Venture funding in the Waterloo Region reached $148.6 million in the second quarter of 2020, largely driven by large, late-stage investments into two artificial intelligence startups, according to Hockeystick’s latest ecosystem report.

“For a really tiny ecosystem by population, Waterloo is a powerful engine for all of Canada. It’s not just the little early-stage engine.”

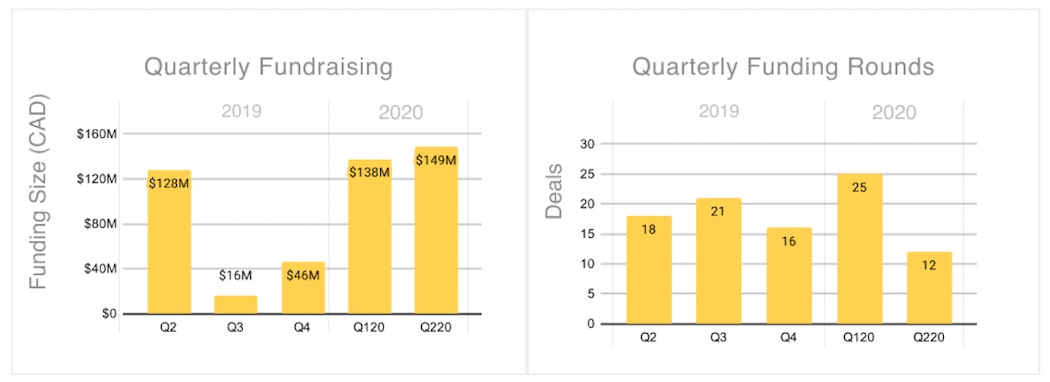

Venture funding in the Waterloo Region reached a five-quarter high in Q2 2020, due to ApplyBoard’s $100 million Series C round and Clearpath Robotics’ $40 million Series C round. Total venture funding increased by 7.8 percent from Q1 2020 and by16 percent year-over-year. However, deal volume notably dipped in the Waterloo Region with 12 deals closed, only half that of last quarter’s 25 deals.

This drop in deal volume mirrors tech ecosystems across Canada during Q2 2020, with Montréal, Toronto, and British Columbia also experiencing a decline in deal volume. Hockeystick attributed the Waterloo Region’s decline in deal volume to a very active January, which drove deal volume higher than the rolling average. When compared to Q2 2019, which closed a total of 18 deals, the disparity is less pronounced.

“There was a long time when there were no late-stage deals in a lot of the Canadian ecosystem,” said Hockeystick CEO Raymond Luk. “The fact that in a place like Waterloo, which most people see as the incubator generating lots of early-stage, there are the Clearpaths and the ApplyBoards, it’s a good sign.”

Hockeystick’s data is sourced through exclusive partnerships with organizations like the Canadian Venture Capital and Private Equity Association (CVCA) and the National Angel Capital Organization (NACO). Hockeystick also compiles data from startups using its platform, as well as public data sources.

Large late-stage deals indicate ecosystem maturity

Late-stage funding dominated in the second quarter of 2020, driven solely by Series C rounds. Overall, Series C rounds accounted for 93 percent of all funding in the region over the quarter. Luk noted the performance of Waterloo companies during Q2 2020 demonstrates that the Waterloo ecosystem is maturing.

The two largest late-stage deals were both raised by homegrown companies. Sumeet Pelia, director of research at Hockeystick, pointed to the fact that ApplyBoard and Clearpath Robotics both opted to continue scaling in Waterloo, rather than departing the region for places like Silicon Valley. Pelia noted ApplyBoard was founded by two graduates from Kitchener-based Conestoga College and one from the University of Waterloo.

“They’re from Waterloo and are still headquartered in Waterloo,” Pelia added, speaking of ApplyBoard.

Like ApplyBoard, Clearpath was also created by a group of four University of Waterloo graduates and remains headquartered in the Waterloo Region.

“All the big companies are staying there because the amount of support that the companies get in the region really incentivizes them to stay in the region,” added Max Folkins, data analyst and content writer at Hockeystick.

The dominance of late-stage funding is in line with late-stage funding in much larger ecosystems over Q2 2020. For example, in British Columbia, late-stage funding surged to $161.5 million. Similarly, Montréal late-stage funding also helped the region set a new funding record, specifically with Sonder’s $230 million Series E round and Hopper’s $102 million Series E round, both of which accounted for almost 60 percent of funding in the region.

