Calgary tech startups eclipsed the city’s previous venture funding record in 2021, thanks in part to a surge in deal volume in the first quarter of the year, according to the briefed.in’s latest ecosystem report.

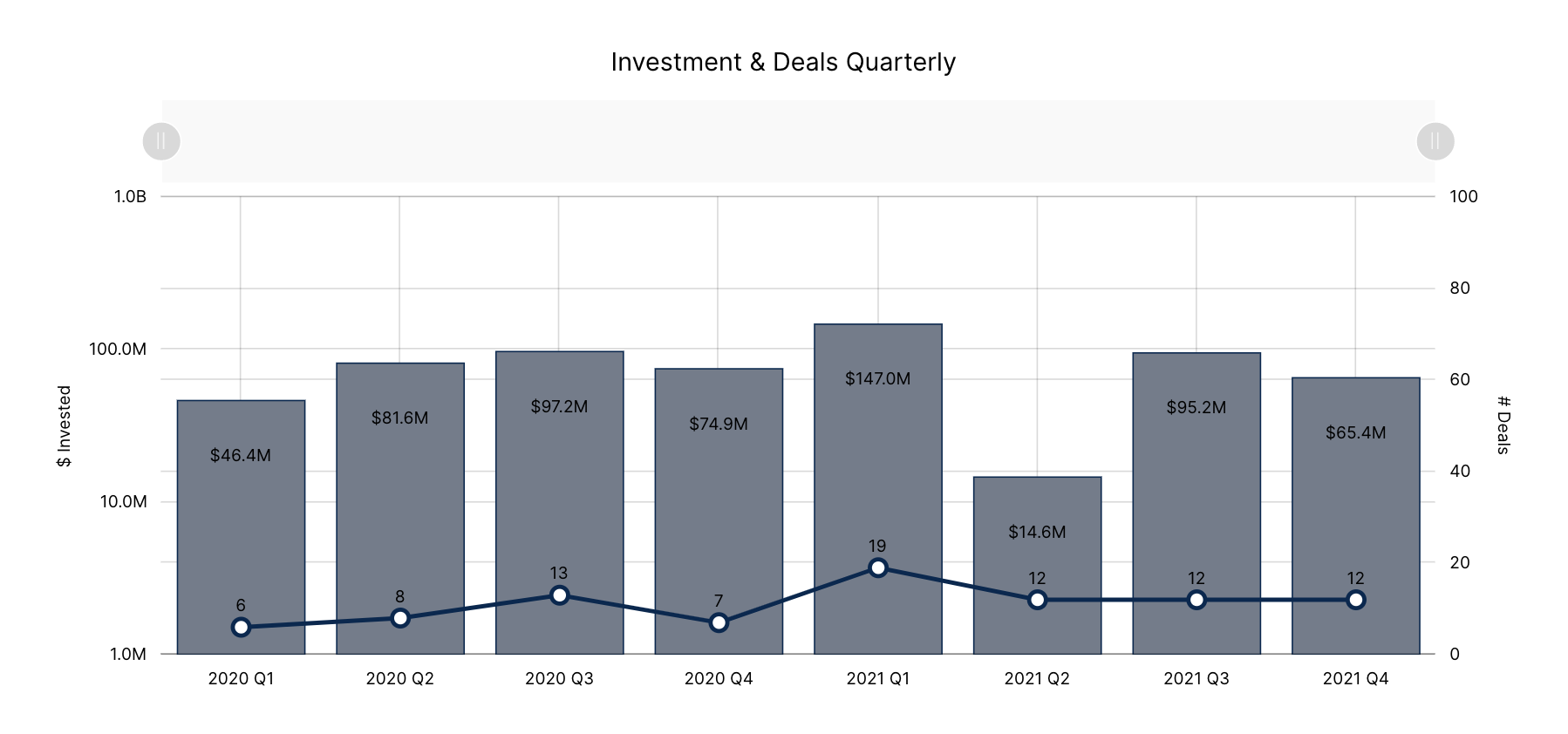

In the fourth quarter of the year, Calgary companies attracted $65.4 million in venture funding across 12 deals. The quarter brought the city’s total funding in 2021 to $322.2 million, a seven percent increase from the $300 million raised in 2020.

“The entire investment community in Calgary adapted quickly, and came together to make something great happen.”

– Patrick Lor, Panache Ventures

briefed.in collects its ecosystem data from online, public sources, and founders who submit their deal information to its database. briefed.in dates deals based on the date an investment is announced, or through confirmation from the founder of when the deal took place.

