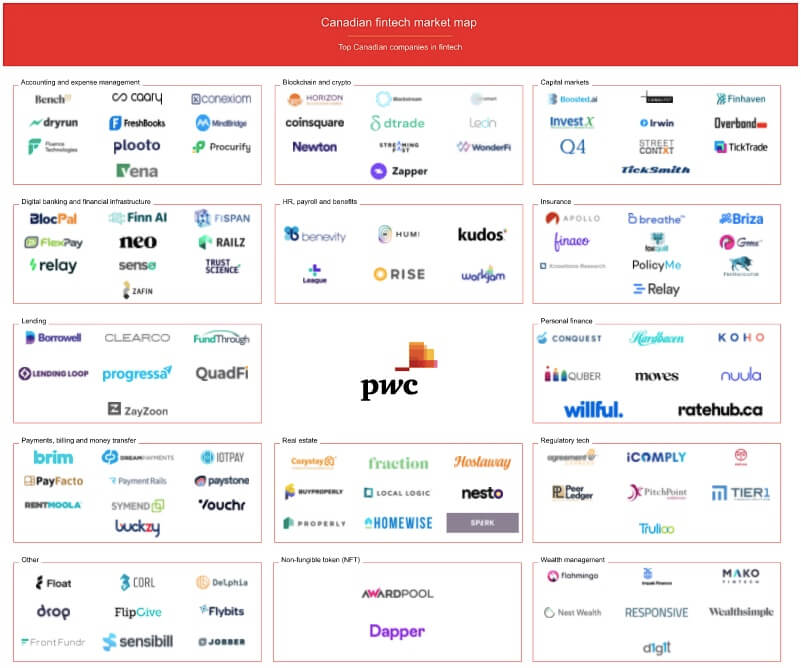

With the help of Hockeystick, PwC Canada has produced a map that illustrates some of the trends shaping Canada’s financial services ecosystem.

The map breaks down Canada’s stable of privately-held FinTech companies by subcategory, listing the top Canadian-headquartered startups per sector that have raised angel, venture capital, or private equity financing since 2015, based on total funding.

COVID-19 put financial pressure on businesses and consumers alike, leading many to pay closer attention to their finances. According to PwC, this environment led to rising demand and investor interest in FinTech solutions related to expense and investment management.

This trend has benefitted startups like Vancouver-based Bench and Toronto-based Wealthsimple, which PwC classifies as accounting and expense management and wealth management, respectively, two increasingly competitive FinTech categories. In 2021, Wealthsimple and Bench both raised major funding rounds.

“We’ve already seen several fintech companies complete IPOs and raise equity rounds in the last 12 months,” said Andrew Popliger, partner and national technology leader at PwC Canada. “We expect that trend to continue in the coming year or two and see an increasing number of fintech IPOs and equity rounds.”

According to PwC, amid COVID-19, demand also remains high for payment integration and processing solutions like those offered by Toronto’s Brim and London and Montréal-based Paystone, two of the 10 firms listed in that category.

The number of companies in sub-sectors, along with the amounts of funding they have secured, is an indication of where the focus in venture-backed Canadian FinTech is currently concentrated.

Other categories with 10 companies include: digital banking and financial infrastructure; capital markets; insurance; and blockchain and crypto, which features Vancouver-based Blockstream.

RELATED: Following $61 million TSX IPO, Propel Holdings eyes US expansion

PwC’s wealth management category was slightly less populated, featuring six startups (in addition to Wealthsimple), including emerging players like Toronto’s d1g1t, Montréal-based Mako Fintech, and Calgary’s Flahmingo.

Like wealth management, PwC’s lending category, for instance, was a bit less populated, featuring seven players, including Toronto-based Clearco and Borrowell. Other categories with a smaller amount of representation include: real estate; HR, payroll, and benefits; and regulatory tech.

PwC’s accounting and expense management category features Toronto-based Vena and Freshbooks, both of which secured sizable investments earlier this year.

RELATED: Koho secure $70 million Series C to scale adoption of its digital banking services

The least represented category on the list is non-fungible tokens (NFTs), with only two startups. However, that includes well-capitalized, and much-talked-about, Vancouver-based Dapper Labs.

Going forward, PwC expects the rollout of open banking, which the Liberal government has promised to introduce by 2023, to increase interest in Canadian FinTech companies.

Feature image by Visual Stories || Micheile on Unsplash