Toronto tech startups once again broke venture funding records, raising over $1.6 billion through 53 deals in Q3 2021, according to the latest report from Hockeystick and briefed.in.

Per Hockeystick and briefed.in data, Toronto tech funding has soared to a new record in every quarter of 2021 so far. The $1.64 billion raised in Q3 2021 represents a 12 percent increase from the previous quarter, and a 431 percent increase year-over-year. The strong Q3 performance also preserved Toronto’s first-place lead in Canadian tech in terms of dollars raised.

“I’m seeing many VCs who previously focused almost entirely on the Bay Area and New York turn their attention north, especially to Toronto.”

Matt Cohen, the founder and managing partner of Ripple Ventures, believes Toronto’s record-busting Q3 is a sign that investor interest in the city’s startups has turned a corner.

“Toronto is no longer a second thought for VCs, and this is reflected in how it’s matching other startup hubs’ incredible funding growth this year,” Cohen told BetaKit.

As of the end of Q3, Toronto startups have raised a cumulative $4.1 billion this year, surpassing the total investment raised in 2020 by 281 percent. Laura Lenz, partner at OMERS Ventures, said the continued boost in funding can be partly attributed to an increase in round sizes for Toronto startups.

“It’s a founder’s market, meaning rounds are being raised quickly and at high valuation multiples – 20x forward revenue is not uncommon,” Lenz said. “With a massive amount of supply in the market, round sizes are getting larger.”

The largest deals closed in the region during Q3 included Clearco’s $268 million Series C round of funding, Deep Genomics’ $226 million Series C round of funding, and FreshBooks’ $163 million Series E financing round.

Artificial intelligence was the most active quarter in Toronto during Q3, accounting for 17 percent of deal volume. SaaS, FinTech, and healthtech were also among the most active sectors during the quarter.

“Toronto’s reputation in AI has long been the highlight of its tech ecosystem,” Cohen said. “VCs are finally catching on to the incredible innovation going on in healthtech, FinTech, and also logistics.”

The three largest rounds contributed significantly to Toronto’s record-setting Q3, but only accounted for approximately 40 percent of all investment in the region, indicating that funding was spread healthily across deals.

Though investment in the region has continued to skyrocket, deal volume continued to decrease. The 53 deals closed in Toronto during Q3 represent a 22 percent decrease from last quarter, but still an eight percent increase year-over-year. Since reaching a high of 79 deals in Q1 2021, deal volume has fallen each quarter in Toronto.

“Total funding dollars outpacing the number of rounds tracks with the broader funding trends, where late-stage mega-rounds have dominated the overall amount of funding going into startups,” Cohen said.

Lenz also noted the slowdown in deals may be explained by VCs clustering around the city’s “outperformers,” meaning companies that have a “great founding team, a massive market they are disrupting, or impressive month-to-month revenue growth.”

“This that OVO, that SZN, this that [mature] Toronto”

