With a cumulative $1.4 billion in venture capital raised last year, the Waterloo Region tech ecosystem may appear healthy at first glance. But a new report from briefed.in has identified some worrying trends that could affect the future health of the local tech sector.

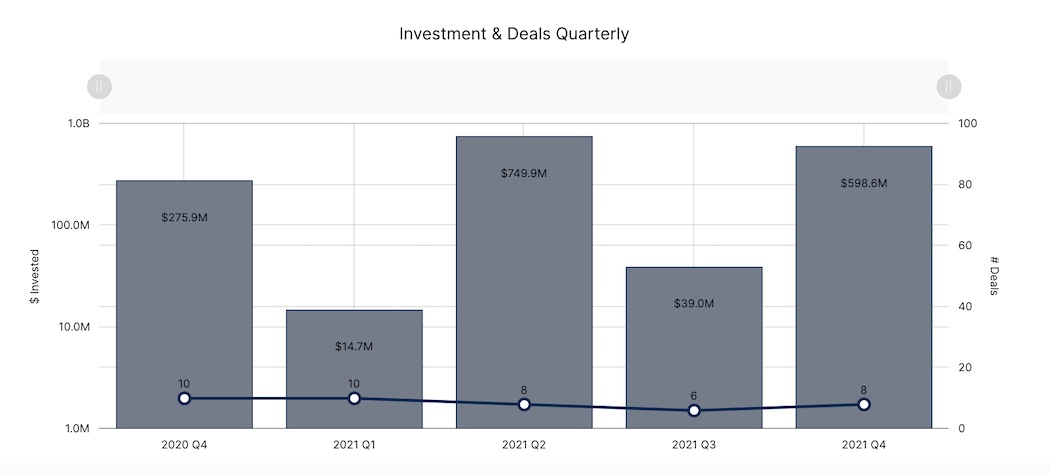

In the fourth and final quarter of 2021, Waterloo-based tech startups raised a total of $598.5 million through eight investments. Venture funding increased by 1437 percent quarter-over-quarter and 117 percent year-over-year and brought the region’s total investment for 2021 to $1.4 billion, roughly double the amount raised in 2020.

“We need diversity and a blend of great ideas and bold investors to propel the ecosystem.”

– Jay Krishnan, Accelerator Centre

Though this growth may seem impressive on the surface, over 83 percent of all funding in Q4 2021 was raised by one company: Faire, which raised a $500 million Series G round of funding in November.

Faire’s Series F and Series G funding rounds accounted for $814 million, or 58 percent, of all local investment dollars raised in 2021 alone.

briefed.in gathers ecosystem data from a variety of public sources. Its data accounts for companies that are either headquartered in a Canadian tech ecosystem, or companies, like Faire, which have dual headquarters in Canada.

A few large companies accounting for the lion’s share of venture funding is not new for the Waterloo Region. Without Faire’s deals, total regional investment for each of the last three years was $337 million for 2019, $485 million for 2020 and $587 million for 2021. Edtech unicorn ApplyBoard, another fast-growing Waterloo-based company, has also accounted for a high share of total regional investment in recent years.

Combined, Faire and ApplyBoard raised 85 percent of the total funding for Waterloo Region in 2021 ($1.19 billion) across just three deals. Jay Krishnan, CEO of the Accelerator Centre, believes these results are in line with the global trend of consolidated investments going to a few big winners.

“ApplyBoard and Faire making up a strong portion of the investment figure is not a surprise,” Krishnan added. “It is reflective of a strong pipeline of ideas that have matured to the point of mega-success, and that is good news for the ecosystem.”

Deal volume continued downward swing in 2021

When compared to other Canadian ecosystems, the Waterloo Region is far smaller in terms of local companies. Still, in the last decade, the region has established itself as an important character in the larger Canadian tech story, with several successful tech companies tracing their roots to the region. What’s more, a cadre of tech multinationals has also sought to set up shop in the Waterloo Region, including Square, Google, Shopify, and MasterClass.

But according to briefed.in data, the region’s tech investment activity has been on the decline since 2019, most recently falling from 43 deals in 2020 to just 32 in 2021. This is nearly half of the 59 deals reported two years ago.

