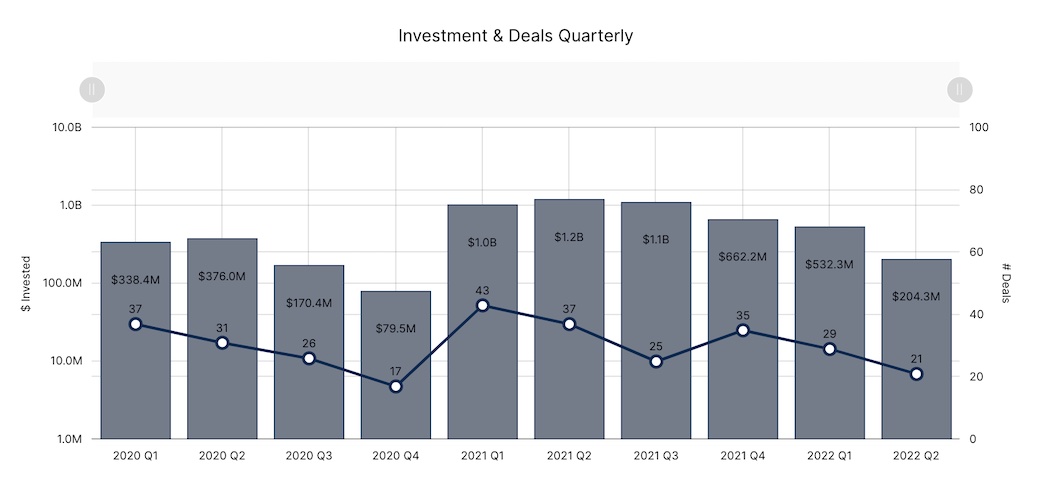

British Columbia’s tech sector continued to cool off in the second quarter of 2022 as venture funding and deal volume fell to a six-quarter low according to a new report from briefed.in.

BC’s tech startups collectively raised $204.3 million in Q2 2022, a 62 percent decrease compared to Q1 2022 and an 83 percent decrease year-over-year. Deal volume, which totalled 21, also decreased 28 percent from last quarter and 43 percent year-over-year. Investment has fallen every quarter in BC since reaching a record-high of $1.2 billion in Q2 2021, with Q2 2022 representing BC’s lowest quarter for investment and deal volume since Q4 2020.

“Deals are still getting done, just not at the pace or volume that we saw these past two years.”

– Ray Walia

While the drop in investment was significant in Q2 2022, several stakeholders in BC’s tech sector expected such a decline earlier in the year. In April, Jay Rhind, partner at Vancouver-based Rhino Ventures, said the consensus was that valuations would “reset” based on the global slowdown in public markets and rising inflation.

Chris Neumann, BC-based partner at Canadian early-stage firm Panache Ventures, said he has noticed a slower pace of investment as investors and startups pause to take stock of the broader market changes. Still, he noted, the decrease in investment in BC was consistent with what occurred in other major tech ecosystems in Q2 2022, and the general state of mind on the ground is still positive.

“The local tech industry is still relatively small,” Neumann said. “We’re not yet at the stage where new unicorns are being crowned every quarter, so we need to be careful of knee-jerk reactions to natural ebbs and flows.”

So far in 2022, British Columbia is just 18 percent of the way to matching the total investment in 2021, but investment in the first half of the year has matched that of 2020 and exceeded that of 2019. Ray Walia, CEO of Vancouver-based Launch Ventures, believes BC venture funding is now re-aligning with pre-pandemic levels, but “by no means is startup funding crashing.”

“Deals are still getting done, just not at the pace or volume that we saw these past two years,” he added. “A lot of good companies raised in 2020 and 2021. Those companies are now in build mode. New companies are facing stricter due diligence processes and greater expectations for traction.”

Late-stage stumbles, early-stage investment remains stable

A key trend contributing to British Columbia’s record-setting 2021 was the prevalence of massive late-stage megadeals in the province’s tech sector. Trulioo, LayerZero, Blockstream, and Canada Drives were just a few of the BC-based firms that closed nine-figure financing rounds last year. One company, Vancouver-based Dapper Labs, closed two rounds in 2021 that both surpassed $300 million.

