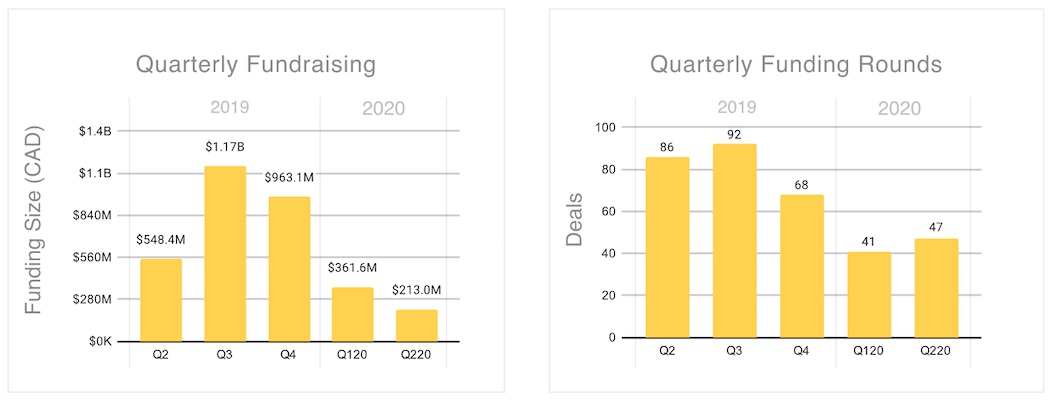

Despite its historical prominence in Canadian tech, Toronto failed to contribute much to Canada’s record funding quarter. Venture funding in the Greater Toronto Area (GTA) slumped to $213 million in the second quarter of 2020, vastly underperforming compared to past quarters, according to Hockeystick’s latest ecosystem report.

“Two quarters of quiet late-stage activity likely means the region won’t sustain the growth of 2019.”

– Raymond Luk

The quarter represented a series of low bars for Toronto venture funding. Total venture funding in the GTA dropped 41 percent from $361 million in Q1 2020, the third consecutive drop over the last three quarters. Q2’s funding also represents the lowest funding amount reported in the GTA in the last 18 months. Toronto venture funding for the quarter was less than half of Q2 2019’s total, a 61 percent drop year-over-year.

“You can’t really deny that this is the third quarter in a row since Q3 that numbers have dropped, and it really can’t drop much more than that,” said Raymond Luk, CEO of Hockeystick. “$213 million is a very small number for an ecosystem the size of the GTA.”

Hockeystick’s data is sourced through exclusive partnerships with organizations like the Canadian Venture Capital and Private Equity Association (CVCA) and the National Angel Capital Organization (NACO). Hockeystick also compiles data from startups using its platform, as well as public data sources.

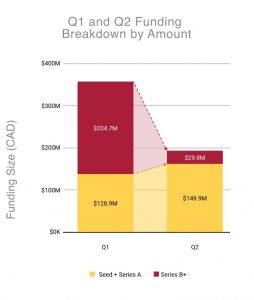

Top disclosed deals from Q2 2020 included Ritual’s $29.8 million post-Series C round, Humi’s $15 million Series A round, and Elevate Farms’ $13.5 million round. In Q1 2020, the top seven disclosed venture rounds were all larger than $20 million, while in Q2 2020, only Ritual’s post-Series C funding exceeded $20 million.

Toronto saw 47 deals over the quarter, the GTA’s second-lowest deal count since at least Q3 2018, when Hockeystick began collecting such data. Deal count in Q2 2020 comprised approximately half that of Q2 2019.

Hockeystick did note some encouraging signs from the quarter. Deal volume increased by 15 percent quarter-over-quarter, despite taking place in the middle of the COVID-19 lockdown. Luk said the uptick in Q2 was matched nationally, indicating limited impact from the pandemic on Canadian venture funding. Preliminary numbers from Q3 2020 show several deals in the $40 million to $50 million range, providing hope that next quarter could start to reverse the GTA’s downward trend.

Toronto’s late-stage funding dries up

While deal volume increased in 2020, the pace of funding in Toronto has dramatically cooled since a record-setting 2019. By the end of Q2 2019, Toronto had completed 178 funding rounds totalling more than $1 billion. The GTA has seen a 50 percent drop in funding rounds (88), and a 44 percent drop in funds raised ($573.2 million) at the mid-year mark.

“The longer the late stage is absent, the unhealthier the picture looks.”

– Raymond Luk

The same slowdown has not been seen across the country, with the Canadian Venture Capital and Private Equity Association (CVCA) reporting over $1.7 billion in venture investments in Canada over Q2, which represents a new record, as well as 11 “mega-deals” of more than $50 million (Hockeystick is the official data partner of the CVCA).

Some of those larger late-stage rounds in Canada over the quarter included Calgary-based Symend’s $73 million CAD in Series B round, Kitchener-Waterloo-based Applyboard’s $100 million CAD Series C round, and Vancouver-based AbCellera’s $144 million CAD Series B round. Of those late-stage Canadian deals, none took place in the GTA.

“Eleven mega-deals happening outside the GTA is positive for Canada, full stop,” Luk said. “Most regions have been good at starting companies but Toronto has been the scale-up engine until now.”

Toronto saw only three Series B and above rounds in Q2 2020, of which only one deal, Ritual’s $29.8 million venture round, was disclosed.

“It’s really the lack of late-stage deals for the second quarter in a row that is somewhat concerning,” Luk said. “It’s not that late-stage deals are dropping everywhere and the GTA just happens to be one of those; it’s that late-stage deals are happening all across Canada, but it’s not happening in the GTA at the same level that it was happening last year.”

While late-stage funding disappeared, seed and Series A funding collectively increased from last quarter. In Q1 2020, pre-seed and seed deals comprised 48 percent of all venture investments in Toronto. In Q2 2020, pre-seed and seed investments comprised approximately 40 percent of all deals.

During Q2 2020, Series A deals in Toronto totalled $105 million in funding, accounting for 49.9 percent of all funding for the quarter in Toronto, and increasing by almost 75 percent from last quarter. The number of Series A deals also increased from three to 11 quarter-over-quarter.

“Strong Series A activity is crucial,” Luk said. “But the longer the late stage is absent, the unhealthier the picture looks.”

The GTA’s continued leadership in Canadian tech depends on the return of late-stage venture deals. Luk was clear on the role late-stage deals play in the ecosystem’s growth.

“We expect a bigger Q3, but two-quarters of quiet late-stage activity likely means the region won’t sustain the growth of 2019,” Luk added.

Those interested in receiving the full Toronto Technology Report can sign up here.

BetaKit is a Hockeystick Tech Report media partner.