Over the last year, Montréal has often relied on one megadeal to keep venture funding levels healthy each quarter. But in the second quarter of 2021, the city saw several significant investments that helped it set a new funding record, according to the latest BDO-Hockeystick report, with data from briefed.in.

“Québec clearly has a maturing ecosystem of companies and investors are taking notice.”

Startups in Montréal collectively raised $711.7 million in Q2 2021, a 180 percent increase compared to last quarter, and a 37 percent increase year-over-year. This represents Montréal’s best investment quarter ever by a wide margin and can be attributed, at least in part, to a number of large late-stage deals.

In Q1 2021, Hopper’s $213 million Series F round accounted for 84 percent of all dollars raised in the city. The city’s dependence on a single megadeal to drive quarterly funding growth can also be seen throughout 2020. But in the second quarter of this year, the Montréal tech ecosystem bucked this trend, with several deals each totalling $100 million or more.

Chris Arsenault, partner at Montréal-based venture firm Inovia Capital, told BetaKit the region’s surge in funding was expected and is a reflection of the growth seen across the Canadian tech ecosystem.

“We now have more Canadian tech champions with realizable global ambitions,” Arsenault said. “What were early-stage tech companies 10 years ago, have grown into growth-stage companies.”

The largest deal in Q2 2021 was healthtech startup AlayaCare’s $225 million Series D round of funding, which closed in June. EdTech firm Paper, which offers an educational support system targeted toward K-12 students, also raised a $123 million Series C round of funding at the end of Q2. Biotech firm Ventus Therapeutics’ $100 million Series B funding round also made its way into the top three deals of the quarter.

“I’m not surprised to see the growing number of megadeals,” said David Nault, co-founder and general partner of Montréal-based venture firm Luge Capital. “Québec clearly has a maturing ecosystem of companies and investors are taking notice.”

While investment was strong in the second quarter of the year, funding activity also held steady. A total of 23 deals closed in Q2, representing a 21 percent increase quarter-over-quarter and a 39 percent decrease year-over-year.

“This quarter, Montréal has continued its consistency in deal volume at twenty-three deals,” said Rob Darling, CEO of briefed.in. “If you look back to Q1 2020, Montréal has been fairly consistent in deal volume, always having 23 deals or more, with the exception of last quarter.”

FinTech accounts for one-fifth of all deal volume

Although the three largest deals in Montréal spanned healthtech, EdTech, and biotech, the most active vertical in Montréal during Q2 2021 was FinTech. FinTech deals comprised 20 percent of the 23 deals closed during the quarter.

Darling noted that the largest cohort of companies in Montréal that have raised money since 2020 Q1 are in the FinTech sector, followed by SaaS and healthtech. While FinTech is the largest cohort, healthtech startups have seen the highest number of deals since Q1 2020.

Luge Capital is an early-stage FinTech investor that has been keen to invest in its own backyard, with its portfolio including Flinks, Livescale, and Flare Systems. Nault told BetaKit the growth of the sector is evident in the capital local FinTech startups are attracting, as well as the region’s ability to attract large financial institutions.

“Over the last three years we’ve worked hard to grow the Montréal FinTech ecosystem,” Nault told BetaKit. “It’s paying off.”

RELATED: Flinks CEO says Montreal FinTech has “grand plans” as National Bank takes majority stake

According to Tourisme Montréal, the city is home to more than 3,000 financial organizations that collectively employ more than 100,000 people. Active financial institutions in Montréal include Desjardins Group, BMO Financial Group, Power Corporation of Canada, and Caisse de dépôt et placement du Québec.

“The most interesting trend is the willingness of large financial institutions to work with local startups as customers or partners,” Nault said, adding that all of Luge’s investors have dedicated teams that regularly meet with FinTech startups.

