Despite a season filled with storms, summer 2022 was particularly dry for venture funding in Toronto’s tech sector, and a new report from briefed.in sheds light on just how far investment in the city has fallen from the bull market highs of 2021.

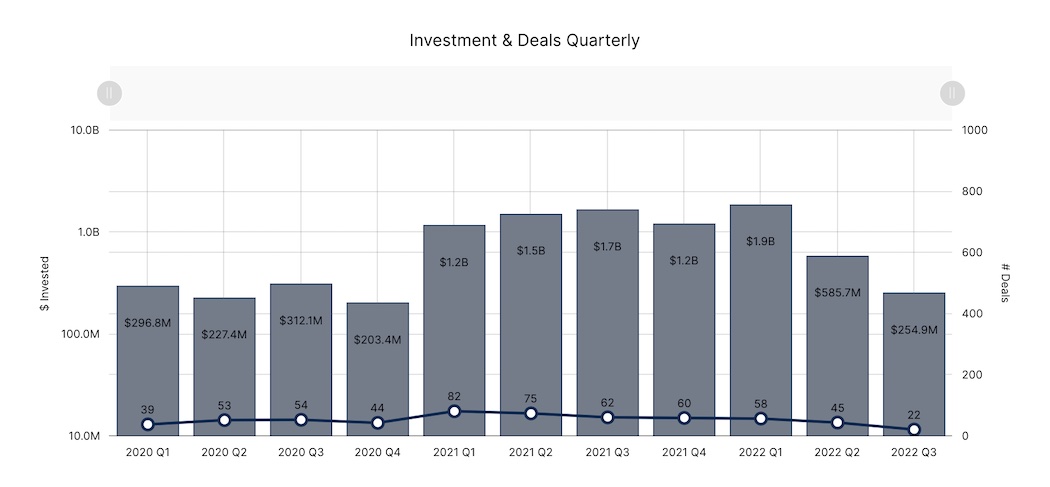

During the third quarter of 2022, venture funding in Toronto totalled $254.9 million, a nearly two-year low for the city. Total investment declined by 56 percent compared to Q2 2022 and fell by 85 percent year-over-year. So far this year, Toronto startups have raised less than half of the total capital raised in 2021.

While total investment in Toronto during Q3 2022 looked very different from 2021 levels, it was in line with the pre-bull market levels of 2020 (investment totalled roughly between $200 million and $300 million in each quarter of that year). Several local investors have noted this recent venture funding decline is a reversion to the mean and more reflective of a normalized capital deployment cycle than a catastrophic crash.

“Reserve strategy hasn’t been this important to portfolio construction in a long time.”

– Anthony Mouchantaf

Deal volume has also fallen each quarter in Toronto since reaching a high of 82 in Q1 2021, but with just 22 investments captured by briefed.in in Q3 2022, it sank to its lowest level in at least three years. Anthony Mouchantaf, head of capital at RBCx, believes the slowdown in both investment and deal volume is stark but was also anticipated given the broader economic climate.

“In times of uncertainty, there’s a tendency among investors to freeze, and this is what we are seeing across venture capital,” Mouchantaf told BetaKit. “We’re in a highly unstable and volatile macroeconomic environment, and recent inflation numbers out of the US have been dampening the mood further.”

Tending the crops

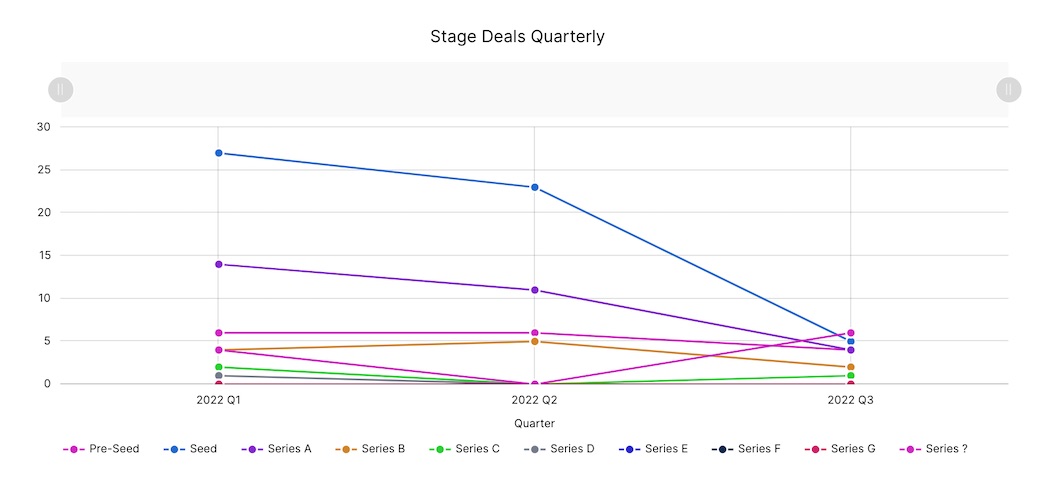

The drop in both investment dollars and deal volume were felt across virtually every deal stage in Toronto during Q3 2022. In the later stages (Series B and higher), deal volume declined from 11 in Q3 2021 to just three in Q3 2022. Matt Cohen, founder and managing partner of Toronto-based Ripple Ventures, said he has noticed a major slowdown in the later stages as investors become increasingly selective and cautious with their capital.

