Most Canadian tech ecosystems were hit hard by the economic headwinds of 2022, but perhaps none more so than British Columbia, which saw local venture funding fall by more than two-thirds during the year.

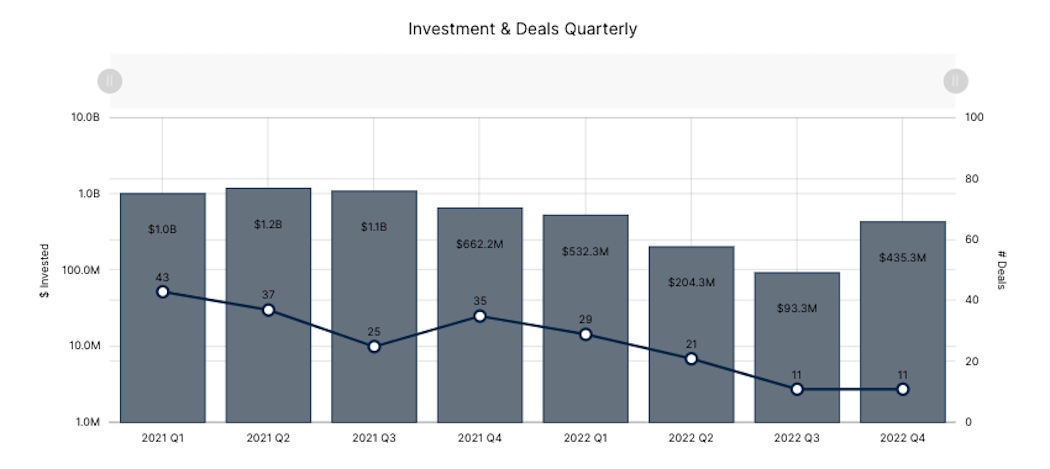

According to a new report from briefed.in, startups in BC raised a total of $1.3 billion in 2022 down by 67.5 percent from 2021, but up by 34 percent from 2020. Of all the Canadian tech regions tracked by briefed.in, BC saw the most significant year-over-year decline in funding. briefed.in tracked a total of 72 deals in BC during 2022, which is close to half of the 140 deals in 2021 and a 35 percent decrease from the 111 deals closed in 2020.

As with most other ecosystems in Canada, 2022 followed what was a standout 2021 in BC, which saw $4 billion in venture capital raised as valuations and deployable capital reached record highs.

BC startups still collectively raised more money in 2022 than in 2020, indicating a market that has cooled, but not crashed.

But the macroeconomic tides changed in 2022. Venture funding across BC, and across most of Canada, was roiled by surging inflationary pressures and a tightening fiscal policy, which weighed down valuations and caused investors to ease up on new deployments. As a result, startups shifted their focus from chasing capital to conserving it.

BC startups still managed to collectively raise more money in 2022 than in 2020, following the trends of ecosystems like Toronto and the Waterloo Region—indicating a market that has cooled, but not crashed. Mike Winterfield, founder and managing partner of Active Impact Investments, believes BC was in step with the wider trends observed across Canadian tech last year.

“According to the recent CVCA report, the national trend is parallel to general tech VC with dollars invested in 2022 being down from 2021, but the number of deals remained relatively flat, which shows that valuations are coming down,” Winterfield said. “This is likely more of a correction than a recession, as deal volume and valuations in 2021 were at an all-time high.”

Venture funding in BC fell in every quarter of 2022 aside from the fourth: thanks to Svante’s $318 million Series E funding round, BC venture funding increased by 366 percent quarter-over-quarter to $435.3 million in Q4. However, Winterfield believes that result does not necessarily indicate BC’s venture landscape has made a comeback.

“The spike in Q4 2022 appears to be an outlier based on what we have seen for Q1 so far, but it’s too early to know how 2023 will shape up,” he added.

