Although Calgary tech startups raised more venture funding through more deals in 2020 than in the year prior, a lack of early-stage deals could indicate a funding gap at this stage extending across Western Canada.

Hockeystick tracked four deals under $250,000 in 2019 and 2020, indicating an early-stage gap.

Hockeystick’s Calgary Tech Report looks at how the province’s tech ecosystem fared in terms of deals and dollars, with data sourced through exclusive partnerships with organizations like the Canadian Venture Capital and Private Equity Association (CVCA). Hockeystick also compiles data from startups using its platform, as well as public data sources.

Overall, Calgary’s ecosystem showed healthy growth across both funding and deal volume in 2020. Startups in the city raised a total of $307 million over the year, an 88 percent increase from 2019. A total of 34 deals closed in 2020, up by 26 percent from 2019.

“The majority of this increase can be accounted for in the three largest deals in 2020 with two of those deals being in FinTech companies,” said Rob Darling, research partner at Hockeystick. “What we are seeing is a shift in the Calgary ecosystem, showing that it is also a great place to start and grow a FinTech or healthtech company.”

In its report, Hockeystick attributed Calgary’s solid year of venture activity to the city’s deep talent pool and strong foundation of startup support. Calgary is home to several post-secondary institutions, which are fuelling a pipeline of talent that can be seen in two of the largest deals of the year.

According to data from LinkedIn, 37 percent of the team at Symend, which raised a $73 million Series B round of funding in May, have graduated or taken courses from Calgary post-secondary institutions. That number is 24 percent for Neo Financial, which raised a $50 million Series A round of funding over the course of 2020. Neo Financial and Symend’s deals represented the largest Series A and B rounds in recent Alberta history.

“We can see the significant impact that post-secondary schools in Calgary are having in developing graduates with the skills needed for growing tech companies,” said Darling.

Calgary is also home to a number of ecosystem support organizations, such as co-working spaces, incubators, and accelerator programs. Over the last year, the city has drawn attention from notable Canadian organizations looking to tap the Calgary ecosystem.

Last year, MaRS entered into exploratory talks with the University of Calgary to bring a new innovation hub to Western Canada. This week, Platform Calgary and the DMZ, Ryerson University’s tech incubator, launched a new partnership to foster long-term collaboration between the Toronto and Calgary startup communities.

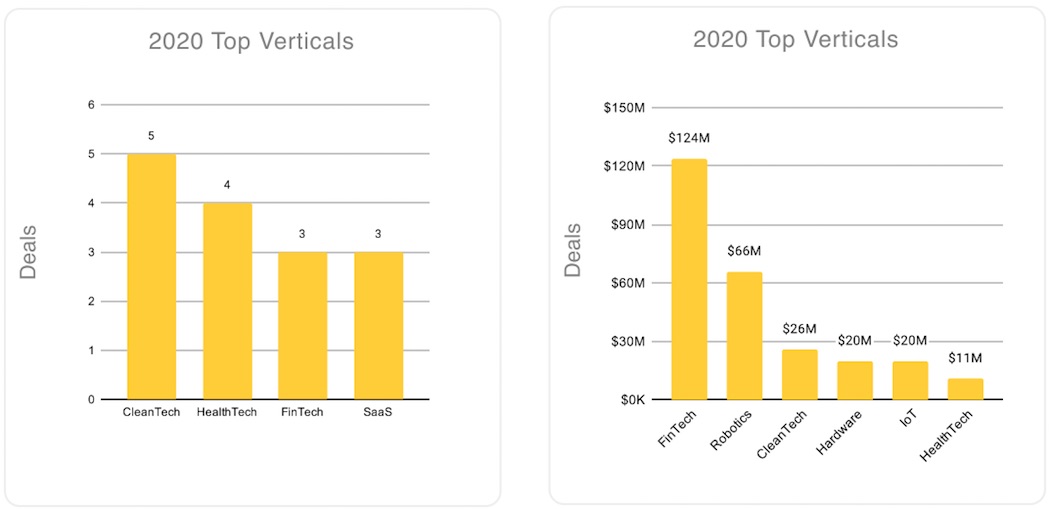

As a historically oil and gas economy, Calgary’s tech venture activity is generally largely dominated by deals in the cleantech and energy sectors. While this was the case in 2019, according to Hockeystick, healthtech emerged as the second-highest number of deals in 2020, with FinTech and SaaS tied for third. FinTech led all other verticals in total investment dollars, attracting $124 million or 37 percent of all investment in 2020.

