In January, PwC Canada and CB Insights released the MoneyTree report analyzing Canadian VC activity for Q4 and all of 2017. In a year where Canadian companies raised $3.3 billion CAD ($2.7 billion USD) total, the report found that seed stage investments are declining across the country — a sign that Canadian companies are finding their product-market fit, according to PwC’s Michael Dingle.

The report also tracks Canadian cities showing significant activity within their startup ecosystems. To gather a yearlong perspective on how Canada’s tech hubs have performed, BetaKit spoke with PwC’s tech team from each city to talk standout sectors, and what each ecosystem needs.

Toronto and Waterloo

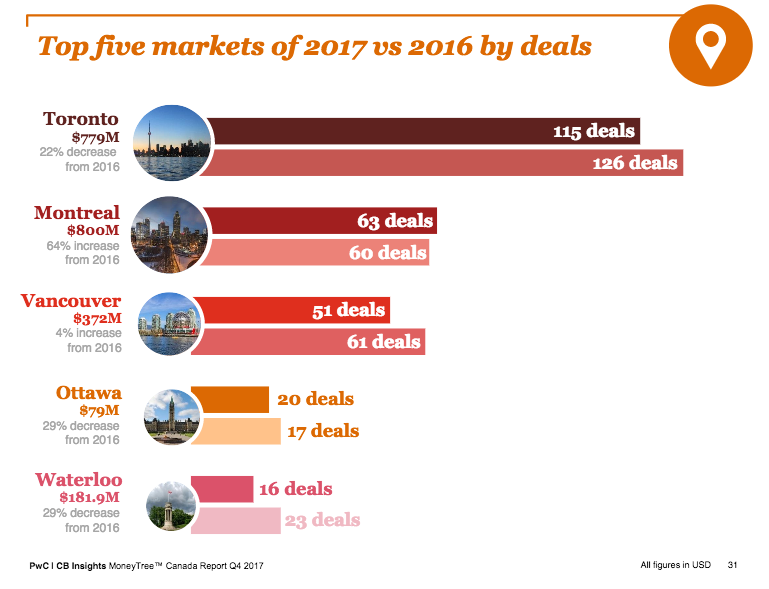

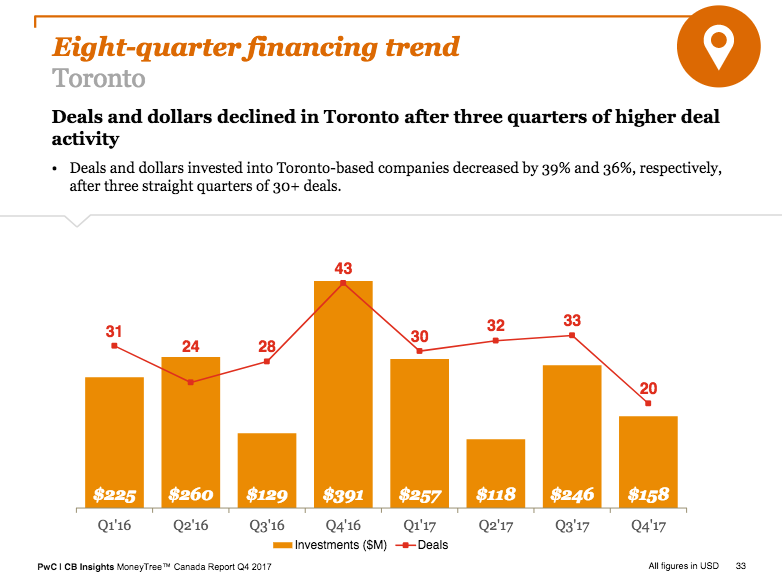

Toronto came at the top of the list, with $976 million ($770 million USD) invested across 115 deals in 2017, while Waterloo raised $229 million ($181.9 million USD) across 16 deals.

For Toronto, this number represented a 22 percent decline from 2016, which saw $1.2 billion ($1 billion USD) invested over 126 deals. Waterloo experienced a 29 percent decline from 2016, when the region saw $323 million ($256 million USD) across 23 deals.

Toronto PwC tech managing director Rich Adam said that these declines shouldn’t be a source of concern, however, since there were “some high points” in 2016 compared to 2017.

“Toronto and the Waterloo region represent such a huge portion of the Canadian tech market that it will be a leader for years to come,” said Adam.

In Toronto, advancements in AI, FinTech, and cybersecurity have made it an attractive city for investments. Toronto has a history of pioneering in AI, and the leaders working in this space — such as University of Toronto’s Geoffrey Hinton and Uber ATG lead Raquel Urtasun — are now attracting US interest and setting the foundation for AI talent in the city. FinTech has also long been considered an area of strength in the city, thanks to a heavy presence of Canada’s banks that are keen to work with startups.

