Following a two-year low for tech investment, Calgary’s tech ecosystem saw a return to health in the third quarter of 2021, according to Hockeystick and briefed.in’s latest report on the region.

“There is no doubt that the combination of early-stage ventures, increasing capital, and evolving government policy is setting the stage for continued growth.”

– James Lochrie, Thin Air Labs

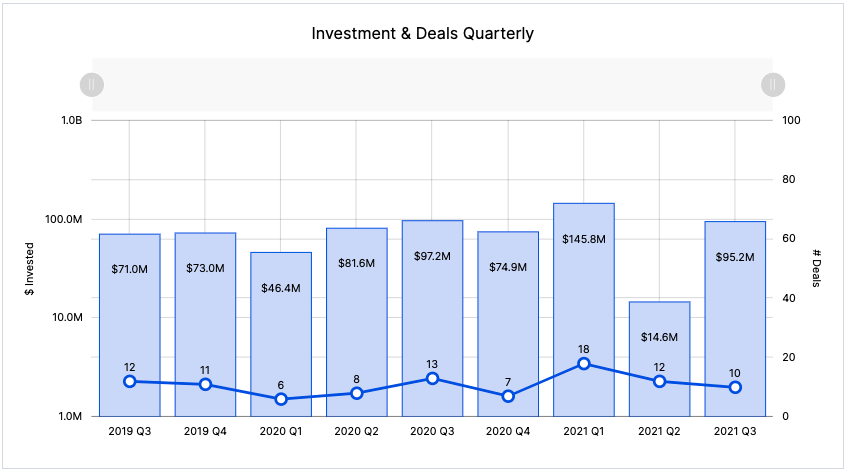

Calgary startups cumulatively raised $95.2 million in Q3, a 552 percent increase from what was widely considered a poor second quarter for Calgary. In the two years prior, Calgary tech investment has stayed relatively consistent, averaging approximately $83 million each quarter. The Prairie city’s investment results in Q3 indicate the tech sector bounced back to meet expectations.

James Lochrie, partner at Calgary-based venture studio Thin Air Labs, doubled down on his assessment from Q2 2021 that large fluctuations should be expected for a smaller ecosystem like Calgary.

“The numbers are going to vary wildly from one quarter to another,” Lochrie told BetaKit. “The key thing I like seeing is the quality of the deals and ventures that are growing and getting funded.”

Neo Financial’s $64 million Series B funding round was the largest funding round by a significant margin, accounting for two-thirds of all funding raised in Calgary. Without that deal, funding in the region would have totalled just over $30 million, which would still have been higher than the total investment raised in Q2.

A total of 10 deals closed in Calgary during Q3, a small slump from the 12 deals closed in Q2 2021. However, deal activity in Calgary is growing consistently on a yearly basis, according to Hockeystick and briefed.in.

With a total of 40 deals closed in 2021 so far, Calgary has already surpassed its 2020 performance in terms of deal volume by 23 percent. Alice Reimer, site lead at Creative Destruction Lab’s Calgary accelerator, CDL-Rockies, is not concerned by the short-term decline in deal volume.

“There is a lot of activity ongoing in the ecosystem currently,” she told BetaKit. “For example, at CDL-Rockies, we know that at least 10 of our 83 Alberta-based alumni ventures are currently raising funding.”

Shelley Kuipers, co-CEO, general partner, and growth officer at The51, agreed that the small decline in deals is not currently a worrisome sign, especially considering the quality of deals taking place in the ecosystem.

“We are seeing maturity in ventures and their growth; later-stage companies are being built here, which requires more capital [and] bigger cheques,” Kuipers told BetaKit. “This is a good sign, but we need to continue to build the follow-on venture investing capacity.”

