A new analysis by Hockeystick of British Columbia’s deal activity for 2020 shows a gap in early-stage startup funding.

Hockeystick’s BC Tech Report looks at how the province’s tech ecosystem fared in terms of deals and dollars, with data sourced through exclusive partnerships with organizations like the Canadian Venture Capital and Private Equity Association (CVCA). Hockeystick also compiles data from startups using its platform, as well as public data sources.

In 2020, BC saw general capital support across all stages. Early-stage deals accounted for 31 percent of all deals, while Series A deals accounted for 20 percent, and late-stage deals accounted for 40 percent. Since Hockeystick’s Q2 2020 report, there has been consistent late-stage activity for the region.

Only two deals closed in the $0 to $250,000 range in 2020, however, raising a total of $280,000 — a worrisome sign for what should be the widest part of an ecosystem’s growth funnel. In 2019, BC saw nine deals that raised a total of $1.6 million.

Rob Darling, research partner at Hockeystick, said the gap in early-stage deals could be due to undisclosed deal totals. “But these numbers are really low,” he added. “If this is truly the fact that there are fewer new ventures, or not enough funding for these new ventures, that will mean that you won’t, in theory, have any companies moving on to the later stages.”

Overall, $1.1 billion in total funding was raised in BC in 2020, down 21 percent from 2019, which saw $1.4 billion raised. The change is due to a drop in $30 million-plus deals in 2020, which attracted $588 million in 2020 compared to $872 million in 2019. Vancouver-based legaltech company Clio’s $330 million funding round in 2019 was the largest driver of that figure.

Despite early-stage lull, BC remains active

The lack of early-stage activity could also showcase the need for more angel investors in BC, a key group of funders for this stage. There are some efforts to make this happen: in October 2020, the National Angel Capital Organization (NACO), an industry association of 4,200 angel investors, 45 incubators and accelerators, and 44 angel groups, received $710,000 from the federal government to expand in Western and Atlantic Canada, working with Victoria’s Capital Investment Network and VANTEC Angel Network to spur capital in the city.

In 2019 and 2020, the largest cohort of BC deals fell into the $1 million to $5 million range, indicating that early-stage companies have been growing and are pursuing their series A or seed-plus rounds. “That part of the ecosystem is healthy,” said Darling.

BC’s most active investors for Q4 2020 were a mix of both Canadian and U.S. investors, including Allegis Capital, Battery Ventures, Boldstart Ventures Management, BDC, Evok Innovations, HarbourVest Partners, iNovia Capital, Luge Capital, Mantis Venture Capital, TELUS Ventures. Investor participation saw an uptick, indicating that there’s still great interest in the ecosystem. In 2020, 131 investors invested in BC startups, up 39 percent from 2019.

“Usually this means that they’re going in together on larger deals. So that’s an indicator that they’re interested in the ecosystem, and they’re partnering with others,” said Darling.

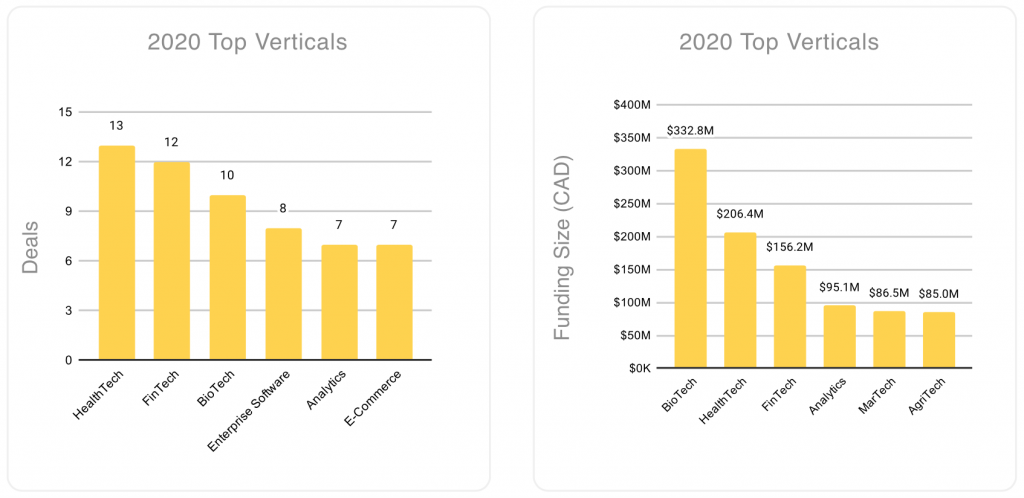

2020 saw an ecosystem shift in focus to healthtech, which led the province in number of deals. However, healthtech was second in total investment dollars to biotech, which led all other verticals. AbCellera’s $144 million Series B in Q2 2020 for its antibody drug discovery platform — which is developing research in neutralizing antibodies for COVID-19 — was a large driver of biotech’s success for the year. Since Hockeystick’s Q1 2020 report, life sciences companies have been major drivers of funding activity for the region.

It’s a big shift from 2019, when most investment dollars and deals went to BC’s FinTech and legaltech verticals, and healthtech attracted 50 percent fewer deals and a 64 percent drop in total investment.

Room for optimism

In Q4 2020, like other ecosystems, BC’s top deals were those that could enable companies to adjust to the remote work environment caused by COVID-19. Sales enablement platform Dooly raised the largest deal with a $21.4 million Series A; cloud-based workforce management company SkyHive raised $10.8 million; and ThoughtExchange, an enterprise tool to effectively gather employee insights, raised $4 million in the second tranche of its $30 million Series B.

Q4 2020 saw a drop in deal volume, the third straight quarter showing a decline, but 2020 ended up hitting the same number of deals as 2019.

While Hockeystick’s Q4 2020 report indicated a decline in deal volume, the third straight quarter showing a decline, 2020 ended up hitting the same number of deals as 2019, at 93. The quarter also seemed to follow Q2 2020 and Q3 2020’s theme of “fewer seeds and more scale.”

Still, activity declined on a quarterly basis. In total, $100.5 million in total funding was raised in Q4 2020, down 67 percent from Q3’s $305.5 million, making it the lowest funding quarter BC had seen in 2019 and 2020. The 20 deals closed in Q4 2020 indicated a 13 percent decline from Q3 2020, and there were 21 investors in Q4 2020, down 43 percent over Q3 2020.

While activity has remained stagnant, a number of new government programs recently announced to support small businesses could potentially create a new pool of talent. The federal government is preparing to launch a regional development agency for the province, with over $500 million in funding committed over the next five years. Meanwhile, BC’s 2021 budget earmarked $506 million in new investments to support CleanBC, an initiative to help find solutions to climate change, and upskilling programs to help companies hire youth and post-secondary students.

Though the mega-deals didn’t come in Q4 2020, companies moving into the later stage, with ecosystem leaders advocating for stronger startup support, could mean that BC tech is one to watch for 2021.

BetaKit is a Hockeystick Tech Report media partner.