For the fifth straight quarter, venture funding in British Columbia trended downwards in Q3 2022, but local VCs aren’t sounding the alarm just yet.

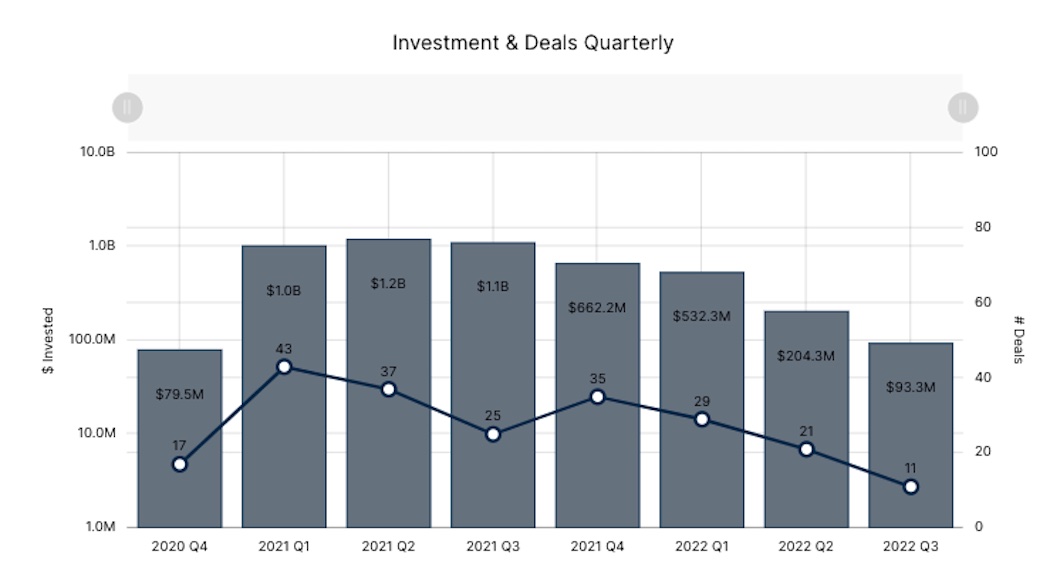

According to a new report from briefed.in, BC-based companies raised a cumulative $93.3 million through 11 investments in Q3 2022. Investment in the province declined 54 percent from Q2 2022, and fell 92 percent year-over-year, making Q3 2022 BC’s lowest funding quarter since Q4 2020.

“I think it’s safe to say that we are in the ‘stand-still’ phase of the market, where the bid-ask spread is too far apart and people are not transacting

Venture funding in BC has declined each quarter steadily since reaching a record of $1.2 billion in the second quarter of 2021. Mike Winterfield, founder and managing partner of Vancouver-based Active Impact Investments, said that while the macro environment is tough and investor sentiment has changed since 2021, he still believes BC is an attractive market to invest in.

“This time last year, investor FOMO was everywhere and we saw many investors chasing sizzle instead of steak,” Winterfield told BetaKit. “We have always made investments based on business fundamentals, and we’re seeing more investors being similarly choosy now.”

Deal volume in the third quarter also marked a three-year low for deal volume in the province. Only 11 deals closed, which is a 48 percent decline from Q2 2022 and a 56 percent decline year-over-year. Jay Rhind, partner at Vancouver-based Rhino Ventures, believes that while there were several deals that were not captured by briefed.in’s analysis, there is still a great deal of uncertainty in the province’s venture community.

“I think it’s safe to say that we are in the ‘stand-still’ phase of the market, where the bid-ask spread is too far apart and people are not transacting,” Rhind added.

Investors staying on the sidelines

briefed.in’s report tracked zero megadeals (meaning deals valued at $100 million or more) in BC during the third quarter of 2022, per briefed.in’s report. Last year, the province was a hotbed for megadeal activity, with rounds like Trulioo’s $476 million Series D funding round, Visier’s $155 million Series E raise, and Clio’s $136 million Series E funding round pushing BC’s investment metrics to new records.

