With no late-stage deals, the second quarter of 2021 marked the Calgary tech ecosystem’s lowest quarter for venture funding in the last two years, according to the latest Hockeystick + briefed.in and Calgary Economic Development report.

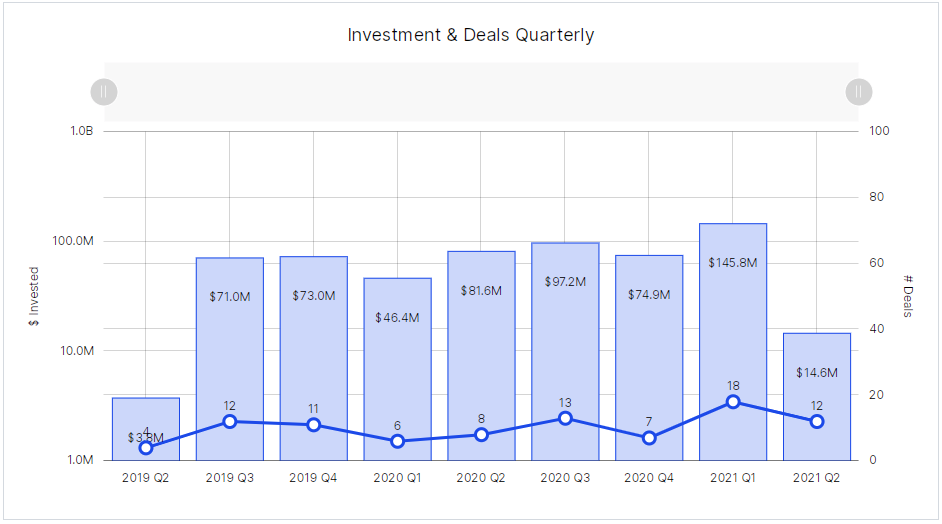

In Q2, the Calgary tech ecosystem had 12 investments totalling $14.6 million, a 90 percent decrease in total investment from last quarter and an 82 percent decline compared to Q2 2020.

“Calgary has been a bit of a new entrant into the story of Canadian technology, but I think that narrative is going to continue to change.”

– James Lochrie, Thin Air Labs

For a smaller tech ecosystem, Calgary has managed to keep venture funding consistent since Q2 2019. In the first quarter of 2021, the city set a new two-year funding record with $146 million raised. However, the city’s Q2 performance stood in stark contrast to four other Canadian tech ecosystems (Toronto, Montréal, British Columbia, and the Waterloo Region), which saw their best quarters ever.

James Lochrie, partner at Calgary-based venture studio Thin Air Labs, was surprised by the city’s performance in Q2. However, he sees this as an aberration rather than a trend.

“Despite its accelerating growth, Calgary is still a relatively small market, and this type of short-term result is probably to be expected,” Lochrie told BetaKit. “I would say the same thing if the number was enormous.”

Deal volume also slowed compared to the first quarter of the year. With a total of 12 deals, activity decreased 33 percent quarter-over-quarter but increased 50 percent year-over-year. Lochrie said because deal volume declined, it’s easy to miss that the companies that do close deals are often “highly scalable companies working on very difficult challenges in huge markets.”

David Edmonds, who serves as industry chair of the A100 and heads up Alberta-focused Accelerate Funds II and III, said the city’s results are explainable. He noted that following a stressful winter and a pause on COVID-19 restrictions, many in the Calgary tech ecosystem needed time off work to “decompress.” Edmonds indicated this could be a reason that deal flow in the region fell.

“A numbers game”

