Macroeconomic challenges persisted in British Columbia in the first quarter of 2023, culminating in the province’s least active quarter for venture funding deals in the last three years.

According to briefed.in’s latest report, in the first quarter of 2023, startups in BC raised a total of $95.1 million through nine deals. Investment in terms of dollars raised fell by 78 percent from the fourth quarter of 2022 and 82 percent year-over-year (all dollar amounts are in CAD).

Despite its slow start to the year, there are signs that BC’s tech sector will pick up fundraising momentum in 2023.

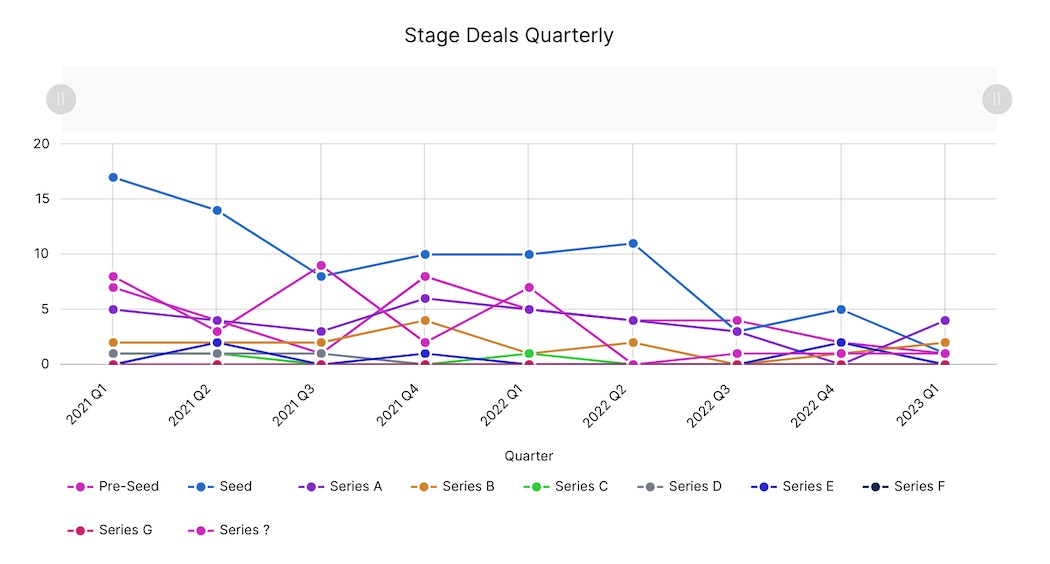

Q1 2023 represented BC’s third-lowest funding quarter in the last three years, with only Q3 2022 and Q4 2020 being lower. The first quarter was also BC’s slowest in terms of deal activity since at least Q1 2019, when briefed.in began tracking venture funding in the province. Deals fell by 18 percent from Q4 2022 and 69 percent year-over-year.

Much like other Canadian tech ecosystems, BC venture funding has fallen dramatically in the last year following a record-setting 2021 in which the province’s startups cumulatively raised approximately $4 billion, putting it on par with ecosystems like Toronto.

Venture funding has declined almost every quarter in BC since the third quarter of 2021—though the province saw one uptick in funding in the fourth quarter of 2022.

Chris Neumann, BC-based partner at Canadian early-stage firm Panache Ventures, observed that funding activity was sluggish in the first quarter, particularly at the later stages. “While pre-seed and seed investors generally remained active— Panache closed six investments in Q1—the industry overall continues to progress with caution,” Neumann said.

“Last year, the best founders across Canada put themselves in a position to delay fundraising and take more control of their destiny,” Neumann continued. “With so many VCs still sitting on their hands in Q1, the strong move for founders was to stay heads down and focus on their business.”

Neumann believes another factor that may have influenced British Columbia’s venture funding results in the first quarter of 2023 was the rise of generative AI. The fast emergence of AI tools like ChatGPT and DALL-E has sparked significant discussion in the tech sector, not due to their ability to generate sophisticated content, but also for their potential impact on future tech sector investments.

Neumann said while AI deals remain competitive, “deals in most other sectors slowed in Q1 as investors and founders tried to wrap their heads around the question of ‘What does this mean for me?’”

VCs across Canada are now starting to take a closer look at generative AI tools and the opportunities they present. Jordan Jacobs, co-founder and managing partner of Radical Ventures, which recently began raising a $550 million USD venture fund for AI companies, said he believes “AI will eat all software over the next decade.”

Given the meteoric rise of AI at the beginning of 2023, Neumann believes it’s currently a great time to fundraise “if you’re in or around AI. For everyone else, focus on the fundamentals.”

Raising off the record

During the first quarter, briefed.in tracked only two early-stage deals in BC, including one $1 million pre-seed round of funding closed by Levr.ai, and one $8.1 million seed funding round closed by recently formed Terramera subsidiary, EnrichAg. Two early-stage deals represent a three-year low for early-stage activity in the province.

Neumann, who invests in startups at the seed stage, said while Q1 was certainly a soft quarter in the early stages, he believes there was an underreporting of early-stage deals at play.

“In Q1, Panache made investments into six startups, including two in BC—and none of those rounds have been publicly announced,” Neumann said. “As investors, we follow the lead of our founders and only disclose with their permission.”

briefed.in’s data is collected from founders who submit their deal information directly, or from online, public sources, and not all companies or investors publicly disclose early-stage deals.

Neumann has noticed for several years, an increasing proportion of founders have chosen to not publicly announce their rounds. “That trend increased as the economy slowed and shows no signs of reversing,” Neumann said.

There were four Series A funding rounds tracked by briefed.in Q1 2023, making it the most active stage during the quarter. Major rounds included pH7 Technologies’ $21.7 million Series A funding round and ZenHub’s $10 million Series A funding round. Neumann said the relatively high number of Series A deals in Q1 2023 indicates a still-healthy early-stage ecosystem in BC.

Silver linings in Q2

Although British Columbia experienced a slow start to the year, there are encouraging signs that the province’s tech sector will pick up fundraising momentum in the remainder of 2023.

For one, new venture funds actively came online in the province in the first quarter, including Yaletown Partners, which closed its $200 million growth fund; Raven Indigenous Capital Partners, which completed the final close of its $100 million venture fund; and Pender Ventures, which closed the first half of its $100 million fund.

Adding to this optimism, a number of companies in the province have already pulled off significant fundraising feats since the close of Q1, including Vancouver-based LayerZero, which last month closed $120 million at a $3 billion valuation, and Abdera Therapeutics, which raised $142 million for a combined Series A and Series B round of funding.

Neumann said his firm has invested in one BC-based startup this quarter, and noted that only one month into Q2, he has seen fundraising activity at all stages pick up significantly across both Canada and the US, which he believes is a “promising sign for BC-based startups.”

briefed.in is owned and operated by Communitech. BetaKit receives data from briefed.in as part of a media partnership with Communitech and retains full editorial control of all articles that reference the data produced by briefed.in/Communitech.