“Businesses in energy would have been much easier for the ecosystem to understand and support in the early days, but with successes in FinTech and the growth of healthtech, we are really seeing that Calgary is much more than energy,” Darling said.

Does Western Canada have an early-stage funding problem?

Hockeystick’s Calgary Tech Report tracked only four deals closed in the $0 to $250,000 range in both 2019 and 2020, showing signs of a gap in early-stage funding in Calgary similar to the gap seen in BC last year. In BC, two deals closed in the $0 to $250,000 range in 2020, raising a total of $280,000.

Similar to the BC ecosystem, Hockeystick said the gap could be attributed to smaller deals not being disclosed. A total of nine deals were classified as “unknown” in 2019 and 2020. But Hockeystick’s data could also signal that the concerning rift in early-stage deals is not only a BC problem, but also a Western Canada problem.

Darling compared early-stage startups in Alberta to oil prospectors, in that a stoppage at the early stage can lead to the collapse of an entire industry. Darling said, “any gap in a startup stage ends up impacting all future stages, which will impact economic progress in a region.”

“At this point, what we can say is that Western Canada looks lower compared to [other regions] in Canada and that there are initiatives … that have been started in response to the lower angel activity in Western Canada,” he added.

A lack of early-stage deals could be driven by a low number of new ventures or investors available at this stage. One potential reason Hockeystick cited for this was the Alberta government’s cancellation of the Alberta Investor Tax Credit (AITC) in 2019 could be playing a role.

“At this point, what we can say is that Western Canada looks lower compared to [other regions] in Canada.”

In 2019, the Alberta government, under United Conservative Party leadership, suspended the tax credits, a decision censured by many in the province’s tech sector. At the time, one Alberta-based founder told BetaKit his company would not exist without programs like the AITC, while another called the province’s decision to cut the AITC short-sighted.

The AITC was part of a number of program cuts initiated by the UPC that faced backlash from the tech sector. The UCP later created a working group to advise the government on its tech sector strategy and has made some commitments to the sector in its subsequent budgets and economic recovery plan, but has not reinstated the AITC.

Darling said he had heard of angel investors that paused or stopped investing altogether in Alberta companies when the AITC was cancelled.

“Who wouldn’t pause if they were unsure if a 30 percent tax credit was going to come back or if a new program was going to be announced?” he added. “While the Alberta government did change course and released some new programs for the technology sector for R&D and venture capital, it still leaves a gap in incentive for angel investment, especially in the under $250,000 deal size.”

Last year’s investor surge could fill the early-stage gap in 2021

Although the region’s smallest deals diverge from the Calgary ecosystem’s hopeful quarter, it appears some groups are looking to fill the gap. In the last year, several early-stage angel groups moved to Calgary, looking to inject some capital into the ecosystem.

In October, angel group Allied Venture Partners launched in Calgary, focusing on early-stage tech companies. More recently, NACO launched its own angel investment programming as well as a Calgary tech hub to support early-stage activity in the region. These moves came a year after NACO CEO Claudio Rojas signalled his desire to expand the organization’s reach in Alberta.

Hockeystick’s report reflects some of these recent developments. The number of investors in Alberta shot up over 2020 to 62, an impressive 195 percent increase.

Hockeystick’s Calgary Tech Report also indicated that last year’s distribution of deal size in Calgary appears healthy from $250,000 upward. A total of 53 percent of deals below Series A Financing and 47 percent of the deals at Series A or above in both 2019 and 2020.

“I think the numbers for 2021 will see a slight uptick based on these organizations getting established, building the relationships, and getting the pipeline for deal flow started,” Darling said. “But it will take time for Calgary to readjust to the dynamics of no tax credit for early-stage investment.”

BetaKit is a Hockeystick Tech Report media partner.