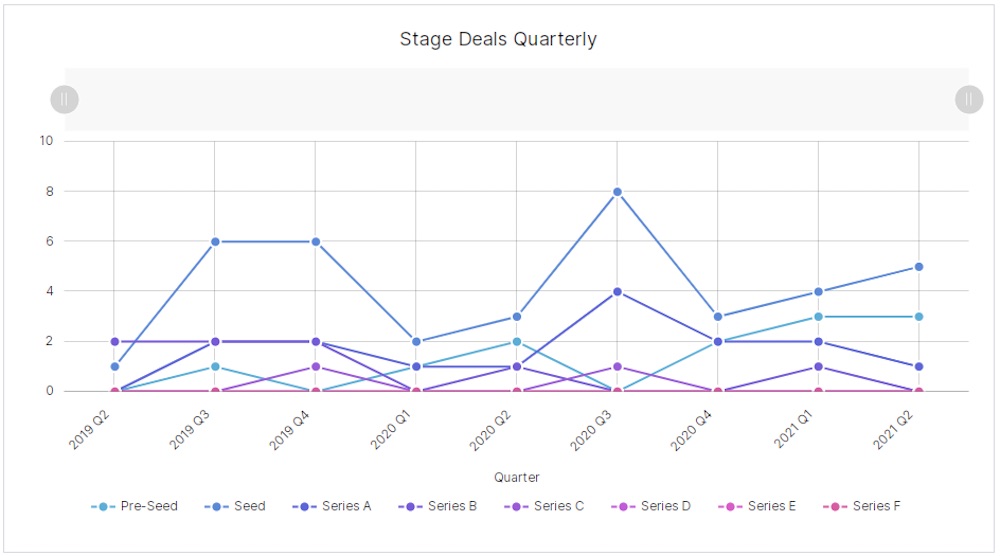

According to Hockeystick and briefed.in, Calgary saw three pre-seed deals and five seed deals close during Q2. Some notable early-stage deals included Kinetx Sciences’ $3.8 million seed funding round, Virtual Gurus’ $2 million round of seed funding, and PayShepherd’s $700,000 pre-seed raise.

Last year, Hockeystick tracked a possible gap in early-stage funding for the Calgary tech ecosystem. But recently, several initiatives have spun up from the public and private sectors to fill that gap.

In the private sector, tech financiers, including Thin Air Labs and the Accelerate Funds, have eagerly invested in local early-stage ventures. Additionally, the National Angel Capital Organization has also recently expanded its presence in Calgary and Alberta more broadly.

In the public sector, the City of Calgary funds various local early-stage initiatives through organizations like Calgary Economic Development and Platform Calgary. The latter also runs Startup Calgary, another early-stage-focused innovation entity.

Patrick Lor, a Calgary-based managing partner at seed-stage venture firm Panache Ventures, told BetaKit the Calgary ecosystem is quite busy from his vantage point, particularly from an early-stage perspective. He said Platform Calgary, StartupTNT, Alberta Innovates, and The51 are a few of the initiatives that may contribute to more deal flow in the fall.

Lochrie said though the ecosystem has made strides in closing the early-stage funding gap, he wants to see more activity at this stage.

“We have a long way to go, and the next step is scaling the number of investors and the amounts they invest,” Lochrie said.

Edmonds said he is seeing an increasing number of ventures at the seed stage in Calgary, though not all are investment-ready. The Accelerate funds made three investments in Q2, and Lochrie noted the early-stage pipeline has “never been more full of possibilities.”

Cleantech firm Orennia’s May round of funding was the sole Series A deal that closed in Calgary during Q2. The investment amount was undisclosed but was in the “high single figures” of millions in US dollars, according to The Globe and Mail.

Hockeystick and briefed.in did not track any deals in the Series B-and-above stage, which further explains the low levels of overall investment during Q2. Edmonds acknowledged that Alberta as a whole should grow its capital ability when it comes to large financings, like the ones the province saw with Absorb and Benevity.

“Late-stage funding is harder to grow,” Edmonds said. “Most companies doing large Series A, B, and beyond in Alberta want to engage with organizations that bring much more than money to the table as investors.”

However, Lochrie said the lack of late-stage deals in Q2 does not necessarily suggest companies in Calgary are struggling to get to the next growth stage.

“In Alberta, it is simply a numbers game. If there were more seed investors or seed investors who could write larger cheques, we would see more later-stage funding,” Lochrie said, adding that supporting early-stage ventures so they can eventually fill the late-stage gap is part of Thin Air Labs’ underlying thesis.

“Calgary is coming”

In the first half of this year, Calgary has reached 53 percent of the funding raised in 2020 and 88 percent of the deals closed in 2020, both thanks to the city’s record-setting first quarter. CEO of briefed.in Rob Darling noted that Calgary is currently on target to beat 2020, which was the city’s best year ever, in terms of deals and funding. Despite the lower funding levels in Q2, Edmonds said he is still very positive about Calgary’s ability to create, grow, and scale its tech sector.

“It takes the entire community to support these firms in terms of money, being first customers, attracting new [and] experienced talent, and working hard on attracting new capital,” said Edmonds.

“Calgary has been a bit of a new entrant into the story of Canadian technology, but I think that narrative is going to continue to change and likely in continually significant steps as we move forward,” added Lochrie. “Calgary is coming. It’s inevitable.”

BetaKit is a Hockeystick Tech Report media partner.