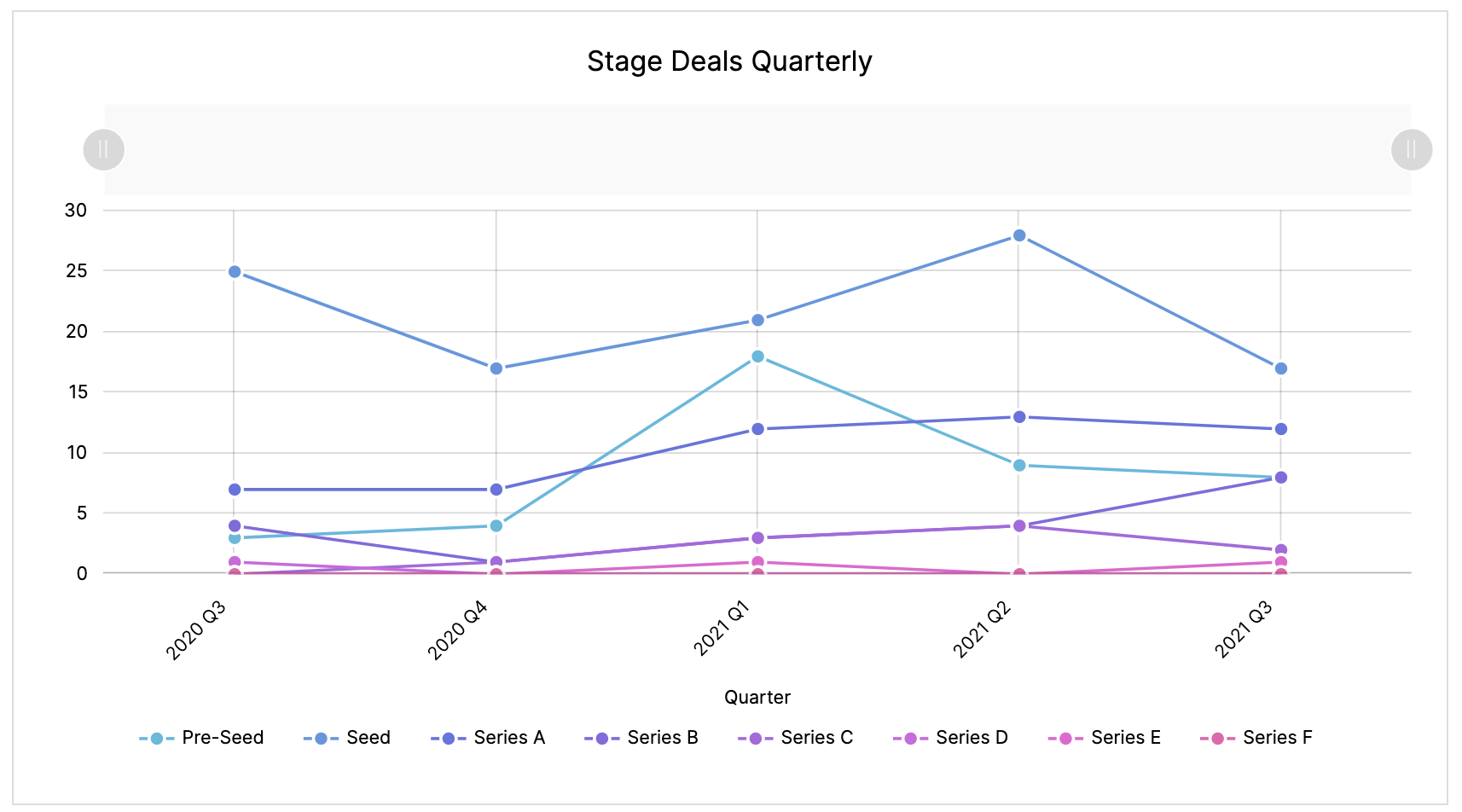

Of the 53 deals closed in Toronto during Q3 2021, eight were pre-seed-stage and 17 were seed-stage, which, when combined, equates to nearly half of all deal volume. Though this represents a decline from last quarter, Lenz said the city’s early-stage tech ecosystem is still stronger than she has ever seen.

“Many early-stage companies decide to disclose their funding round at a later date, so this might not yet give us a clear picture,” she added.

Top early-stage deals included Horizon Blockchain Games’ and Aviron Interactive’s seed funding rounds, each totalling $5.6 million, and Float’s $4 million seed funding round.

Of all the seed-stage companies in Toronto, 72 percent have managed to raise a Series A round within the standard 18 months following their seed rounds, according to Hockeystick and briefed.in. In Q3, 12 Series A deals closed in the city.

A total of 11 Toronto late-stage (Series B and above) deals closed during the third quarter, up from the eight late-stage deals closed in Q2. Eight of these late-stage deals were Series B rounds, including Gatik’s $107 million Series B funding round, Properly’s $44 million Series B funding round, and Fresh Prep’s $21 million Series B funding round.

Lenz said the increase in late-stage activity demonstrates the maturity of the wider Canadian tech ecosystem.

“Three years ago, Series B deals were roughly 10 percent of the deal volume, now it is almost double that, demonstrating that Canadian companies have the team and aspiration to scale,” she said.

Bay Area attention

Toronto’s frothy market for tech valuations has made it an increasingly attractive city for global investors this year. According to briefed.in data, Y Combinator, Global Founders Capital, and Techstars are now some of the most active VCs in Toronto. In Q3, foreign investors such as SoftBank and Accomplice were also participants in some of the city’s largest venture rounds.

“I’m seeing many VCs who previously focused almost entirely on the Bay Area and New York turn their attention north, especially to Toronto,” Cohen said, adding that Canadian investors are also uniquely suited to take advantage of Toronto’s current tech boom.

Cohen noted that even if the Toronto market starts to pull back in 2022, investors may continue supporting deals in the city given “how financially sound so many of the startups are.”

“There’s a strong builder ethos here, and in this era of soaring valuations, VCs are finding some great investment opportunities in financially disciplined Canadian startups,” he said.

BetaKit is a Hockeystick Tech Report media partner.