Tech startups in the Waterloo Region raised $749.7 million in venture funding during the second quarter of 2021, making Q2 the best funding quarter the region has seen in at least the last two years, according to the latest Hockeystick + briefed.in report on the region.

“There’s no question we’re on an exponential curve of growth right now, the likes of which the region has never seen before.”

Total funding bounced back dramatically from a disappointing start to 2021. In Q1, the region only saw $14 million in total funding, the lowest funding quarter since at least Q1 2019. In Q2, total investment increased 5,364 percent quarter-over-quarter, and 387 percent year-over-year. In the first half of 2021, the Waterloo Region has already surpassed the total investment raised in 2020.

“These are absolutely exceptional results, and are really a validation of the hard work by our founders over a long period of time,” CEO of Communitech Chris Albinson told BetaKit.

“There’s no question we’re on an exponential curve of growth right now, the likes of which the region has never seen before,” he added.

The Waterloo Region’s strong venture performance in Q2 2021 was due in large part to ApplyBoard’s $368 million Series D round of funding and Faire’s $314 million Series F round of funding.

In the last two years, ApplyBoard and Faire have been magnets for venture capital in the Waterloo Region. ApplyBoard, which runs a recruitment platform helping international students apply to education abroad, has raised $600 million to date. Faire, which offers an online wholesale marketplace for brands and retailers, has raised nearly $700 million to date.

Albinson said the Waterloo Region is now home to a high density of “large-scale, globally impactful companies,” that are helping bring in significant capital. Although Faire is headquartered in the United States, the company still has strong ties to its hometown and has previously used venture funding to expand its presence in the Waterloo Region.

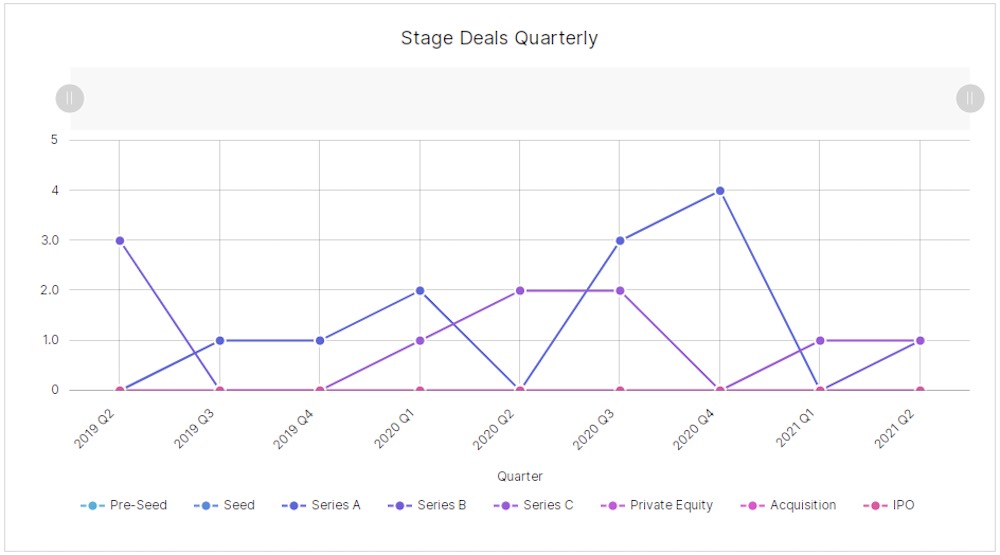

While funding in the Waterloo Region exploded thanks to ApplyBoard’s megadeal, only seven venture deals closed in Q2 2021. This represents a decrease of 22 percent compared to Q1 2021 and year-over-year.

“This is a low quarter for deals in Waterloo Region, and after the first half of 2021, they have still not reached 50 percent of 2020 deals,” Darling added.

Of the deals closed in the region over Q2 2021, three were classified as seed deals, while four were classified in the Series B-or-above stage. The number of seed-stage deals appears to be low for this region, which is known for being an early-stage hub due to its high concentration of accelerators and incubators.

In the first half of 2021, the Waterloo Region’s tech startups have raised six seed deals, which is less than half of the seed deals in 2020 and less than a quarter of the seed deals of 2019. Darling said these results indicate there may be fewer companies to invest in or fewer companies making it to the seed stage.

“You’re going to have quarterly fluctuations,” said Albinson, regarding the lack of seed-stage deals. “But overall, company formation still looks extremely robust.”

While the first half of 2021 saw local startups surpass the total investment raised in 2020, the region has not seen any Series A deals so far this year. CEO of briefed.in Rob Darling noted that, on average, it takes a startup 18 months to go from seed stage to Series A stage.

Not one of the 23 companies in the Waterloo Region that raised seed capital in 2019 has raised Series A capital yet, which Darling said could signal a gap for companies hoping to get to the next stage of growth.

“It does look like a gap, but we do have to consider that overall this is a smaller ecosystem and therefore the numbers can fluctuate more. But certainly, since 2019, the numbers have fallen significantly,” said Darling.

Darling added that Albinson recently joining as CEO of Communitech, as well as Jay Krishnan joining the Accelerator Centre as CEO, could also help the ecosystem create more opportunities for pre-Series A founders.

“There are currently 23 companies in the ecosystem who raised a seed round over 18 months ago, so if they are progressing at the right trajectory, we should see them launching into Series A rounds in the second half of 2021,” Darling said.

In the later-stage category, the four deals included ApplyBoard’s Series D funding round, Faire’s Series F venture round, Tulip Retail’s $34 million Series C funding round, and SkyWatch’s $21 million Series B funding round.

Although deal volume declined in Q2, a handful of significant non-venture deals closed during the quarter indicate the region’s tech ecosystem was still active. One of these deals was Magnet Forensics’ IPO, which saw the digital investigation software company raise over $115 million. There were also two private equity deals, closed by Axonify for $313 million and Dejero Labs for $60 million.

In April, angel investor network Archangel announced it had closed a collective $10 million for its three funds. Archangel was initially launched last April in response to COVID-19 to help entrepreneurs accelerate the development and commercialization. The fund invests in startups across the Toronto-Waterloo corridor and could help give early-stage funding a much-needed boost in the second half of 2021.

“The deepening and breadth of the growth capital that’s coming into the region is a great leading indicator of the size and scale these businesses are going to get to,” Albinson said.

Albinson noted that over a recent 60-day period, ending in early August, Communitech’s members collectively raised $1.6 billion in private growth capital, which is almost 80 percent of what was raised in the previous decade. He said these results, in addition to the findings of Hockeystick and briefed.in, demonstrate that the Waterloo Region has all the ingredients to attract a significant amount of venture capital.

“We’re starting to see Waterloo really step up to its opportunity to be a driver for global innovation and become the fastest-growing innovation hub in North America,” Albinson added.

BetaKit is a Hockeystick + briefed.in Tech Report media partner.