For 2018, Adam said that as Canadian startups receive more global attention for AI, Toronto and Waterloo will benefit from increased funding from international investors across Canada.

“We’re attracting global interest and global dollars. If you look at some of the deals that took place in Toronto, specifically in the AI market, you have a lot of international investors. That is a real insight that not only are we creating a lot of excitement and cheerleading for the sector, but we’re attracting the investment dollars to back it up,” he said.

Adam also said to keep on the lookout for startups working with blockchain. “I don’t think Toronto or Waterloo have a distinct advantage over the other markets, but I do see that is a big area of development in what we’re going to see happening across the entire Canadian marketplace this year.”

Some deals that pushed Toronto close to the top include PointClickCare’s $111 million CAD ($85 million USD) round — the city’s biggest funding round of the year — and Freshbooks, which raised a $57 million CAD ($45 million USD) round.

However, Adam noted that the Waterloo Region, while smaller than Toronto, has been an important part of the funding story of southwestern Ontario (Ontario had $1.3 billion CAD, or $1.1 billion USD invested in 173 companies, the largest of any province).

From the region, Cambridge-based cybersecurity company eSentire was the biggest deal for the area this year at $100 million, while Waterloo-based Auvik Networks had a significant $15 million Series B.

Corporate participation is higher in southwestern Ontario versus other regions, sitting at 31 percent of deals, versus BC and Quebec, which have 25 percent corporate participation.

While the rise of corporate investment was a major theme across Canada dating back to Q2 2017, Adam noted that corporate participation is higher in southwestern Ontario versus other regions, sitting at 31 percent of deals, versus BC and Quebec, which have 25 percent corporate participation in deals.

“This shows that although total deal flow is lower in BC and Alberta, some companies based there are able to attract attention and funding from corporates, pushing up average deal size. [It’s] indicative of quality tech being produced,” he said.

Montreal

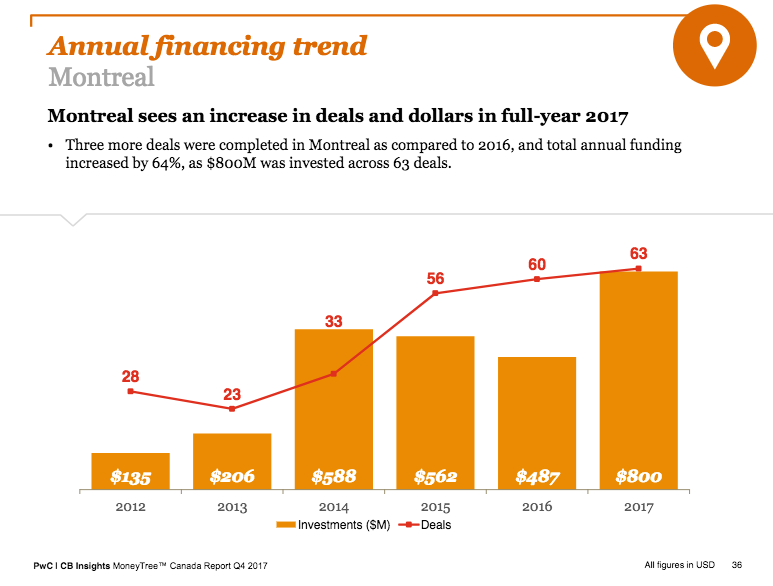

Montreal was second on the list in terms of deals, with $1 billion ($800 million USD) invested over 63 deals. One of the biggest funding boosts to the area included Montreal-based Lightspeed, which raised a $207 million CAD Series D.

As expected, AI was a big reason for 2017’s increased activity in the city, with AI pioneers like Yoshua Bengio leading companies like Element AI, which raised a historic $137.5 million CAD funding round last year. The buzz around Montreal led to international tech companies like Microsoft and Samsung setting up shop in the city to take advantage of its AI talent.

IoT was also a standout sector in Quebec, with companies working on developing the technology behind autonomous vehicles. The biggest funding round in the province was, in fact, Quebec City-based LeddarTech, which raised $128 million CAD from FTQ to support its development of LiDAR technology.

“That’s related to many, many years of investment that the Quebec City area has invested in optical. They have a big foundation of optical-based companies — sort of fibre optics,” said Audrey Larocque, EIR and tech managing director for Montreal. “There are a lot of companies in the Quebec City area around the fibre optic theme and that is one of the reasons that IoT is thriving.”