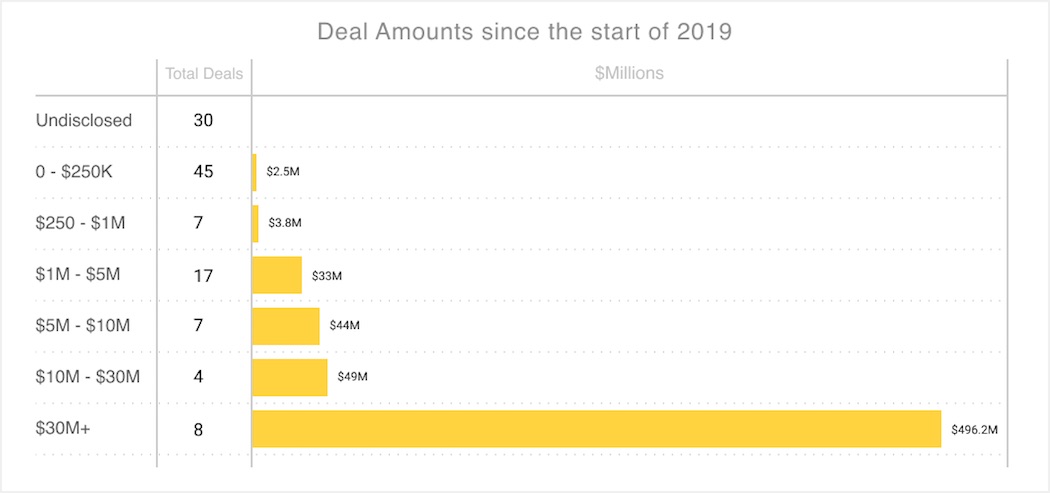

The presence of large deals in Waterloo is also not unique to this quarter. So far this year, $438.1 million or 81 percent of the total funding was invested into deals of $35 million or more. Yet only five out of 51, or 10 percent deals closed over the quarter were over $35 million.

Although late-stage dominated in terms of overall funding, there was also strong seed activity in the region. Pre-seed and seed deals comprised 75 percent of deal volume in Q2 2020. Seed funding only comprised 6.4 percent of venture funding over the quarter. One notably large seed round was Odyssey Interactive’s $7.9 million round.

Hockeystick noted a relatively large amount of seed activity coming from accelerators across Q2 2020. Access to seed funding, as well as resources such as office space, mentorship, and lab space are also notable characteristics of the Waterloo ecosystem, created by a concentration of universities, incubators, and accelerators.

AI dominates Q2 funding

Two of the Waterloo Region’s largest deals were both AI companies. ApplyBoard offers an artificial intelligence-enabled recruitment platform helping international students apply to post-secondary education abroad. Clearpath has created one of the first platforms for robotics research, establishing itself as a leader in autonomous robotics development.

“The amount of support that the companies get in the region really incentivizes them to stay.”

Overall, robotics and AI have accounted for $84 million of the region’s venture funding since the beginning of 2019. In addition to Clearpath and ApplyBoard, Miovision, an AI and analytics startup, raised a massive $120 million investment in the first quarter of the year. Pelia noted the AI vertical was a “significant strength” of Waterloo’s ecosystem.

Waterloo is home to a number of AI-focused hubs and incubators, such as the Waterloo Artificial Intelligence Institute (Waterloo.ai). Waterloo.ai develops foundational AI — which includes research in statistical learning, deep learning, data science — and operational AI, which develops scalable, secure, and transparent solutions for a wide range of applications.

An ecosystem punching above its weight

The Waterloo Region has historically seen substantial venture deal activity and value relative to its size. The region’s population is very small compared to tech ecosystems such as Toronto, Montréal, or Vancouver.

But thanks in large part to the region’s network of accelerators, incubators, and hubs for emerging technology startups, the ecosystem is also home to a deep talent pool, fuelled by leading engineering and technology-focused programs at the University of Waterloo.

The Velocity Innovation Fund, for example, recently seeded four Waterloo startups, while the Autonomous Vehicle Innovation Network’s (AVIN) Waterloo Ventures fund launched a cohort of eight tech startups, which included Clearpath Robotics. AVIN’s latest Q2 2020 cohort supported an additional 10 startups, for an aggregate of eight Waterloo-headquartered startups receiving a total of $400,000.

Rob Darling, founder at Darling Ventures and former CTO of Communitech, noted that Waterloo companies’ strong late-stage performance is a testament to the technology ecosystem created by the combination of education and ecosystem support in Waterloo Region.

“When you take the strong talent from the University of Waterloo, Wilfrid Laurier University, and Conestoga College along with strong startup support from the Velocity, Waterloo Accelerator Centre, Google’s Accelerator, and Communitech, you have a one-two punch that continues to allow Waterloo Region to punch above its weight class.”

“For a really tiny ecosystem by population, Waterloo is a powerful engine for all of Canada. It’s not just the little early-stage engine,” added Luk. “It’s actually a pretty mature ecosystem in its own right.”

Hockeystick’s full Waterloo Technology Report can be found here.

BetaKit is a Hockeystick Tech Report media partner.