More startups in the pipeline to Series A

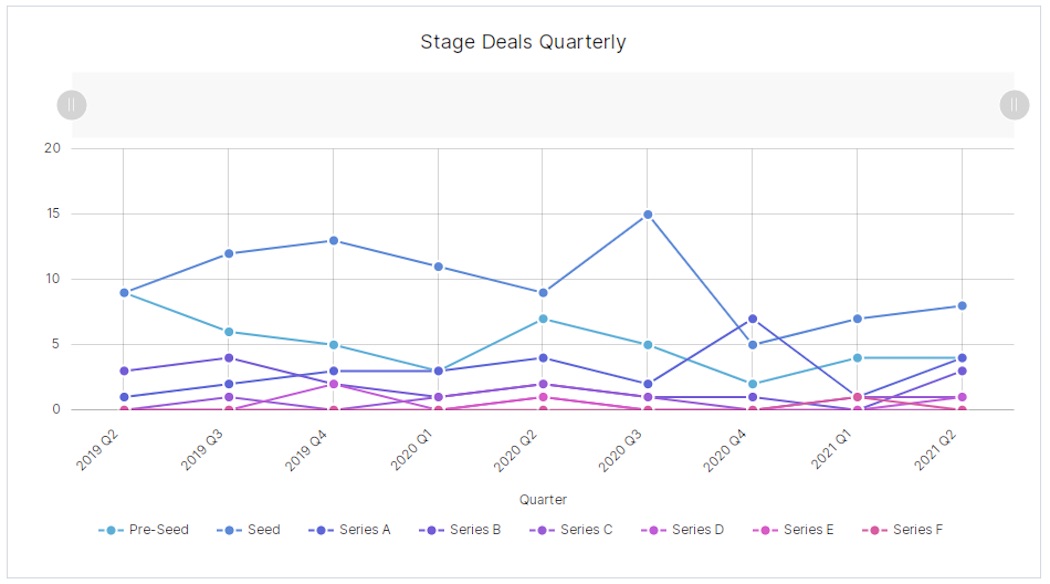

Of the 23 deals closed by tech companies in Montréal during Q2 2021, four were classified as pre-seed rounds, eight were seed rounds, and four were Series A rounds, indicating a healthy spread of deals across the earlier stages.

Some of the more notable early-stage deals included Deeplite’s $4.9 million seed round of funding and My Intelligent Machines’ $6.1 million seed financing round. Giiant Pharma also raised a $15 million seed round of funding during Q2 2021. Nault said $15 million appears to be “a bit of an outlier” for a seed funding round, but noted that the bar is being set higher for early-stage rounds.

“Rounds are clearly getting bigger because talent is more expensive and companies are expected to grow faster and faster,” Nault said. “The race is on.”

Inovia partner Magaly Charbonneau told BetaKit round sizes are getting larger at the earlier stage for a few reasons, one being that there is more capital circulating in the ecosystem, which has led to increased competition in rounds. Charbonneau also noted that larger round sizes are a product of startups’ aggressive growth ambitions and their desire to attract strong talent.

Five deals were classified in the Series B stage and above in Q2 2021, representing roughly one-fifth of total deal volume. Aside from the three megadeals, other significant late-stage rounds included Nesto’s $76 million Series B round of funding and Salesfloor’s $33.2 million Series B funding round.

“With deals across all stages from pre-seed to Series C, this is a healthy quarter for Montréal overall,” said Darling. “Of particular note is the balance between seed and Series A deals, where seed had two times as many deals as Series A, meaning there is a healthy pipeline of companies that will be ready to move to Series A in future quarters.”

In Q2, three private equity deals closed in Montréal. These included dcbel’s $49 million deal, eStruxture’s $600 million raise, and Averna, which received an undisclosed investment in April.

Nault also highlighted that in the last year, Montréal tech companies have been very active in public markets. He said the successful IPOs of companies such as Nuvei, Lightspeed, and Dialogue are driving investors to take “big bets” on the current generation of Montréal companies.

Nault said he believes the Montréal tech ecosystem will see continued growth into next year, so long as access to capital, talent, and customer demand in the region remain strong.

BetaKit is a Hockeystick Tech Report media partner.