachers,” Darling said.

Though EdTech drove significant funding into the GTA’s strong Q1, the FinTech and healthtech sectors continue to see the highest number of deals, comprising 21 percent and 11 percent of all deals, respectively.

FinTech and healthtech have emerged as important verticals in the Toronto ecosystem over the last few years. In 2020, healthtech emerged as a leading vertical for venture capital investment, attributable in part to the region’s many ecosystem supports, such as innovation hubs and hospitals.

As one of the largest financial centres in North America, Toronto’s FinTech companies have long drawn in large amounts of venture capital, with the city’s high concentrations of financial services companies, compounded by a network of FinTech accelerators and incubators.

Though venture funding in the GTA was given a huge boost by megadeals, the region also saw a sizable jump in funding activity. A total of 81 deals closed in Q1 2021, up 138 percent from Q1 2020, and up 72 percent quarter-over-quarter.

These deals were spread healthily across the early and late stages, with 40 raises tracked in the pre-seed and seed stages, and 34 raises in the Series A stage and higher.

According to Hockeystick, the nearly 50-50 split signals the GTA has a strong pipeline of early-stage startups raising money to support their growth. The allotment of deals across stages in Q1 also reflected the barbell effect seen throughout 2020 in the GTA.

Since 2019, the average seed round size in the GTA sits at approximately $2 million, on par with Montréal and British Columbia. However, companies in the GTA are demonstrating the ability to raise above-average seed rounds.

Among these is dTrade, a decentralized trading platform, which raised a $7.9 million seed round of funding. Manifest Climate, which offers software to identify climate-related risks and opportunities for businesses, secured a $6.5 million seed round of funding in February.

Disco, a young startup that aims to help its users build virtual learning experiences through its software, closed $6 million in seed funding in March.

There were also significant late-stage raises in the first quarter, including Koho’s $70 million Series C round of funding, Snapcommerce’s $107 million growth funding round, and iLobby’s $126.7 million strategic investment.

“The volume of deals in all stages this quarter are strong indicators of continued future growth for Toronto,” Darling said.

Toronto’s impressive Q1 was also marked with other notable developments seen in the broader Canadian tech ecosystem. One trend seen in Canada this year is the high number of go-public transactions from homegrown technologies, including many based in the GTA. During Q1, Payfare, MCI Onehealth, theScore, and Mednow all either closed or filed for significant initial public offerings, with some raising north of $100 million.

Several notable acquisitions were either announced or closed in the first quarter, including the acquisition of app development and data engineering consultancy TWG was acquired by Deloitte. Wattpad announced it would be acquired by South Korean firm Naver for upwards of $700 million (the deal closed in the Q2 2021).

“Ecosystems with high-growth companies followed by acquisitions and IPOs really enable the growth flywheel,” said Darling. “This results in investors who did well allocating funds into other startups solving other problems in the same vertical and new investors who gained experience working with the company in the vertical to start investing. This also results in new startups from existing employees, solving other problems in that vertical.”

BetaKit is a Hockeystick Tech Report media partner.