A wake-up call for BC’s late-stage giants

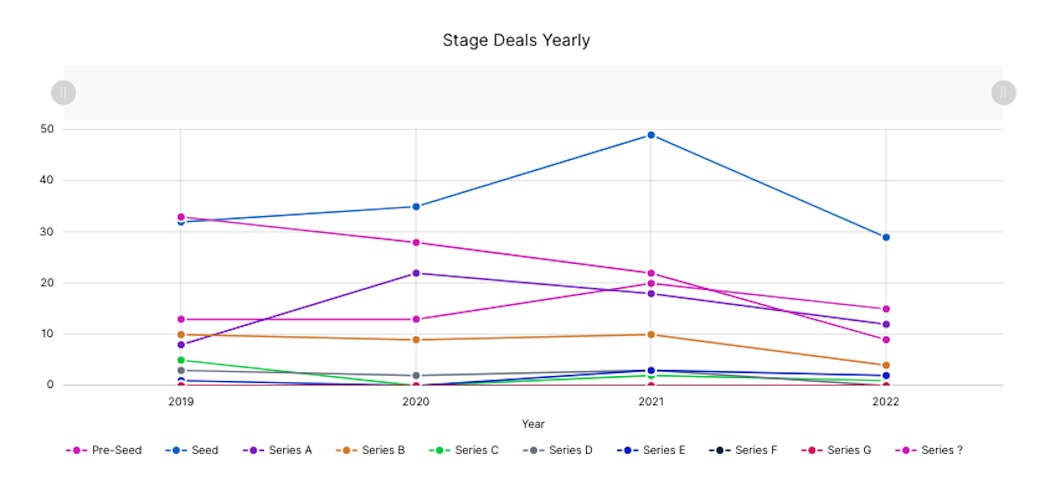

Deal volume fell across every funding stage in BC during 2022, but nowhere was this decline more evident than in the earlier stages. Seed activity in the province reached a four-year low of just 29 deals in 2022, while pre-seed deals fell from 20 in 2021 to 15 in 2022.

Stakeholders in BC like Rhino Ventures’ Jay Rhind have previously noted that the early-stage squeeze is not a problem exclusive to BC. Indeed, every ecosystem tracked by briefed.in saw a decline in early-stage funding in 2022. On the brighter side, the average sizes of pre-seed, seed, and Series A-stage deals in BC were still up significantly in 2022 compared to 2020 and 2019.

BC’s record-setting 2021 was buoyed by an abundance of late-stage megadeals from companies like Trulioo, Blockstream, and Dapper Labs. The province did see a handful of mega-rounds in 2022, such as Svante’s Series E funding round and LayerZero’s $135 million financing round. Still, megadeals that came thick and fast in 2021 were certainly scarcer in the year that followed.

Last year proved to be a difficult one for BC’s late-stage companies in more ways than one. Some of the companies that reached incredible funding milestones in 2021 have reacted to the changing economic tides of 2022 by making layoffs, including Trulioo, Dooly, and Dapper Labs. After Hootsuite’s plans to go public in late 2021 fell through, the company made successive rounds of layoffs in 2022. Other 2021 winners, like Blockstream, which claimed a $4 billion valuation that year, are now raising capital at significantly lower valuations.

“The challenge will be to grow healthy, cash-efficient companies that can avoid down, dilutive rounds as the markets even out,” Winterfield said of BC’s late-stage companies.

BC’s green, mean fighting machine

Per briefed.in’s report, cleantech companies accounted for a sizeable portion of total venture funding in 2022. Aside from Svante’s megadeal, other notable late-stage deals during the year included MineSense’s $42 million Series E funding round and Nexii’s $45 million growth financing round.

There were also some sizeable early-stage rounds in BC’s cleantech sector during 2022, including Audette’s $12.8 million pre-seed funding round, Trendi’s $6.2 million seed financing round, and Intelligent City’s $12 million Series A funding round.

Generally speaking, SaaS and FinTech tend to be the leading sectors for investment in BC, but cleantech companies also account for a notable chunk of funding. Stakeholders in BC’s cleantech sector, including the BC Cleantech CEO Alliance and the Foresight Cleantech Accelerator, have worked to make the province a global leader in this category.

Outside of BC, it appears the cleantech sector managed to perform well in 2022, relative to other markets. Winterfield, whose Vancouver-based firm invests exclusively in climate tech startups, cited one report from ClimateTech VC that found the global seed-stage cleantech sector saw a 61 percent increase in activity. In Canada, cleantech investment surpassed $1 billion for the first time in 2022, up 52 percent from 2021.

“What this all tells us is that BC needs to lean into climate tech in a much bigger way,” Winterfield said.

“The most urgent, investable and biggest opportunity is in climate tech,” he added. “The growth capital slated for climate tech is stronger than ever and hasn’t been affected by the current volatility. This makes us well-positioned to be investing at the seed stage now.”

As an outlier on the global and local stages, cleantech could be a saving grace for BC in the year ahead. For this reason, Winterfield said his firm is “bullish on the outlook of 2023 and beyond.”

briefed.in is owned and operated by Communitech. BetaKit receives data from briefed.in as part of a media partnership with Communitech and retains full editorial control of all articles that reference the data produced by briefed.in/Communitech.