British Columbia’s tech sector saw a strong start to 2022 with over half a billion raised in the first quarter, according to briefed.in’s latest report on the province.

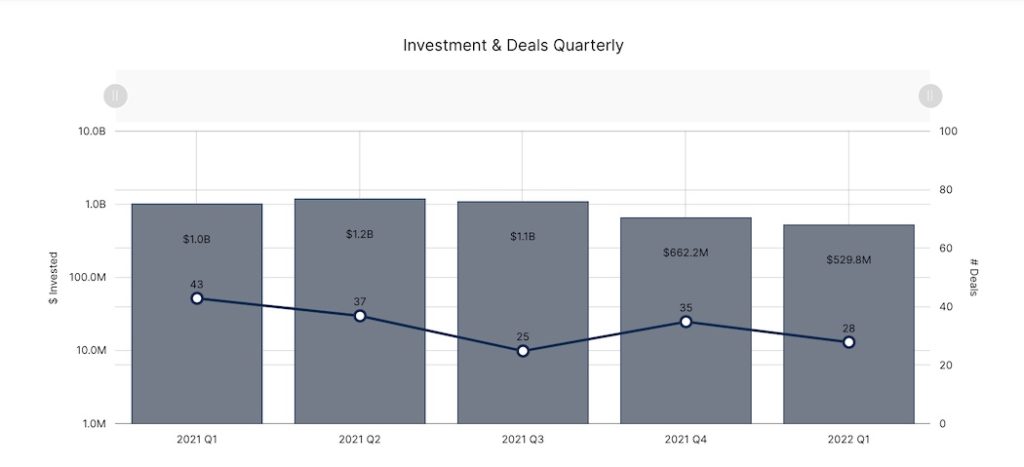

In Q1 2022, BC’s tech startups collectively raised 28 investments totalling $529.8 million. The province saw a 20 percent decline in total investment from Q4 2021 and a 48 percent decrease year-over-year. Vancouver saw the most deals (22) and dollars ($421 million) during Q1 2022 by a wide margin, while smaller cities in the province like Burnaby and Victoria also showed activity.

The first quarter of 2022 represented a year-low in terms of dollars raised across the province, due to a year replete with mega-rounds, high-powered exits, and explosive activity for the BC tech ecosystem. Jill Tipping, CEO of the BC Tech Association, told BetaKit these results demonstrate the underlying strength of BC’s tech sector.

“With inflation on the rise and the tragic conflict in Ukraine creating investment uncertainty, this was a solid performance for BC in Q1.”

“We haven’t peaked yet, there are still many, many investible companies behind those 13 BC unicorns that emerged in 2021,” Tipping added. “With inflation on the rise and the tragic conflict in Ukraine creating investment uncertainty, this was a solid performance for BC in Q1.”

Experts from across Canada anticipate a nationwide cooling in venture funding, given rising inflation and the global slowdown in public markets.

“Near-term volatility seems to be driven by the consensus perspective, among allocators, that valuations will reset based on public market comps that are off materially from their trading multiples in 2021,” said Jay Rhind, partner at Vancouver-based Rhino Ventures. “From where we are sitting, that has yet to happen.”

Q1 2022 appeared to be a solid start to the year for BC relative to prior years. Investment in the first quarter in the province was still higher than almost every quarter in 2019 and 2020. However, Rhind believes BC’s funding activity in the first quarter was actually lower than it appears.

“There is usually a lag effect between when deals are announced and when they actually closed,” Rhind told BetaKit. “I suspect a number of the deals announced in Q1 were actually completed in Q4 2021, and we will see a steeper decline in activity and dollars in Q2.”

It should be noted that briefed.in either uses the publicly announced date of funding rounds or when founders confirm the deal occurred in its analysis.

Later-stage companies raising at yesterday’s prices

In Q1 2022, deal volume in BC decreased 20 percent compared to last quarter and 35 percent year-over-year. This quarter represented one of the slowest in the last year in terms of activity, behind only the third quarter of 2021.

One of the standout trends Rhind noticed in the first quarter was “broken processes,” where companies either failed to get term sheets or failed to fill out a round once a lead was secured. He noted this was the “first time in a long time” he had observed this in BC.

For several BC companies, significant deals did come together. Some of the largest rounds from the first quarter included LayerZero’s $135 million growth funding round, Canalyst’s $87.3 million Series C funding round, and Elastic Path Software’s $76 million growth funding round. Rhind noted that although “the best companies” continue to raise at the premium multiples seen across last year, “that premium has very likely come down, materially,” since the fourth quarter of 2021.

According to briefed.in’s report, several growth-stage funding rounds closed in BC during the quarter, and two deals were classified as Series B+ deals. Rhind has observed that many Series B+ companies are less keen to fundraise, given the current uncertainty around valuations.

“I believe we are entering the ‘standstill’ phase of the market, where sellers of equity (companies) are unwilling to transact at materially lower multiples and are opting to either grow into their valuations or delay going to market until absolutely necessary,” Rhind added.

Early-stage funding in flux

Early-stage funding fell in Q1 2022 from the previous quarter, with nine companies raising in the seed stage and five in the pre-seed stage across the province. Higher early-stage rounds included Matrix Labs’ $5.5 million seed funding round and Paidia’s $4.4 million seed funding round. Five Series A deals closed in Q1, which is roughly on par with Series A activity in Q4 2021.

Rhind described early-stage funding in BC as “in a state of flux,” adding that while there was no noticeable decline in valuations, he is seeing fewer early-stage deals being done. Tipping said she has noticed that investors are far more hesitant in 2022 compared to the year prior. “There are still lots of deals in play, they just aren’t closing as quickly,” she added.

According to briefed.in’s investment trends analysis, there are currently 99 seed-stage startups in BC, 44 of which have not reached their Series A round in the typical 18 months it takes to do so. This indicates a large pipeline of firms still hunting for capital.

Early-stage funding has historically been a sore spot for BC’s tech sector, yet the province seemed to buck this trend in 2021. Still, investors on the ground have noted there is still a significant funding gap for young startups in the province, which stakeholders from both the public and private sectors have tried to fill.

Silver linings for 2021’s winners

For BC’s tech sector, 2021 represented a year of highs when it came to funding rounds, with some of the largest rounds going to Dapper Labs, Blockstream, Canada Drives, and General Fusion.

While Rhind anticipates a slowdown in venture funding for BC in the coming quarters, he said many of the BC startups that have secured some of those significant funding rounds in the last year are managing to grow in capital-efficient ways. Among the companies Rhind mentioned were Canalyst, Klue (a Rhino Ventures portfolio company), and Certn.

If BC’s tech sector becomes a bear market in the coming quarters, Rhind said it could create a less competitive environment for well-managed tech companies. “The one thing that does not go out of fashion, throughout market cycles, is capital efficient growth,” he added.

While the outlook for venture funding in Canada is uncertain, Tipping said BC’s performance in 2022 thus far is still significantly higher than where it was just a few years ago; a fact that’s worth celebrating.

“We’ve level set to a new and higher normal that better matches the potential of the tech sector in BC,” she added.

BetaKit is a briefed.in Tech Report media partner.