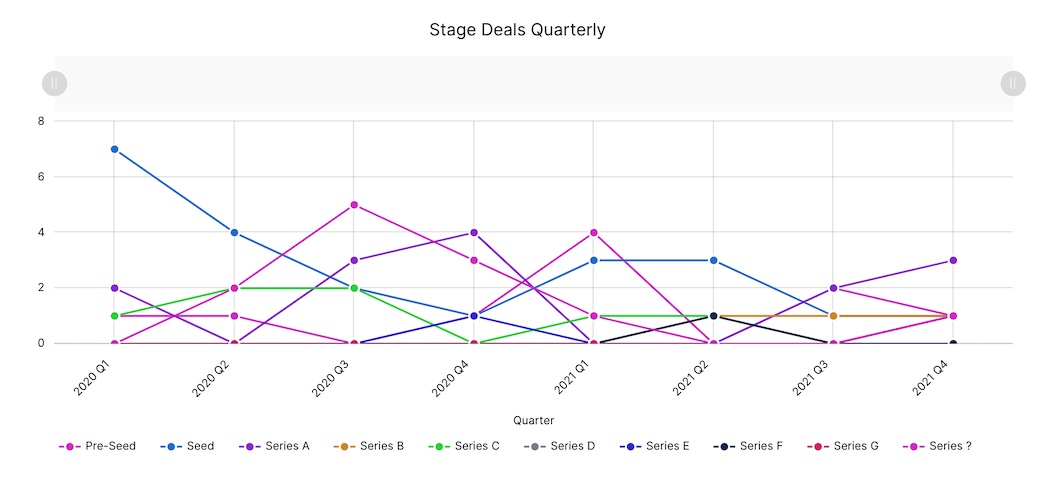

A large part of the region’s decline in deal volume was that seed activity took a nosedive in 2021. Only eight seed-stage deals closed last year, compared to 26 closed in 2019. These results are surprising for Waterloo, which has garnered a reputation as an early-stage tech hub, with its strong funnel of post-secondary candidates and robust network of accelerators, incubators, and innovation hubs.

“While we know that there may be unreported seed-stage deals, we are not seeing this in the other regions we report on,” briefed.in said in its report. “We see this large decline as concerning for the health of the tech ecosystem.”

Rob Darling, CEO of briefed.in, said there could be several factors driving the lack of early-stage activity in Waterloo. For one, the pandemic shut down a number of important ecosystem events, pitch competitions, and investor summits that helped galvanize early-stage investment in the region.

Communitech, for example, held an annual two-day conference, known as True North, to engage ecosystem members on broad sector issues and showcase local companies. Yet critical in-person ecosystem initiatives like True North were halted due to the pandemic.

RELATED: Communitech CEO Chris Albinson shares his plan to help Canadian tech own the podium

“Our experience has been that virtual pitch events are quite efficient and effective for early-stage companies when done well,” Krishnan noted. “Adapting these events to the virtual stage has taken some time and the cancellation of some 2020 and early 2021 events could certainly have had an impact [on the region’s recent funding performance].”

Krishnan said the pandemic has also created delays for aspiring entrepreneurs. Students from the region’s premium post-secondary programs, might be delaying their forays into entrepreneurship in favour of less risky routes as they inch closer to graduation. Krishnan has also noticed a pandemic-related delay in new immigrant founders making their way to the region, which he said creates a backlog of high-potential startups waiting in the wings.

Despite these hurdles, data from the Accelerator Centre points to a consistent number of new companies applying for its incubation programming, which indicates to Krishnan that Waterloo still has a strong pipeline of talent and ideas worthy of investment.

Companies are struggling to get to Series A

Another concerning trend in Waterloo last year is that 71 percent of the Waterloo Region’s startups have not moved from seed to Series A in the last 18 months, the highest rate across all Canadian tech ecosystems tracked by briefed.in. A total of five Series A deals closed in 2021, down from the nine closed in 2020. briefed.in noted that this low conversion number, as well as the downturn of early-stage activity, could spell out less tech growth in the Waterloo Region this year.

One factor that could play into this trend, said Krishnan, is that early-stage investors aren’t taking risky enough bets on local firms. “We’ve noticed investment vehicles and angels play triage in a time like this,” he noted.

“The key in moving more companies from seed to Series A is a more active investor group or groups that are willing to take bigger risks,” Krishnan added. In order to encourage more investors to take these risks and start driving more local startups to the Series A stage, Krishnan said the Accelerator Centre is currently making its investor showcases a big part of its game plan for 2022.

Communitech has also been exploring a $200 million fund as part of its recently-revealed True North Strategy, which aims to help 14 founders across Canada reach $1 billion in annual revenue by 2030. Should the fund invest in local companies, it could move the needle for some startups looking to clinch their Series A funding rounds.

While the Waterloo Region’s 2021 results indicate the local tech sector is facing headwinds, Krishnan said the overall outlook is still positive, noting that investors are still keen and watching the region.

“Not all founders will find success through the same pathway and not all investors have the same risk tolerance,” he said. “We need diversity and a blend of great ideas and bold investors to propel the ecosystem.”

BetaKit is a briefed.in Tech Report media partner.