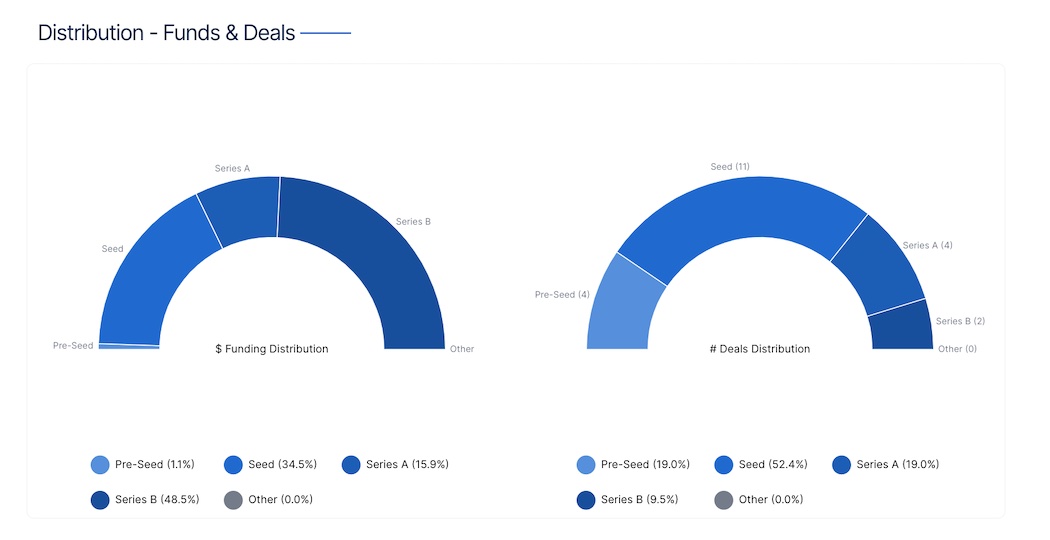

In the second quarter of 2022, late-stage deal volume in BC declined from 2021, but more notably, BC’s largest rounds during Q2 were considerably smaller than the previous year.

briefed.in tracked no megadeals (venture rounds totalling $100 million or more) in BC during the second quarter of 2022. The largest rounds closed in BC from Q2 included Certn’s $65.1 million Series B funding round, Penny AI’s $33.9 million Series B funding round, and Vybe Network’s $13.1 million Series A financing round. This trend was also observable in Toronto, which tracked significantly fewer megadeals in Q2 2022 compared to previous quarters.

While later-stage deals and dollars declined, BC’s early-stage funding remained stable and unchanged between the first and second quarters of 2022. briefed.in tracked 15 early-stage deals in the province over the quarter, including four pre-seed rounds and eleven seed funding rounds.

Walia said he expects some of the macroeconomic headwinds will impact angel activity in BC, particularly as “inflation hits pocketbooks at home.” Neumann noted that changes in public markets do not typically impact early-stage activity in the near term, adding that while many BC startups are reconsidering funding plans for now, his firm is likely to make even more investments in 2022 than it did last year.

“That said, British Columbia remains woefully undercapitalized at the early stages, so I hope we see more emerging funds coming into BC soon,” Neumann added.

BC still making waves in Web3

Two significant rounds closed in BC during the second quarter of 2022 were MeetAmi Innovations’ $36.5 million seed funding round and Vybe Network’s Series A funding round. Both companies operate in the Web3 space, which has grown to become a hot sector in BC, thanks to established players like Dapper Labs, Covalent, and EQ Exchange.

The Web3 sector, which comprises companies operating in decentralization, blockchain technologies, and token-based digital assets, has recently undergone a major market downturn. In the last month, sales of non-fungible tokens across the top 10 blockchains recently hit a 12 month-low, while digital currencies have now lost $2 trillion in value after hitting a high point of $3 trillion in November.

A hit to the global Web3 sector could contribute to less overall investment for the BC tech ecosystem in future quarters. But Walia, who has described Vancouver as Canada’s Web3 capital, said while the industry is still in its nascency, the calibre of BC’s Web3 companies shows promise.

“Globally, there were a lot of people jumping into crypto and Web3 because they saw it as either a way to kill time while locked in at home during the quarantine or worse, as a way to get rich quick,” he added. “Fortunately, the industry we’ve seen being built in BC is more focused around actually building products and infrastructure.”

Some companies, like Covalent and Dapper Labs, have grown significantly in recent years, and both contributed to record-setting quarters for the province in 2021. Dapper Labs is also working to establish its own $725 million fund to invest more dollars into the Web3 ecosystem.

“With these funding opportunities, and as more companies are tapping into the Web3 sector in BC, I can see the crypto and Web3 sector in BC riding out this slump and coming up stronger as a global leader on the other end,” Walia added.

Neumann noted that as more BC companies make waves in traditional industries and emerging categories like Web3, he expects venture funding to regain momentum in mid-August, adding he’s “as bullish as ever” on the province’s tech sector.

BetaKit is a briefed.in Tech Report media partner.