While funding growth paled in comparison to that of larger Canadian ecosystems, such as Toronto and British Columbia, Patrick Lor, managing partner of Panache Ventures, told BetaKit that these results are a clear signal that Calgary’s tech economy is growing.

Lor, who is based in Calgary, said the results likely have much to do with the pandemic-fuelled uncertainty that began in 2020. That, he said, paired with Alberta’s “already tough” economic environment, created a wake-up call for the city’s tech sector.

“It was a signal that we needed to accelerate our efforts to use digital innovation to lift our entire economy,” Lor said. “The entire investment community in Calgary adapted quickly, and came together to make something great happen.”

Funding in Calgary seesawed on a quarterly basis last year. The region’s tech sector had a strong start to 2021, raising $147 million in venture in Q2 2021. However, this quickly plummeted to a two-year low in Q2. Members of the ecosystem, including Thin Air Labs partner James Lochrie, have noted that yearly results are more often a leading indicator of a region’s performance for younger and smaller tech sectors like Calgary. Terry Rock, president and CEO of local innovation hub Platform Calgary, agreed with this sentiment.

“We have a fast-growing ecosystem, but compared to the top Canadian markets, Calgary’s funnel of investment-ready candidates is smaller,” Rock told BetaKit. “We’re also seeing a few larger deals from the fastest-growing or more established startups, which will skew quarterly numbers.”

Contributing to Calgary’s yearly investment growth was a surge in investment activity. In 2021, deal volume in Calgary increased to 55 deals from 34 in 2020. On a quarterly basis, activity peaked in the first quarter of the year, before dipping to 12 deals in Q2 2021, which did not rise or fall in the second half of the year. Rock noted that given some recently launched ecosystem initiatives, he expects this growth trend to continue.

“Platform Calgary has broken its own early-stage startup client volume records over the past three years, nearly tripling the number of founders served, so we are not surprised to see an increase in deal volume this year,” Rock said.