“In BC, many cohorts of [Series B and higher] companies were, arguably, overcapitalized in 2021,” Rhind noted. “These companies are sitting on high-water mark valuations and are taking the rational approach of growing into their valuation.”

The largest reported rounds of Q3 2022 included Nexii’s $45 million funding round, Ideon Technologies’ $21.1 million Series A funding round, and Intelligent City’s $12 million Series A funding round. briefed.in’s report also tracked no deals in the Series B or higher stages.

Rhind noted that there were several insider-led bridge rounds deals not captured by briefed.in’s report, and the current motivation from late-stage companies is to avoid down rounds. He added that investors with capital appear to be waiting on the sidelines for the “trickle-down effect from the public markets to rationalize private market valuations.”

Of the 11 deals closed in BC during Q3 2022, four were pre-seed deals, three were seed-stage deals, and three were Series A deals. According to briefed.in, the province saw a 72 percent quarterly decline in seed-stage deals compared to Q2, making this quarter the lowest on record for seed-stage deals since at least 2019.

Although Rhind has noticed fewer deals at the pre-seed and seed stages in BC recently, he believes it’s too early to rule out the province’s early-stage ecosystem. “This is not a BC-specific issue, it is being felt everywhere,” Rhind added. “The quarter-over-quarter variability is more acute in small ecosystems like BC where few large deals can change the numbers meaningfully.”

“My hypothesis is that in three to five years, when we look back at the cohort of companies launched and capitalized in 2022 and 2023, there will be world-class success stories,” he added.

BC’s key verticals still showing signs of life

In recent years, BC has emerged as a hub for the Web3 sector, which comprises companies operating in decentralization, blockchain technologies, and token-based digital assets. However, the global Web3 sector has floundered this year, with more than $2 trillion USD in value wiped out of the crypto market and the much-hyped NFT sector falling out of favour with companies like Apple in recent months.

Amid fears that the Web3 is dead on arrival, the sector is still showing signs of life in BC. One round in the Web3 sector tracked by briefed.in during Q3 2022 was Airswift’s $2 million pre-seed funding round, which closed in August. Rhind said the fundamental value and applications of Web3 are still being tested, and questions around the utility and economics of these technologies are now the “flavour of the day.”

“As an outsider, it seems clear that we are going through the pains of the installment phase before finding genuine commercial applications of the technology,” Rhind added.

Cleantech has also grown to become a dominant vertical in BC’s tech sector. Per briefed.in’s report, cleantech was among the most active verticals for venture funding in the third quarter. The largest deal tracked was a $45 million financing round raised by Nexii, a sustainability-focused construction tech firm that now claims to be valued at over $2 billion. Winterfield’s fund, which invests heavily in climate-focused technologies, said deal volume for cleantech companies in North America doubled in Q2 2022.

“The climate emergency is increasingly real for more people, more investors, and more asset holders, and that shows in the amount of investment and deal volume coming to climate tech,” Winterfield added.

A healthy re-focusing

So far in 2022, BC tech startups have only raised one-fifth of the venture funding raised in 2021, according to briefed.in, and while the fourth quarter is not expected to move the needle for venture funding, Rhind says there is general enthusiasm that 2023 will still be a productive year for investors.

“While the transition from boom to bust times has been abrupt, the best entrepreneurs are pulling out their copy of The Hard Thing About Hard Things and activating their war-time leadership mode,” Rhind said. “While that might sound doom and gloom, I believe it’s a healthy re-focusing for many companies.”

Winterfield noted that he expects to see more investments in the coming quarters, particularly as the province’s strategic investment fund, InBC, begins deploying capital. The $500 million fund, which revealed its investment strategy this month, will invest in every stage from seed to Series C.

“Right now there is the most dry powder, ever,” added Winterfield. “Over the past two years, mega-funds have raised billions including $20 billion in dry powder for climate tech specifically. So there is going to be deal volume, that capital is going to be deployed somewhere. It’s BC’s job to nurture and crank out great businesses to fill that demand.”

briefed.in is owned and operated by Communitech. BetaKit receives data from briefed.in as part of a media partnership with Communitech and retains full editorial control of all articles that reference the data produced by briefed.in/Communitech.