As for Montreal, Larocque credits the city’s strength in the telecommunications sector in the early 2000s as setting the foundation for the current AI boom. “Montreal was very good at telecommunications in the early 2000s, which has translated to being very good at data from 2007 to 2010. So they have data-driven businesses, which led to analytics,” he said. “Two pillars of data and analytics are a natural foundation for AI. That’s why you have numerous companies that are in this space in Montreal.”

While the number of seed stage investments across Canada declined, Larocque noted that it remained stable in Quebec — though he said that this is an area he’s watching for 2018.

“Entrepreneurs and companies are becoming professionals – it’s the same thing for funds. Funds are raising more cash, the minimum amount of investment is moving up, which means they do less seed investments and in the mid-term, that might be an issue, so we have to keep an eye on that.”

Vancouver

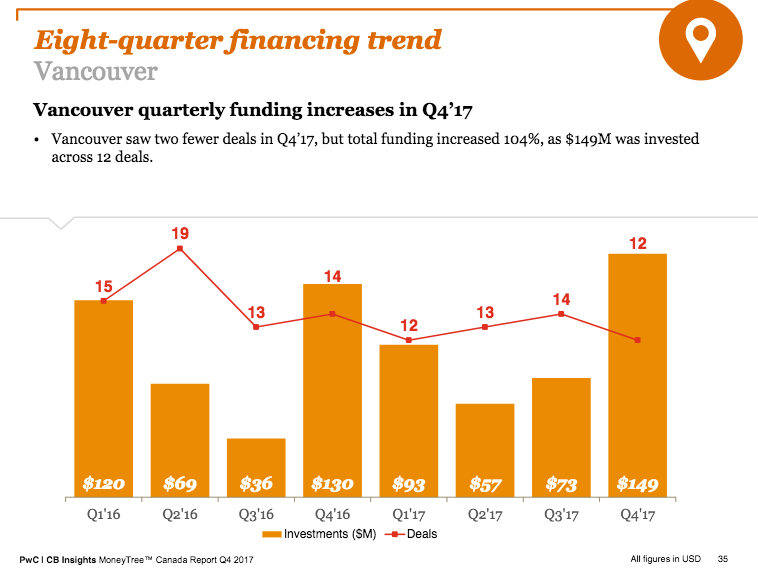

Vancouver raised $471 million CAD ($372 million USD) across 51 deals in 2017, a four percent increase from 2016, when the city raised $450 million ($356 million USD) across 61 deals. For Vancouver tech managing director Cameron Burke, the narrative for Vancouver was one of scale.

“When you look at volume down and amount up is that the money is going to companies that can scale,” said Burke, calling out later-stage companies like ACL, a 30-year-old company that raised its first $50 million CAD round of investment last year. “Vancouver has a vibrant early-stage ecosystem, and one of the struggles we’ve seen — Toronto and Montreal if you look at it, Toronto is putting a lot of institutional weight behind the scaling of tech companies. I’m not saying Vancouver isn’t, but I think that’s been a challenge whether that’s been time zone or finding the right operational talent.”

B2B FinTech, and the tech and identity management space, are particular sectors to watch according to Burke, especially as these companies begin to incorporate blockchain technology into their solutions. While companies like Hootsuite, Vision Critical, and BuildDirect have brought a lot of attention to the area, Burke said that the next generation of companies, like 1QBit and Elastic Path, will begin to push the narrative forward.

While there were less Vancouver deals in 2017 compared to 2016, Burke said that it doesn’t indicate any “structural issues” within the ecosystem.

Speaking with tech companies, Burke said that we should be on the lookout for more companies looking to raise non-dilutive capital through venture debt, rather than going through the traditional VC route. Traditional corporate finance, RTOs, and IPOs may also play a larger role in Vancouver’s narrative.

“There’s some larger rounds that take attention and capital out of the ecosystem, but I think 2018 is a big year in Vancouver tech. There’s going to be a lot of liquidity and a lot of capital around, and it’s going towards things that are scaling and some transformative early-stage tech specifically in cybersecurity, privacy, blockchain, and crypto.”