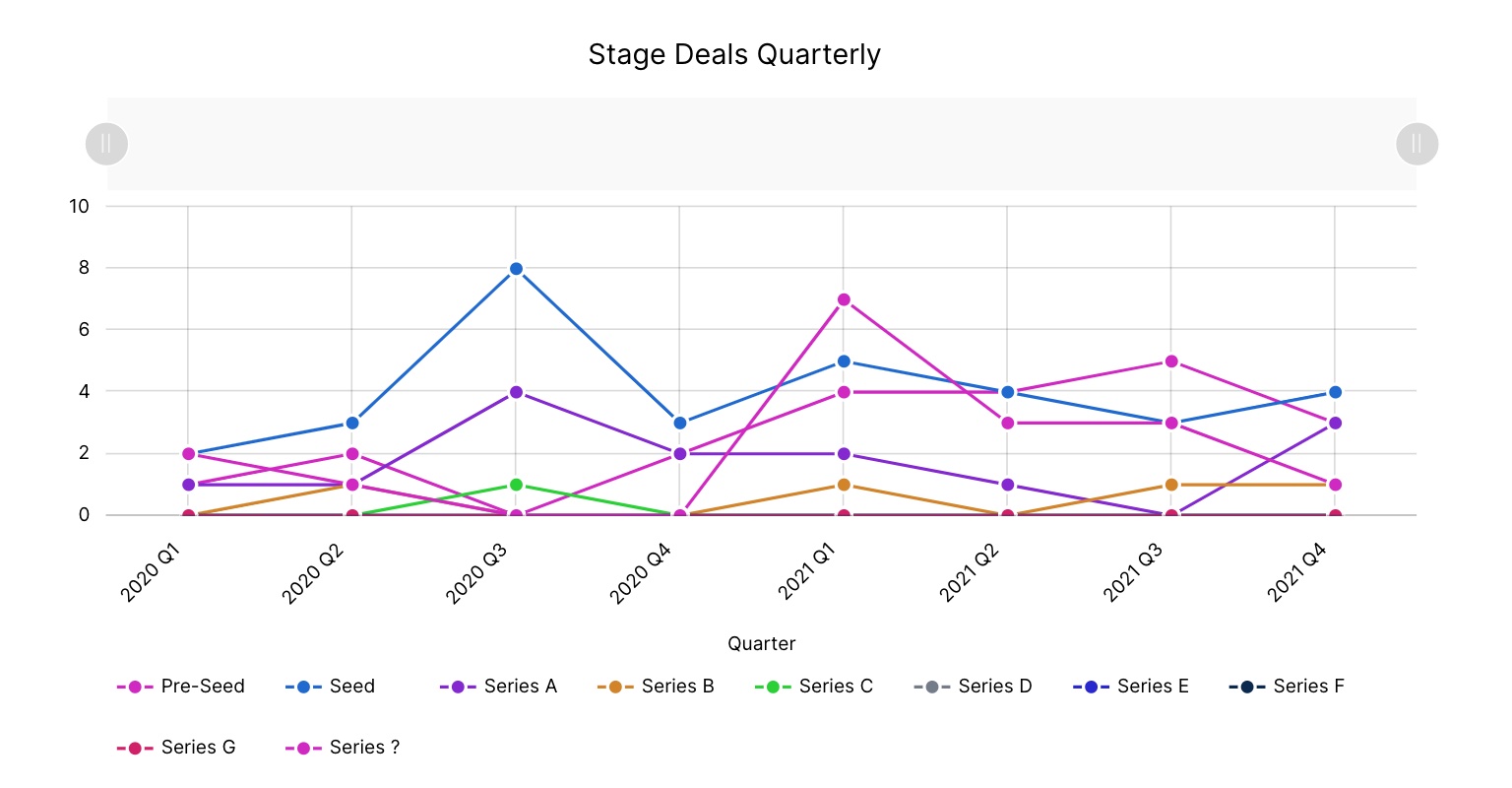

Pre-seed activity tripled in 2021

One of the most notable developments in Calgary during 2021 was the uptick in pre-seed investments. According to briefed.in, pre-seed funding accounted for a small percentage of overall investment, yet activity at this stage still increased by more than 220 percent, from five to 16 deals over the course of last year.

Lor and Rock noted several initiatives that gave early-stage firms a boost in 2021. These included Platform Calgary’s pre-acceleration programming, which was recently reformulated to become a part of pre-accelerator Alberta Catalyzer. Lor also attributed some of this growth to local companies such as MobSquad have helped mobilize talent to early-stage firms in Calgary.

briefed.in’s report also noted that organizations like Startup TNT, which holds weekly meetings and semi-annual showcase summits between entrepreneurs, investors, and scientists, is another ecosystem initiative that may have contributed to the rise in pre-seed funding last year.

Though pre-seed activity saw an upward swing in 2021, seed funding saw no change from the 16 deals closed in 2020. More concerning, Series A deals in the region decreased from eight in 2020 to six in 2021. From Rock’s vantage point, some companies find it easier to drive their Series A rounds quickly in the United States while reporting no or very late interest in Canada.

“On paper, the capital seems to be available,” Rock added. “This result is likely primarily related to the relative maturity of our ecosystem. Most of our Series A candidates are still in the pipeline, but we have a steady stream of exciting stars on the horizon.”

Calgary’s late-stage activity increased slightly from 2020 levels last year, while deals that were not categorized under a specific stage significantly increased in 2021, to account for roughly a quarter of all investments over the entire year. Some of these stageless rounds included Cold Bore Technology’s $14 million growth financing round and Kudos’ $10 million funding round.

Talent will be key to unlocking future growth

FinTech was among the most active verticals for Calgary in the fourth quarter of 2021, and the sector saw significant funding throughout the year. Among the most notable FinTech deals in 2021 were Symend’s $54 million Series B extension and Neo Financial’s $64 million Series B funding round, which together comprised nearly 40 percent of all funding last year.

Smaller funding rounds also contributed to the FinTech sector’s success in 2021, including Flahmingo’s $1.88 million pre-seed funding round and PayShepherd’s $700,000 pre-seed funding round. Lor said FinTech is one of the city’s most exciting spaces at the moment and noted Harvest Builders’ work with companies like Neo Financial and Benevity’s work in the corporate social responsibility space were helping build this velocity.

“The talent coming from these companies, as well as the talent from the head offices from companies in traditional industries, is creating the groundswell for this movement,” Lor added. “We need to continue to support this sector with training through accelerators and mentorship programs, and with advice and capital from angels and VCs.”

While Lor believes talent is what currently makes startups in the Calgary ecosystem stand out, he noted the city will need a lot more of it to reach the next stage of its maturity. “The foundation of all great technology ecosystems is talent,” he said, adding that attracting more talent requires a nuanced conversation about the community and culture of Calgary.

There are signs the wider province of Alberta is taking steps to attract more tech workers. Just this month, the Alberta government launched a new immigration stream for highly skilled tech professionals. Rock said more high-potential people will lead to a greater population of high-potential companies that will ultimately attract more talent, and ultimately dollars, to Calgary.

BetaKit is a briefed.in Tech Report media partner.