The Canadian tech sector is looking strong and fueling the country’s economy, says a new report from The Business Development Bank of Canada (BDC).

“Some tech entrepreneurs have already increased salaries by 20 to 25 percent in an attempt to retain current workers.”

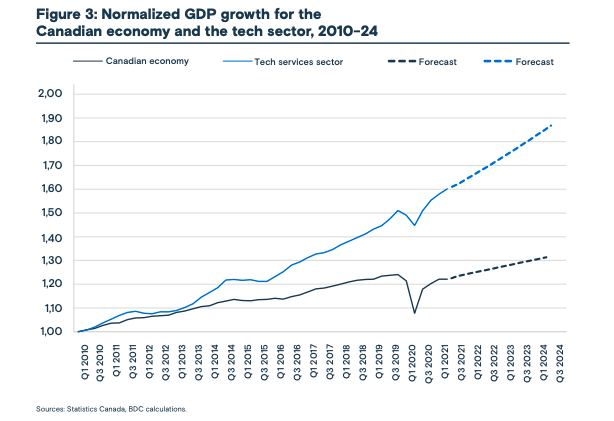

The report states that the tech sector’s gross domestic product (GDP) growth over the last decade has been higher than the overall Canadian economy, and predicts that the trend will not only continue but grow over the next five years.

BDC’s findings expect the tech sector revenue to grow by 5.3 percent in 2022, and by 22.4 percent in the 2021-2024 period.

“Canada’s tech sector has been thriving of late, as demand for digitization and new technologies sweeps across every part of the Canadian economy,” said BDC’s Dwayne Dulmage, vice president and national lead on technology.

“With a robust financing ecosystem, one of the world’s most highly educated workforces and a wealth of passionate entrepreneurs, Canada’s tech businesses are well-positioned to capitalize on these opportunities,” he added. “However, to really benefit, the sector will also need to overcome major challenges, such as a growing shortage of qualified workers and increased threats from cybercriminals.”

That Canada’s tech sector is driving growth in the country will likely come as no surprise to many. While other sectors have struggled with the changing realities of COVID-19, tech has boomed – with sizeable investment rounds, public market exits, and increased demand for tech in an ever-remote world.

BDC’s findings echo a 2020 report from the Innovation Economy Council that noted innovation companies grow at a much faster rate than the overall economy. The group, which includes MaRS Discovery District, Ontario Centre of Innovation, DMZ, CCRM, and Invest Ottawa, emphasized the need for government to foster innovation in the country in order to overcome economic difficulties caused by the pandemic.

For its part, BDC found that the tech sector pulled in an estimated $95.7 billion in revenues in 2020; with companies seeing average revenue growth of 9.4 percent between 2015 and 2020. The report noted the trend will likely continue with one in three (30 percent) of small and medium-sized businesses (SMBs) planning to invest in software over the next 12 months.

While the outlook for the sector is good, challenges still remain. The industry faces a lack of early, seed-stage capital that is required for any healthy ecosystem, and as BDC points out, a lack of qualified tech talent to fill the ever-growing job openings.

Tech companies create an outsized share of new jobs in Canada. And the unemployment rate, according to BDC, averaged 2.8 percent in 2020 (on par with 2019) while the overall economy’s unemployment rate shot up from 5.7 percent in 2019 to 9.5 percent in 2020.

However, BDC emphasized that the sector’s growth is limited by a scarcity of skilled workers. Over half (55 percent) of tech entrepreneurs surveyed by BDC said they are struggling to hire the employees they need.

“Tech businesses will have to spend more time hiring and retaining workers than they did before,” BDC wrote. “Some tech entrepreneurs have already increased salaries by 20 to 25 percent in an attempt to retain current workers.”

While the world of remote work has increased the opportunities for Canadian startups to access a global talent pool, a growing number of international companies are also tapping into the country’s homegrown tech workforce.

Last year, Pinterest, Twitter, and DoorDash opened Canadian engineering hubs joining Microsoft, Netflix, MasterClass, and Reddit as just some of the tech giants tapping into the nation’s talent pool. Canadian tech darling Shopify also announced plans to capitalize on the country’s development talent with the goal of hiring more than 2,000 engineers.

“Tech companies that have made acquisitions in the previous 10 years are three times more likely than their peers to have experienced annual sales growth of 5 percent or more over the past year.”

BDC found that one way Canadian startups are dealing with this issue is through acqui-hires. The report notes that mergers and acquisitions (M&As) rebounded quickly following “the waves of the COVID-19 pandemic” with the main reason for purchasing a business (70 percent) being to acquire technology and intellectual property (IP).

“Tech companies that have made acquisitions in the previous 10 years are three times more likely than their peers to have experienced annual sales growth of 5 percent or more over the past year,” added Pierre Cléroux, BDC’s vice president of research and its chief economist.

BDC called the market for M&A activity “booming.”

Another trend BDC picked up on is a transition to everything-as-a-service (XaaS).

“The debate about whether tech firms should move to the “X-as-a-service” model (XaaS) of cloud computing is long over,” BDC wrote. “Companies are now efficiently and profitably delivering all types of technology products and tools to users as services over the Internet, rather than locally or on site. Apart from being hosted remotely, these services are usually accompanied by a flexible consumption model that makes it easier to enroll new clients and can be scaled up to meet their needs.”

BDC noted that software-as-a-service (SaaS), infrastructure-as-a-service (IaaS), and platform-as-a-service (PaaS) companies are among the fastest-growing segments in the software sector. BDC expects to see growth in each of these areas this year, noting that “cloud penetration” in Canada’s software market was about 29 percent in 2018 and had reached 37 percent by the end of 2020. The report expects average annual growth of 15 percent in the area until 2024.

The fourth trend that BDC noted is increased threats from cybercriminals. With more sophistication on cybercriminals’ parts and more people working remotely, BDC called cybercrime “one of the greatest threats for tech businesses.”

Businesses are targeted mainly for their customer, partner and supplier data; financial information; medical data; payments; and proprietary information, the report stated. And, according to BDC’s surveys, only half of businesses (55 percent) train their employees on cybersecurity.

BDC pointed to certification like ISO 27001 (an international standard on how to manage information security) as one way for companies to put in place best practices to prevent cyber attacks.

BDC’s data for the outlook report comes from four surveys conducted in 2021 and is supplemented by a series of interviews with experts in the field and an analysis of growth from M&A in the tech sector.

“Changes in consumer behaviour, accelerated digitization and the adoption of new technologies are likely to continue sustaining demand for the tech sector’s products and services,” BDC wrote. “In turn, those products and services will fuel much of the innovation and productivity that will power economic growth in the next decades.”

Photo courtesy of BDC