Canada’s Toronto-Kitchener-Waterloo corridor has faced significant investment growth over the past five years in the FinTech space, a recent report from Toronto Finance International has found.

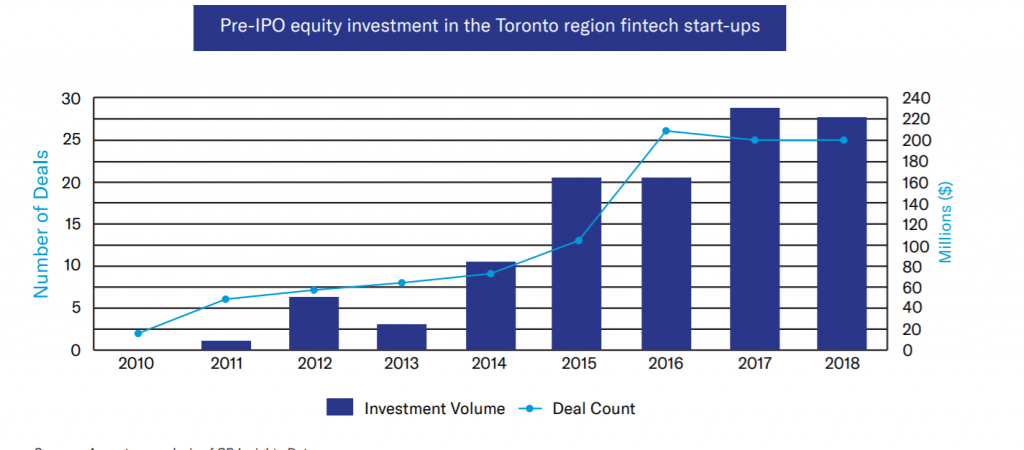

Investments for FinTech startups in the Toronto region grew to a total of almost $221 million across 25 deals in 2018. However, the report also found that the region has a smaller share of global Fintech investment in regards to the number and size of deals compared to other major financial centres such as San Francisco, London, and New York.

Investments for FinTech startups in the Toronto region have grown to $221 million over 25 deals.

The report coming from Toronto Finance International (TFI) is the 2019 update to its original report from last year, and looks at how the Toronto region is becoming a global leader in FinTech. TFI is a public-private partnership organization between Canada’s largest financial services institutions and the municipal, provincial, and federal government.

The report was researched by Accenture and McMillan, and seeks to analyze the progression of the Toronto region FinTech ecosystem, through quantitative analysis of data from various sources, as well as interviews with industry experts in the ecosystem.

It found that the investment and funding environment in Toronto has increased, specifically regarding the value of pre-IPO equity financing deals in FinTech startups. In 2014, the value of pre-IPO equity deals was $83.7 million. In 2017, that figure almost tripled to $230.4 million, with investments dipping a bit in 2018 to $220.9 million.

KPMG’s Pulse of FinTech report, which examined investment trends, issues, and challenges in the FinTech sector during the first half of 2018, found that Canada’s FinTech sector saw a high volume of deals in the first half of the year; however the value of those deals declined compared to 2017.

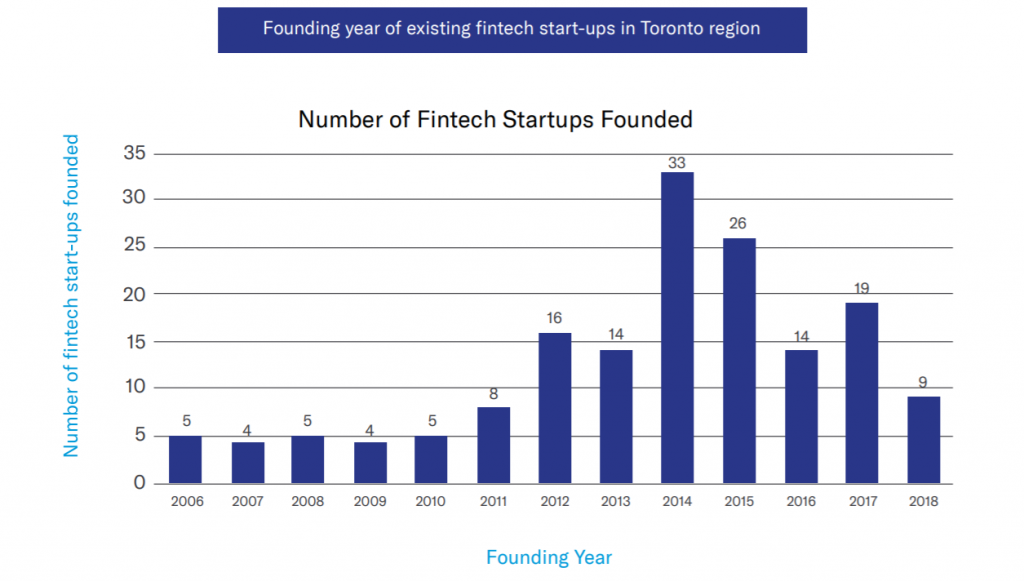

According to the report, the Toronto region FinTech space consists of 194 FinTech companies, 19 VC firms, and over 20 incubators and accelerators. Toronto has the largest FinTech ecosystem in Canada, accounting for about 43 percent of all FinTechs. In 2014, the region saw a spike in the number of FinTech companies founded, with a total of 33 being founded in that year alone.

Since then, the number of FinTech startups founded each year has declined. The report attributes this trend to an increased maturity of the ecosystem, as more companies move beyond the early growth stage. A total of 15 companies have raised more than $40 million, which saw an increase from just six companies in the original 2017 report.

Additionally, the Toronto region has also experienced an increased amount of interest from US-based VCs. The report said that about 43 percent of Canadian VC deals in 2018 are expected to include US-based investor participation, compared to just 27 percent in 2014.

Several Canadian FinTech companies have also been recognized internationally. Wealthsimple and League have been on the FinTech 100 for three years in a row. Recently, Wealthsimple announced a new partnership with TurboTax to make RRSPs easier. Last year, League raised a $62 million Series B round led by Telus Ventures.

The relationship between financial institutions and FinTech companies was also explored in the report. It found that financial institutions are investing in collaboration in the FinTech industry. It also mentions challenges of these partnerships, one of which includes difficulty finding the right FinTech company offering enterprise-ready products and services that meet scalability and security requirements.

Compared to global FinTech hubs such as London, New York, and San Francisco, the Toronto region remains small. As a percentage of global FinTech deals by value (pre-IPO equity), from 2010 to 2018, Toronto represents one percent compared to 5.4, 8.1, and 19.7 percent respectively.

“We have one of the highest investment growth rates globally, with a compound annual growth rate of 118 percent since 2010,” said Jennifer Reynolds, president and CEO of TFI. “While this is a much smaller absolute investment base than that of global hubs like London, New York, and San Francisco, we have the opportunity to leverage North America’s second-largest financial centre, combined with its third-largest tech cluster, and use this momentum to become a global FinTech leader.”

The full report can be accessed here.

Featured image via Pixabay.