Waterloo-based Clearpath Robotics has raised a $40 million CAD ($29 million USD) Series C round. The capital will be used to further expand the company’s industrial autonomous mobile robot division, Otto Motors.

“We are ready for international expansion, and we have aspirations to be in many more countries.”

The round was led by Kensington Capital Partners through its Private Equity Fund. Rick Nathan, senior managing director at Kensington, will join Clearpath’s board of directors as part of the deal. The Series C round, which was entirely equity, also saw participation from Bank of Montreal Capital Partners, Export Development Canada (EDC), and previous investors, iNovia Capital and RRE Ventures.

EDC participated in the round through its newly launched investment matching program, part of the Crown corporation’s response to COVID-19. The program launched on a trial basis last month, looking to match investments of up to $5 million from venture capital and private equity investors for small-and-medium-sized businesses that export their products from Canada.

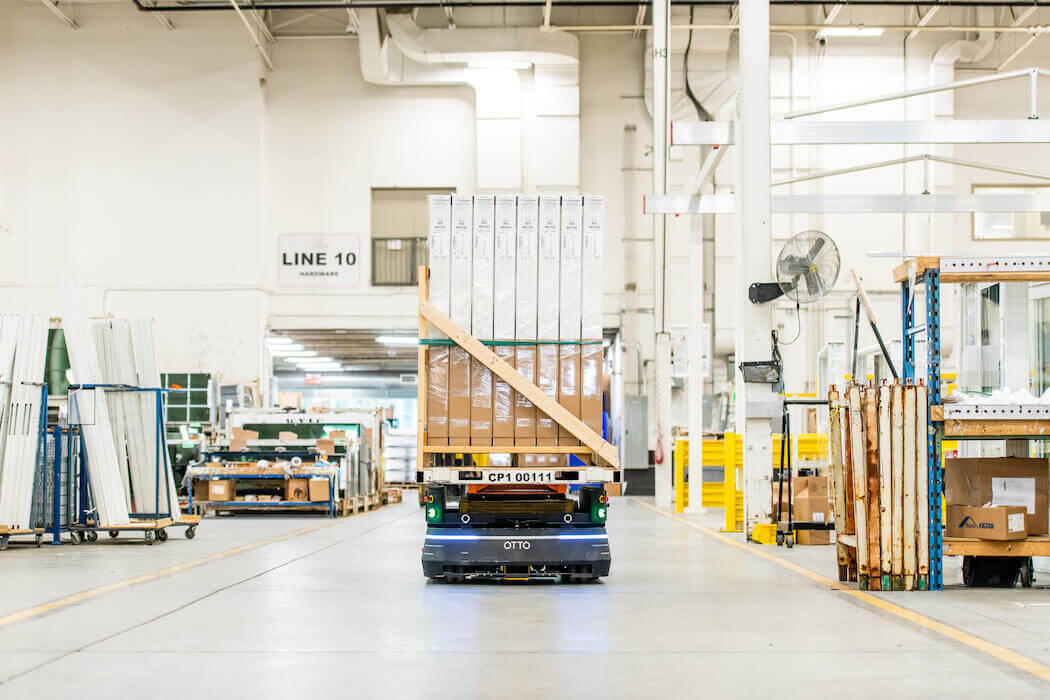

Founded in 2009, Clearpath Robotics has since established itself as a leader in autonomous robotics development, creating one of the first platforms for robotics research. In 2015, the company established its Otto Motors division to focus on the use of autonomous mobile robots for materials handling in warehouses and factories. Clearpath continues to operate as its own division, selling autonomous vehicles for a variety of applications.

RELATED: BDC Capital reveals more details on investment matching program for VC-backed companies

CEO and co-founder Matthew Rendall called the Clearpath division a global leader in a “very strategic and niche category,” noting that it has been profitable for almost 10 years.

This latest round of funding will be used to further expand Otto Motors, specifically looking to make “aggressive investments” in its autonomous vehicle technology.

“We have a portfolio of hardware products, these are the actual physical autonomous vehicles, we design and build those ourselves,” Rendall told BetaKit. “Those products are mature and in market. So, we’re shifting our focus much more now to the software that powers these vehicles.”

Otto Motors also plans to build out the “enterprise fleet management system” portion of its business, which Rendall called the “supervisory layer or air traffic controller for a network of autonomous vehicles.” The CEO noted that these types of systems are required by large manufacturers that have a “high bar for product performance.”

The industrial division of Clearpath Robotics also plans to use the newfound capital to grow its global network of delivery partners and accelerate its product roadmap for enterprise customers.

Otto Motors is working to grow its Fortune 500 customer base, its main clientele. According to the startup, more than 70 percent of autonomous mobile robots installed by Otto Motors are in Fortune Global 500 companies, including GE, Toyota, Nestle, and Berry Global.

Otto Motors mainly operates in the United States, with customers in Canada and Mexico as well. Earlier this year, Otto Motors expanded its operations in the Japanese market with a partnership alongside Japan-based trading company Altech.

