Another megadeal gave Montréal’s tech ecosystem a solid start to 2021, but without it, venture funding would have sunk far below the worst quarter of the last year, according to the BDO-Hockeystick Montréal Tech Report.

In Q1 2021, the Montréal tech ecosystem drew in $253 million, an increase of 146 percent from last quarter, and 26 percent year-over-year. Venture funding held steady due to travel tech startup Hopper’s $213 million Series F round, which accounted for 84 percent of all dollars raised in the city.

Montréal’s reliance on a single megadeal to drive quarterly funding growth has emerged as a key trend in the ecosystem over the last year.

Though Montréal venture funding caught up to Toronto in 2020, the Québec city only raised roughly one-fifth of the $1.15 billion Toronto startups raised in Q1. Without Hopper’s deal, Montréal would sit far behind Toronto, British Columbia, and Calgary in terms of overall investment. According to data provided by Hockeystick, Montréal’s Q1 performance would only lead over Waterloo Region, which saw one of its lowest quarters ever in Q1 with just $14 million raised.

“Montréal, like Waterloo, can have lumpy quarter-over-quarter performance due to each of them having a smaller number of high-growth companies,” said Rob Darling, research partner at Hockeystick. “A low quarter here or there is not a red flag. If we were seeing low numbers across two or more quarters, then there would be reason for concern.”

Montréal’s reliance on a single megadeal to drive quarterly funding growth has emerged as a key trend in the ecosystem over the last year. In 2020, deals such as Sonder’s $230.4 million Series E round and AppDirect’s $250 million investment helped the city achieve some of the strongest quarters seen in years.

The number of deals closed in Montréal over the first quarter of 2021 was down 25 percent from Q4 2020 and 31 percent year-over-year. Though deal volume has stayed relatively consistent over the last year, peaking at 35 deals in the second quarter of 2020, Q1 2021 had the lowest deal count in at least the last year.

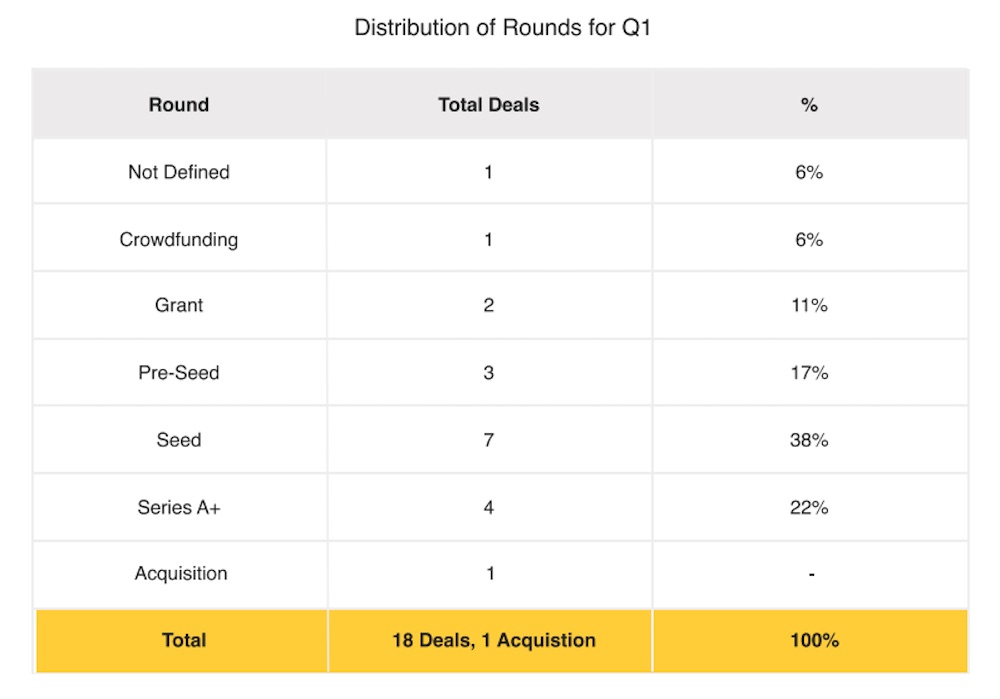

Of the 18 deals closed in Q1, 10 were classified as either pre-seed or seed-stage deals. Significant early-stage raises included Heyday AI’s $6.5 million seed round of funding, Livescale’s $2.5 million early-stage raise, and Eli’s $1.2 million raise.

The high early-stage activity in Q1 2021 is reflected in some of the region’s most active investors during the quarter, such as Real Ventures and Panache Ventures, which both invest in the pre-seed and seed stages.

At the same time, a new accelerator, run in partnership between Highline Beta and FinTech Station, also launched in Montréal in Q1, which could bolster the city’s early-stage startups in future quarters.

“The pre-seed and seed-stage deals for Montréal are in line with previous quarters and show that the ecosystem still has a strong pipeline of early-stage companies,” Darling said.

Darling also described late-stage funding in Montréal as healthy in Q1 2021, with four deals classified in the Series A stage or above. Aside from Hopper’s megadeal, the two most significant late-stage deals from Q1 included LiveBarn’s $14 million Series C raise and Innodem Neurosciences’ $7.6 million Series A round of funding.

Hockeystick also tracked the acquisition of Element AI as a non-venture deal of note for the first quarter. Once hailed as the city’s AI darling, the startup was purchased in January by ServiceNow for $230 million USD. The deal was characterized as a disappointment by some in the Canadian tech community, given the startup’s valuation was once estimated to be between $600 million and $700 million.

Darling noted that while the deal was lower than expected, it still led to an influx of money into Montréal and the potential for more spin-off companies in the AI sector.

“The challenge may be that some investors may be more cautious in investing in AI companies unless they really have a solid problem-solution fit in the earlier stages and product-market fit in the growth stages,” Darling added.

Healthtech startups saw the most venture activity in Montréal, comprising 17 percent of all deals closed over the first quarter. The dominance of this vertical was seen across Canada in Q1 and continues a trend throughout 2020.

Though healthtech is an active sector in Canada, many healthtech startups face unique barriers to adoption. One of these challenges includes navigating the country’s ever-evolving privacy legislation to ensure products are compliant with the law. Experts have also pointed to Canada’s procurement system as becoming increasingly centralized and allowing for a smaller number of opportunities for startups.

“The question is whether Canada’s investment in healthtech will lead to high-growth companies in the coming quarters and propel Canada to become a world leader in healthtech,” Darling said.

BetaKit is a Hockeystick Tech Report media partner.