Mouchantaf also noted that VCs in Toronto and across Canada have generally pulled back the reins on net new investments. Instead, they are focused on ensuring their existing portfolio companies have sufficient runway for at least the next 24 months. “Reserve strategy hasn’t been this important to portfolio construction in a long time,” he added.

As a result of the urge to avoid portfolio write-downs and public down rounds, Mouchantaf and Cohen both observed an increase in insider and bridge rounds in recent months. These “quieter” rounds, Mouchantaf said, often take the form of convertible debt with discounts and terms “designed to kick the can on valuation.” While Mouchantaf has also heard anecdotally about some predatory term sheets in recent months, he said they have been “declined summarily.”

The dramatic deceleration in Toronto’s funding activity also demonstrates the changing timelines from investors. Mouchantaf noted that VCs have slowed their pacing and deployment periods from 12 to 18 months to a timeline of three to four years.

Whither the Toronto megadeal?

briefed.in’s report tracked zero megadeals (meaning deals worth $100 million or more) during Q3 2022. This stands in stark contrast to the same quarter of 2021, which saw 14 megadeals, including Clearco’s $268 million Series C round of funding and Deep Genomics’ $226 million Series C round of funding.

“There may be some more short-term pain, but in the long-term, the writing is already on the wall.”

In Q3 2022, the largest deals captured by briefed.in included WellnessLiving’s $66 million financing, Properly’s $36 million Series B funding round, and ACTO’s $23.5 million Series B round. For comparison, the three largest rounds in Q3 2021 all exceeded $160 million.

Mouchantaf noted that monetary policy was the key driver of Toronto’s recent bull cycle, and the abundance of dry powder naturally increased deal sizes to unprecedented proportions. “We’re now in a contractionary monetary environment, so reductions in deal size are not unexpected,” he added. Still, the third quarters of 2019 and 2020 saw three and two megadeals, respectively, signalling that these massive deals have fallen behind even pre-bull market averages.

Another factor contributing to the decline of the megadeal is the recent pullback of “tourist VCs” —hedge funds, crossover investors, and corporate venture investors—from the Toronto market. Many of these firms backed a number of 2021’s mega-fundraises, but Mouchantaf has observed that many of these megadeal capital players have “quietly vacated the market” in recent months. Still, current VC sentiment indicates that the death of the Toronto megadeal is not a foregone conclusion.

“What I do know is there will absolutely still be companies who warrant these types of deals and valuations, as they are building proven business models, which aren’t ultimately dependent on macro policy,” Mouchantaf added.

Fewer seeds in the ground

While deal volume declined across nearly every stage in Toronto during Q3 2022, nowhere was this felt harder than in the early stages. Per briefed.in’s data, Toronto saw a 78 percent quarter-over-quarter decline in seed-stage deals. With a paltry five seed deals and four pre-seed deals tracked, Q3 2022 represented the lowest quarter on record for seed-stage deals in Toronto dating back to 2019, when briefed.in first began tracking deal activity in the city.

Cohen, whose firm focuses on early-stage companies, said pre-seed and seed rounds are still getting done in Toronto from his vantage point, but noted that pre-seed funding rounds are smaller than they were a year ago with valuations that are “more reasonable.”

“Pre-seed and seed are still very active, and we are leading a lot of deals at those stages,” Cohen added.

briefed.in’s data is collected from founders who submit their deal information directly, or from online, public sources, and not all companies or investors publicly disclose early-stage deals. However, the pronounced lack of pre-seed and seed deal volume is a trend that has several Toronto investors concerned about the long-term health of the ecosystem.

Mouchantaf believes that Toronto’s tech sector may never see “enough” seed-stage deals to support long-term growth. “Our inability to finance fundamental research emerging from our universities, in particular, is a perennial societal failure in this country,” he added.

A renewed focus on fundamentals

As Toronto tech enters the fourth and final quarter of the year, the sector is unsure of whether this year’s dry summer will continue into a cooler winter for venture funding, and when markets will in fact bottom out.

While Mouchantaf said the country’s ability to tamper down inflation will continue to be the “wild card” for Toronto tech in the near term, he believes these broader factors are ultimately extrinsic to the fundamental state of the sector.

“There may be some more short-term pain, but in the long-term, the writing is already on the wall,” Mouchantaf added. “Technology is the future, and it will continue to take over our lives and the economy. With that, founders and investors will do well.”

While the recent slowdown in capital deployment might present short-term challenges for some Toronto tech startups, the long-term impact could be quite positive for the ecosystem. Mouchantaf said that for late-stage companies, finding a proximate path to margin growth and capital efficiency is critical if they want to access more private capital. This potential culture shift from ‘growth at all costs’ to capital efficiency could give rise to more sustainable, durable tech businesses in the city.

“Paradoxically, there’s an emerging consensus among investors that 2023 and 2024 vintage funds will be some of the best performing in decades,” he said. “Because the craziness of the past 18 months is now abating, investors and founders are now able to put their respective heads down to build great businesses and focus on fundamentals.”

briefed.in is owned and operated by Communitech. BetaKit receives data from briefed.in as part of a media partnership with Communitech and retains full editorial control of all articles that reference the data produced by briefed.in/Communitech.