Active early stage

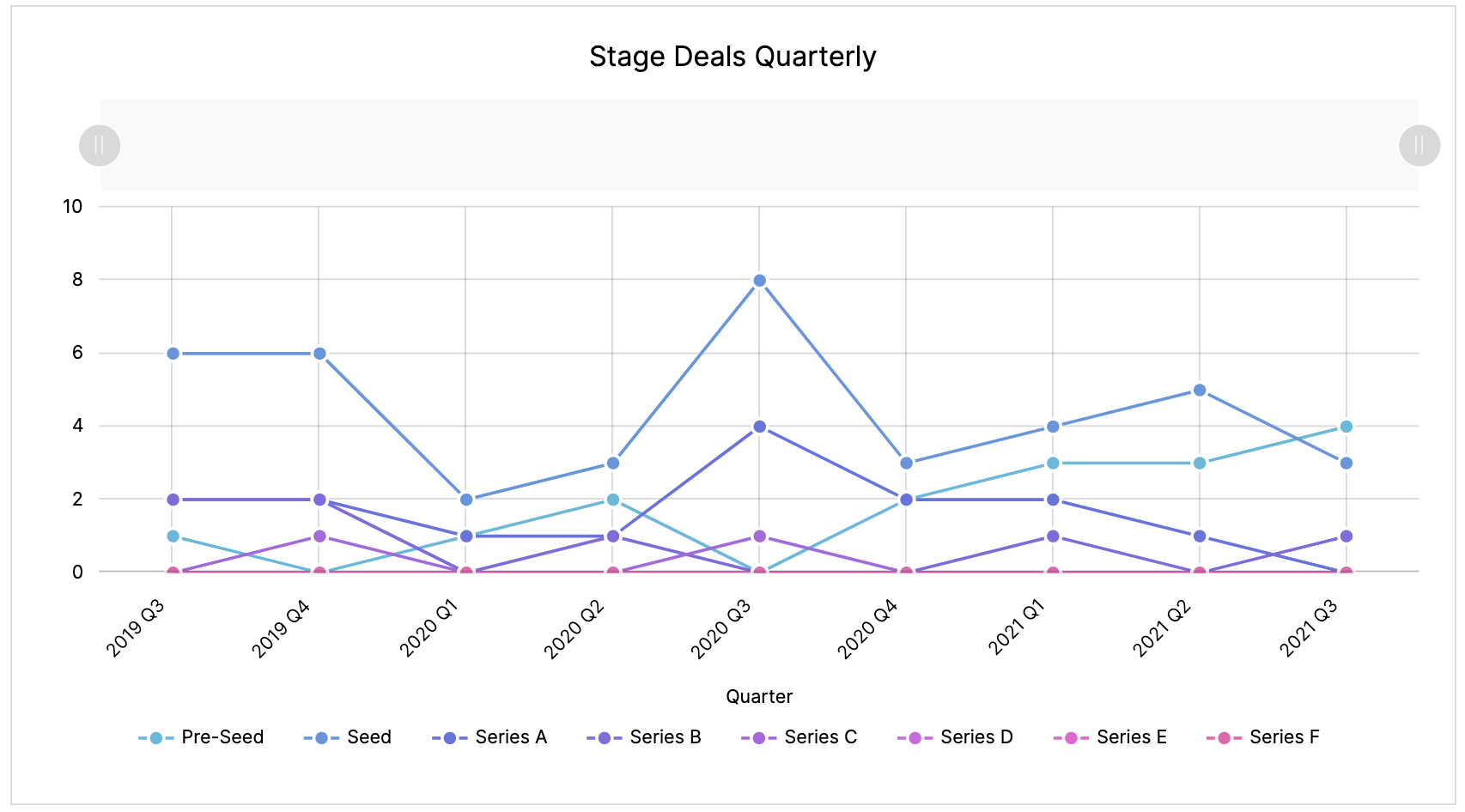

Early-stage activity in Calgary stayed consistent in Q3 relative to previous quarters. A total of four pre-seed deals and three seed deals closed, on par with the early-stage deal count seen over the last year.

The top early-stage deals from Q3 included CruxOCM’s $7.6 million seed financing round, Fluid Biotech’s $5.6 million seed round of funding, and ICwhatUC’s $1.3 million seed funding round.

Reimer noted that various players have made a concerted effort to beef up Calgary’s early-stage funding capacity in recent years, including local organizations such as OKR Financial, provincial bodies such as Alberta Innovates, and even national institutions such as the National Angel Capital Organization.

“It is important to have an active ecosystem and support in both the startup and scaleup stages of growth, in order to keep companies here in Alberta,” Reimer said. “The community in Calgary, and Alberta, has been doing the work for years to build what is now an active and growing startup ecosystem.”

Calgary startups on time when it comes to raising Series A rounds

Although no Series A rounds closed during Q3, data from Hockeystick and briefed.in indicates that most seed-stage companies in the region have managed to reach their Series A rounds on schedule.

Approximately three-quarters of Calgary’s seed companies have managed to close Series A funding rounds in the 18 months following their seed rounds; on that front, Calgary currently has the best record in Canada when compared to the four other largest Canadian tech ecosystems.

Kuipers said Calgary startups get to the Series A quickly because the region has fewer startups compared to other major Canadian cities, adding that Calgary’s “tight-knit” tech community is keen to throw its weight behind the potential winners.

“That funnel will grow as we build capacity in pre-seed, seed financing levels,” Kuipers noted, adding that she expects to see Calgary’s startups work hard to access capital in the short term given strong interest by venture investors.

Lochrie said Calgary’s tech ecosystem is also similar to that of Toronto a decade ago, when “a lack of capital coming out of the financial crisis forced companies to work on incredibly pragmatic solutions that create real value to known problems.”

”I believe that makes it easier to build a consistently performing business, even at the early stages,” he said. Lochrie noted that he expects to see continued volatility due to the size of Calgary’s ecosystem, but added that he anticipates several robust deals in the quarter ahead.

“There is no doubt that the combination of early-stage ventures, increasing capital, and evolving government policy is setting the stage for continued growth,” Lochrie said.

BetaKit is a Hockeystick Tech Report media partner.