The last year for Toronto’s tech sector has looked like a wild party. Almost every week, the tech ecosystem celebrated a new massive funding round or exit as capital deployment and deal-making activity reached unprecedented levels.

But as with any good rager, when the party winds down, the hangover is fast to follow, and according to a new report from briefed.in, Toronto’s hangover began in the second quarter of 2022.

In Q2 2022, Toronto tech startups raised $585.7 million through 45 deals, representing a year-low for investment and deal volume. Investment dollars fell 69 percent from Q1 2022 and 61 percent year-over-year, while deal volume fell 22 percent from last quarter and 40 percent from Q2 2021.

“If 2021 was the party, then 2022 stands to be a sobering experience for founders, employees, and investors alike.”

– Ameet Shah, Golden Ventures

The significant drop in investment over Q2 dramatically diverges from Toronto’s prior year of venture funding. In every quarter of 2021, venture funding surpassed $1 billion, and with nearly every passing quarter, the city set a new record for investment.

“If 2021 was the party, then 2022 stands to be a sobering experience for founders, employees, and investors alike,” Golden Ventures partner Ameet Shah told BetaKit.

As sobering as the city’s results may be, they are not all that surprising. Stakeholders from across the Canadian tech ecosystem anticipated a market correction as early as 2021, when record-setting tech IPOs, sky-high valuations, and nine-figure venture rounds were very much the norm.

Even during the first quarter of 2022, when venture funding in Toronto broke yet another record, warnings of a cooling period loomed as public markets slumped, inflation soared, and geopolitical conflict erupted.

While Toronto’s venture funding fell significantly from last year’s highs, investment in Q2 2022 still exceeded every quarter in 2020, which all tracked under $500 million. For Shah, it indicates the second quarter of 2022 represented a reversion to the mean for Toronto’s tech sector.

“At a macro level, I think everyone understands that 2021 was an anomaly in terms of pace, valuations, and deal terms in general,” added Shah. “I think we will see a flight to quality in terms of the companies that can attract capital, which is probably healthy for the ecosystem at large.”

Over the second quarter, Shah said he noticed valuation compression at all stages, which is slowing down deal velocity in Toronto tech. “Many companies are recalibrating internally due to the shift in sentiment from capital markets,” Shah added.

But as tech companies are bracing for impact, it’s been a slightly different story for VCs. Venture firms like Inovia Capital, Round13 Capital, and Impression Ventures closed sizeable venture funds in the second quarter of 2022, and several investors are taking a more optimistic view of today’s market conditions.

“My view is this is a short-term slowdown, a moment for people to breathe and gather themselves and adjust their bar for what types of investments make sense for the next five to 10 years,” said Fahd Ananta, the investor behind Roach Capital.

Massive megadeals missing in action

One of the prime movers for Toronto tech’s standout 2021 was the abundance of late-stage megadeals, meaning venture rounds exceeding $100 million. Canadian and US investors, flush with cash, showered startups with capital at dizzying valuations, leading to frequent and unprecedented financings throughout the year. From Vena Solutions’ $300 million Series C funding round to Tenstorrent’s $245 million Series C funding round, nine-figure deals were ubiquitous in Toronto tech.

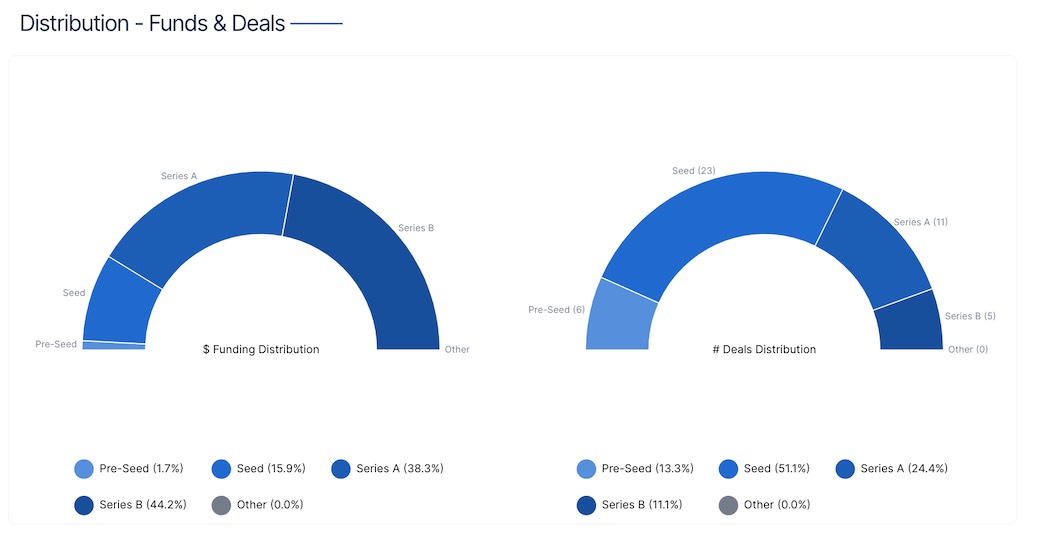

briefed.in tracked five Series B deals in Q2 2022, which comprised all late-stage activity during the quarter. While late-stage deal volume was lower than every quarter of 2021, the decline in deal volume is negligible compared to the average sizes of deals at the Series B stage.

The three largest deals in Q2 2022 were Tailscale’s $128 million Series B funding round, Delphia’s $75.2 million Series A financing, and Forma AI’s $57.8 million Series B funding round, meaning only one round reached into the nine figures in Q2 2022. For comparison, Tenstorrent, Ada, Vena, and Xanadu raised rounds above (and in some cases well above) $100 million in the second quarter of 2021.

The compression of late-stage rounds is also observable across briefed.in’s trendlines for average deal size. In 2021, the average Series B round size was approximately $72 million; in 2022, this has already fallen to roughly $56 million.

Does Toronto tech investment have further to fall?

briefed.in tracked 29 pre-seed and seed-stage deals in the second quarter of 2022, with significant early-stage rounds including Signal 1’s $12.7 million seed funding round, Savvii’s $10 million seed funding round, and Mash’s $7.6 million seed funding round.

Early-stage activity is down slightly from the 33 such deals closed in Q1 2022. This fall may seem negligible on its face, but when following the broader trend line, investors like Matt Roberts, partner at ScaleUP Ventures, have observed that the gross volume of early-stage deals has fallen more significantly from 2017 and 2018 levels. But Ananta believes Toronto’s early-stage funding environment is still “healthy and growing steadily.”

“Toronto doesn’t have an overwhelming early stage funding ecosystem, so there’s less competition for VC dollars into companies and less percentage of those dollars paid as a premium to win the deal,” said Ananta. “Funds like Garage, Golden, and my own fund, Roach, are still active in early stage investing here as usual.”

While venture funding appears to be relatively active in the third quarter of 2022 thus far, the city’s Q2 2022 funding results naturally prompt the question: has investment in Toronto tech bottomed out, or is there still further to fall?

“The summer months will be slower as founders, employees, and investors take some time off,” Shah projected. “I expect Q4 will show an uptick in volume relative to Q3 as people begin to be more outward facing in terms of new deals and new fundraising.”

Even if Toronto’s investment numbers continue a downward trend for the remainder of the year, Ananta believes the city’s entrepreneurs can turn adverse conditions into a competitive advantage.

“My view is we often need these types of great filters for everyone to regroup,” Ananta added. “Much like a forest fire, in the end, it leaves us stronger, with some companies that will end up becoming the giant redwoods and some that will be recycled into nourishing the soil.”

BetaKit is a briefed.in Tech Report media partner.