The partnership with Altech was one of Otto Motors’ first forays into developing its global network of delivery partners. The company is currently working to build out a network of certified installation partners to help make it easier to onboard and service international customers.

Otto Motors had originally entered the Japanese market in 2018, with “several successful deployments completed.” However, Rendall explained to BetaKit, “the further you get away from your home base, the more expensive it is for you to service and maintain your assets for your customers.”

“We’ve been working on building a playbook on how we work with partners close to home, to understand what their needs are, and build out a capability to support them,” he said. “We’ve got 40 or so certified partners supporting us in North America.”

The CEO said the company is now taking that playbook and “replicating it in key international geographies,” calling the move “the next horizon” for Otto Motors.

RELATED: Calgary-based Attabotics raises $25 Million Series B for robotic supply chain system

“Japan was the first kind of big stick in the ground to say, ‘we are ready for international expansion, and we have aspirations to be in many more countries,’” Rendall added, noting the strategic benefit of being in the Japanese market, which is a leading manufacturer and adopter of industrial robots.

Another recent partnership for its delivery network includes Berry Global Group, a Fortune 500 manufacturer. Using the Series C capital, Otto Motors plans to expand the network across North America, South America, Europe, and the Asia Pacific.

In recent months, Otto Motors reported a “surge in demand” for its robots, from essential businesses responding to increased operational risks due to COVID-19. Rendall pointed to sectors such as food, beverage, and medical device manufacturing, which are all seeing increased demand and at the same time the need to meet new health and safety practices.

“There are some businesses that can operate successfully entirely remotely; many software businesses, or IT businesses, services businesses, are able to be fully productive,” said Rendall. “But when you are producing a physical good, it is very, very challenging. It’s an existential threat to not be able to operate your manufacturing plant, and manufacturing businesses got reminded of that very swiftly when COVID came online.”

The Clearpath Robotics CEO noted that these factors have led to both existing and new Otto Motors customers accelerating their automation roadmap from a typical five-year plan to a six to 12-month timeframe.

“We’re seeing really, really aggressive acceleration in automation strategies,” Rendall said.

“With the COVID pandemic, we believe the market is going to accelerate, and the kind of growth that we might have expected in the market over the next three or four years we think we’ll see in one or two years,” Kensington’s Nathan added.

“The case for eliminating some of the risks involved in having no human workers is more compelling,” he told BetaKit, “Industrial automation and robotics, particularly in a factory environment, is, to me, a clear example of the kind of business that should get a boost from new risks that everybody’s become aware of, especially in an area where it was on a growth trajectory already.”

Otto Motors has not been immune to the negative effects of the pandemic, however. Due to COVID-19 health and safety measures, manufacturing and production plants are restricting access to outside visitors. This means that companies like Otto Motors are unable to enter to install new equipment.

Rendall predicts with planning, budgeting, and vendor selection happening now, “the automation wave is going to hit hard in 2021.” There are going to be “massive” ordering and install backlogs, he said, that will only begin clearing in 2021.

Prior to this Series C, Clearpath Robotics’ previously raised its Series B round of funding in 2016 – drawing in $39 million CAD ($30 million USD). Notably, this most recent round is $1 million smaller than its previous round.

“Our outlook on fundraising … we think about it a little bit differently,” Rendall said, explaining the reason for the smaller Series C. “Our goal is not to raise outside amounts of capital, and then grow something that’s not as efficient as it could be.”

The CEO further explained that Clearpath Robotics started as a bootstrapped company and was self-funded “very aggressively” for almost seven years before raising venture capital. He added that the company was profitable within 18 months of launching.

The decision to raise venture capital, Rendall told BetaKit, was always in pursuit of building out the Otto Motors division. “[The] Series B was really about hardening the [Otto Motors] product offering and Series C is about scale,” he said.

While it is not typical to see a company raise a smaller VC round than its previous raises, several VCs BetaKit spoke with on background explained it is not entirely unusual for profitable companies.

RELATED: Trexo Robotics wants to redefine mobility for children with disabilities

One did note, however, that it is more common for software-as-service companies to raise less capital as compared to hardware-focused companies, which typically need more upfront cash to deliver products.

However, COVID-19 has provided what some VCs speaking to BetaKit have called “weird signals.”

“There’s no question that this is a tough time to raise money,” Nathan told BetaKit, predicting a “slow year” after previous record-breaking years for VC in Canada.

“Because of COVID, we just decided, we’re not going to drag [Clearpath Robotics’ raise] out,” he said. “Everybody was unable to do meetings and kind of normal diligence. So, we had a debate among our team, and [Kensington was] comfortable because we started working on this [deal] quite a while ago. But, I think that in this environment, the decision, and I supported the decision, the decision to go ahead and close was really just expedience of the times.”

Rendall told BetaKit that closing the Series C was about being able to meet the increased demand from customers that are accelerating their automation roadmaps at an unprecedented pace.

Otto Motors via Twitter