Toronto’s tech sector once again swept venture funding records away in the first quarter of 2022, according to a new report from briefed.in. Despite a seemingly favourable start to the year, there are signs Toronto’s roaring tech sector may cool off in the coming quarters.

In Q1 2022, Toronto tech startups raised a collective $1.87 billion through 58 deals. Total investment increased 54 percent compared to last quarter and 59 percent year-over-year. The city’s previous venture funding record, which totalled $1.7 billion, was set in Q2 2021.

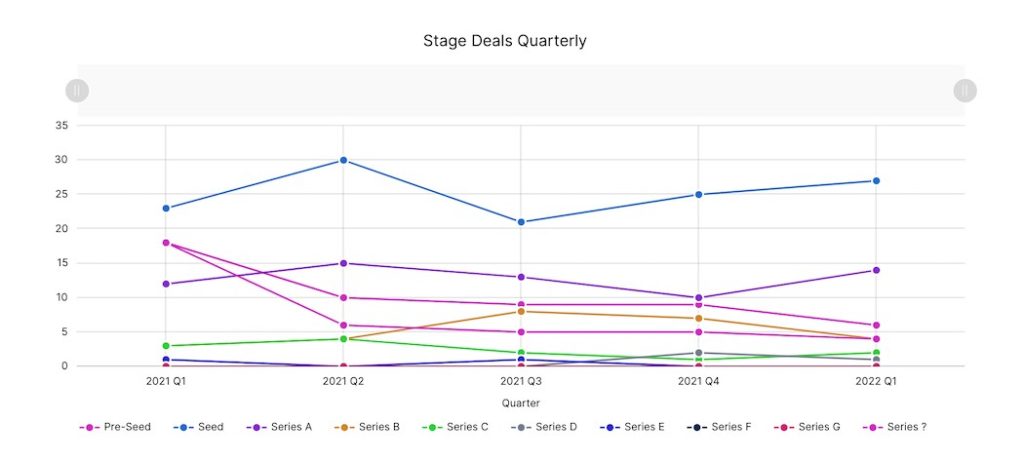

Looking back over the last year, Q1 2022 was the slowest quarter in terms of deal volume for Toronto. The 58 deals closed over Q1 represent a meagre three percent decline from Q4 2021 and a 29 percent decline from Q1 2021. Funding activity has steadily declined since the first quarter of 2021, which saw a record-high of 84 deals.

Toronto tech startups raised a collective $1.87 billion through 58 deals.

The recent turbulence in the public markets, driven by rising inflation and higher interest rates, was expected to temper down lofty valuations and late-stage financings this year. In Q1 2022, global venture funding fell quarter-over-quarter for the first time in a year.

Toronto’s record-breaking investment in Q1 may outwardly indicate the city’s startups were immune to this global slowdown, but Shawn Chance, partner at OMERS Ventures, said the “ripple effect” from public markets is impacting various regions at different rates.

“Whereas Silicon Valley was very quick to adjust (primarily on valuations, multiples and speed at which deals are done, which is a direct result of competition), Canada, and Toronto by extension, seem to have been a little slower to react,” Chance told BetaKit.

Late-stage rounds impress, but VCs may be hedging their bets

The majority of dollars that flowed into Toronto tech firms went to late-stage deals in Q1 2022. Matt Roberts, partner at ScaleUP Ventures, described it as a graduation process, where deals for the “winners are coming together.”

Among the largest deals from Q1 2022 was 1Password’s $744 million Series C round of funding, which the startup claims is the largest Canadian venture round in history. Other significant late-stage financings included Hydrostor’s $315 million funding round and Koho’s $160 million Series D funding round.

Over the last year, later-stage deals have seen increased competition from US investors like Tiger Global. The trend continued into the start of 2022; 1Password’s and Koho’s deals were led by US-based investors.

The average sizes of late-stage rounds have exploded over the last two years. Per briefed.in’s analysis, the average Series B round in Toronto during Q1 was $70 million, roughly triple the average size of Series B rounds in 2020. Roberts noted valuations for late-stage companies have increased commensurately.

“Now the stock market is down significantly, and people are beginning to question those valuations,” Roberts added. “So they’re putting terms on those valuations now to protect themselves in case this all goes to hell.”

Some of the “unfriendly terms” Roberts has noticed include participating preferred stock, which is often used when a company wants a higher valuation, but the investor believes in a lower valuation. While they are usually seen in deals for distressed companies, the recent emergence of participating prefs for outwardly healthy companies could indicate that VCs are now more eager to protect against downside risk.

Are bigger early-stage rounds always a good thing?

In Q1 2022, a total of six pre-seed deals and 27 seed deals closed in Toronto. Some large early-stage deals during the quarter included Feroot Security’s $14 million seed funding round and Key’s $11 million seed funding round. Chance said the exit velocity from the last two years has created more early-stage investors, making early-stage a “very hot segment right now.”

Round sizes have ballooned in the early stages across Canada. According to briefed.in’s annual report on Canadian tech, the average size of seed-stage deals in Canada increased by 65 percent to $3.8 million last year. In Toronto, the average seed-stage round totalled $3.7 million in Q1 2022, up from the 2021 average of $2.8 million.

But Roberts has observed that while earlier rounds have grown in size, the gross volume of early-stage deals has fallen from where it was five or six years ago. “Where I play, which is in the earlier stages of the market, I’m seeing a very striking pattern of a lack of institutional capital available, not a lot of deals getting done,” Roberts said, adding that part of this is because of less company creation in the city.

Roberts also noted valuations in the earlier stages have skyrocketed in Toronto. As Ramin Wright, former investment associate at Luge Capital, notes, sky-high valuations can be dangerous for young startups who want to avoid dampened valuations, down-rounds, and more difficult fundraises or exits in the future.

According to briefed.in, Toronto’s seed deal volume in Q1 2022 nearly matched the 25 seed deals closed in the first quarter of 2019. Since Q1 2019, seed activity has fluctuated from quarter to quarter, but has roughly remained around the 20 to 30 mark.

“If we’re not having an increase in total seed rounds, then we’re going to have [fewer companies] graduating,” Roberts added. “If it’s relatively flat, you’re not going to see a significant increase in the growth curve of those companies going forward.”

Many experts are warning of a major drop in private valuations for Canadian tech companies, considering the current downward trend of public markets. Others suggest the country’s tech sector still has room to run, given that dry powder is still abundant from Canadian and US investors.

“With capital availability being at an all-time high, we expect that Q2 will still have a lot of velocity, but would not be surprised to see this taper from what we saw in 2021,” added Chance.

BetaKit is a briefed.in Tech Report media partner.