Ottawa

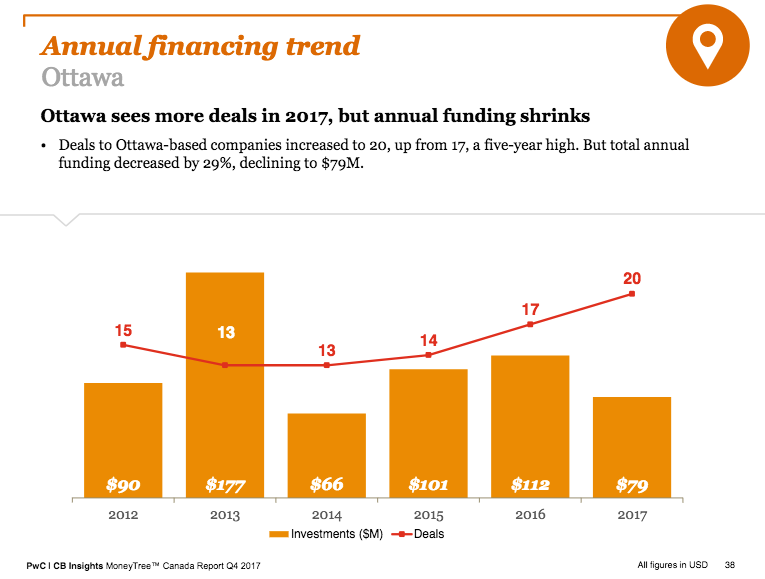

In 2017, Ottawa raised $92 million ($73 million USD) in 20 deals — a five year high for the city. However, total funding decreased by 29 percent compared to 2016, when the city attracted $141 million ($112 million USD).

Jonathan Dervin, a PwC partner in Ottawa, attributes this to the stage of development of Ottawa companies: many are in the seed and early-stage. While markets like Toronto and Montreal are seeing more later-stage investments, Ottawa bucked this trend.

“Ottawa is kind of an infancy market with respect to where the investments are happening, but it is a good sign that the number of deals is significantly higher in the last few years,” he said.

In Ottawa, Q4 2017 — which had $10 million ($8 million USD) invested across three deals — was a decline compared to the year before, which saw $44 million ($35 million USD) across eight deals. Dervin said this is normal; as many VCs want to get their deals done before the end of the year, Q2 and Q3 are usually peak quarters every year.

In terms of YoY, 2017 experienced a decline from 2016 since the latter year saw major later-stage deals like Turnstone Biologics’ $41 million CAD round, bringing that investment dollar up. Noting that Ottawa is a “hotbed” of SaaS activity with accelerators like L-SPARK supporting the ecosystem, he hopes that we will see more of a shift towards later-stage funding.

Dervin noted cloud-based software companies were the majority of investments in Ottawa — representing about 65 percent of investments — while AI and cybersecurity are emerging industries in the Ottawa market.

“As these companies start to expand to Series A and B, we’ll start to see a trend towards more on the expansion side,” said Dervin. “Similar to what you see in Montreal, Toronto, and Vancouver – they saw more proportionally more investment in the later stages, and less in the seed stage, whereas Ottawa is the opposite and it’s just a timing issue.”

While Dervin anticipates a shift in the size of dollars in these deals, “I think it’s positive to see that there’s a healthy market environment when it comes to companies looking to set up shop.”

As for what is needed to boost the ecosystem, Dervin said that he’s hoping for more participation from Canadian firms.

“I’d say 60 to 70 percent of the investors are from the US. So you’re left with the remainder in Canada, and a small percentage is coming from Ottawa itself,” Dervin said. “In Canada’s larger markets, we have proportionally more Canadian investors – I would like to see more attention paid to Ottawa-based startups.”

Calgary and Edmonton

While Calgary and Edmonton weren’t included in the report as they are less mature markets, BetaKit spoke with Calgary technology leader Joon Chan and Edmonton partner Charles Evans to get their perspective on what’s happening in the two tech ecosystems, as Alberta-based companies raised $276 million ($218 million USD) over 21 deals in 2017.

According to Chan, companies in Calgary are smaller, receive less deals, which are often not coming from institutional VC. The angel community is an important part of the funding ecosystem in Alberta, as the province doesn’t have as many on-the-ground VCs.

“We’re certainly seeing more high net-worth individuals that have capital that they’ve developed looking to get into the space.”

The Canadian government’s VC arm, BDC Capital, is also an important part of funding Alberta companies. The hope is that programs like the Alberta government’s $90 million investor tax credit program will encourage more investment in the area.

The province has a lot of public company activity, said Chan, because these companies would have to go this route in order to raise funds.

“I do think we need more venture capital here. Ten years ago, I went to a tech conference in Banff and they talked about how VCs from Silicon Valley wouldn’t invest in companies they couldn’t drive to. That’s changed a lot in the last few years. But I do feel like companies here aren’t being funded is because we don’t have a large concentration of local VCs here,” said Chan.

In Edmonton, Evans said that there is more capital coming from private individuals, but not too much experience in the tech market, which won’t change in the next year.

“We’re certainly seeing more high net-worth individuals that have capital that they’ve developed looking to get into the space,” he said. “The downfall is that there isn’t the experience with technology, which speaks to the early stage of the market on the company and investment side.”

Chan anticipates more acquisitions by tech companies and increased financing, while Evans noted that Edmonton will see more M&A activity.

View the full MoneyTree report here.

BetaKit is a PwC MoneyTree Canada media partner.