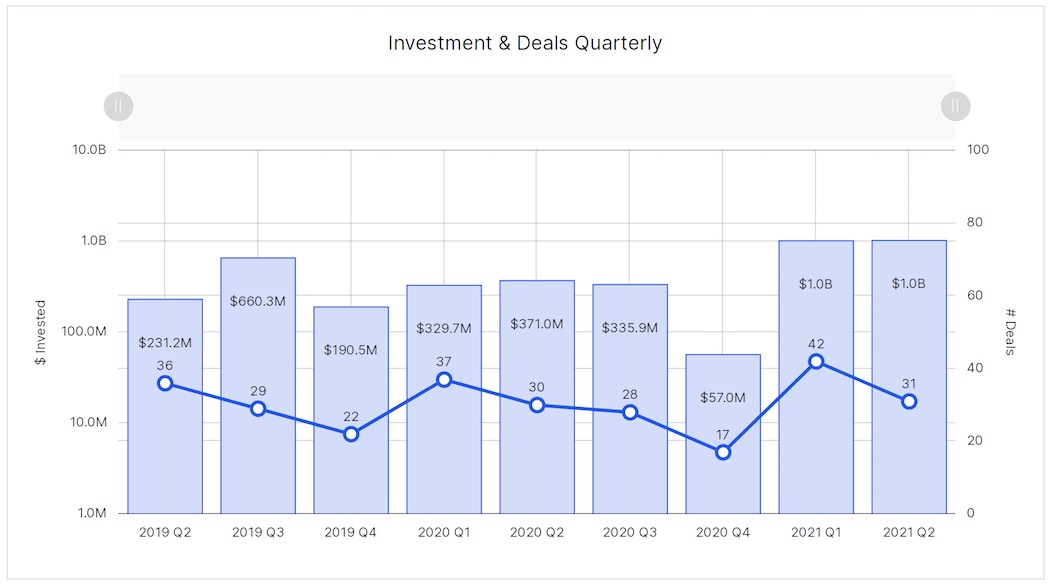

Tech startups in British Columbia raised over $1 billion in the second quarter of 2021, slightly eclipsing total investment in Q1 2021 and setting a new record for venture funding in the province, according to the latest report from Hockeystick and briefed.in.

“We have reached the stage where capital is hungry and motivated to make investments.”

Tech startups in BC raised a total of $1.03 billion in Q2 2021 through 31 deals. Total investment increased one percent from last quarter, and 177 percent year-over-year. This represents the second quarter in a row that BC raised over $1 billion.

BC’s impressive results round out a landmark quarter in Canadian tech. Four of the five largest Canadian tech ecosystems set new venture funding records during Q2, with a record total of $4 billion raised across Canada.

In terms of total investment raised, BC only sat behind Toronto, which saw $1.46 billion raised in Q2. Jill Tipping, president and CEO of the BC Tech Association, said the results are “fantastic to see, but not surprising.”

“We have reached the stage where capital is hungry and motivated to make investments,” Tipping told BetaKit. “We don’t see the scarcity of capital that many claimed [BC] had in the past.”

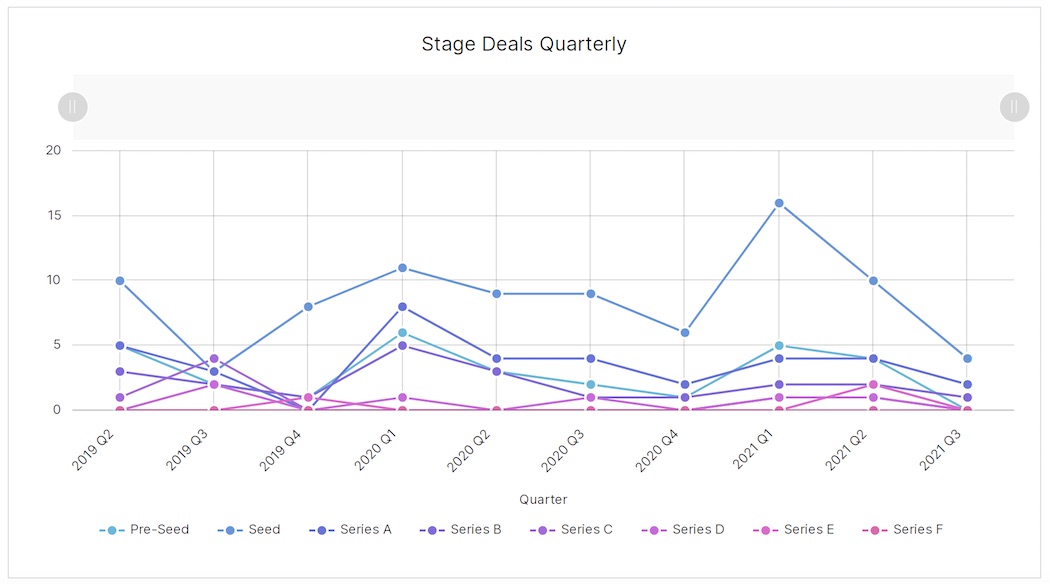

BC’s blockbuster Q2 was fuelled by five deals in the Series B and above stages, with the three largest spanning SaaS and HR Analytics. These deals included Trulioo’s $476 million Series D funding round, Visier’s $155 million Series E raise, and Clio’s $136 million Series E funding round. Dooly also raised approximately $100 million in Series B funding and Bench secured $73 million in Series C financing.

During the second quarter, the most active verticals were artificial intelligence and SaaS, with each accounting for 16 percent of deal volume. Biotech comprised the next-highest share of deals at 13 percent.

“SaaS has long been a strength of BC’s tech ecosystem. AI and BioTech are fast becoming new areas of strength,” Tipping said, adding that she also sees AgTech, digital health, and gaming as other verticals of strength in BC.

Venture funding activity was somewhat steady in Q2, with deal volume declining 26 percent compared to Q1 of this year and increasing three percent year-over-year.

Fourteen of the 31 deals in BC for Q2 were either pre-seed or seed investments, with seed deals comprising the lion’s share of early-stage activity. Notable rounds in Q2 included Stoko’s $6 million seed funding round, Commit’s $6 million seed funding round, and Defined’s $2.5 million seed financing.

In Q2, seed deals in BC saw a 37.5 percent decrease quarter-over-quarter, while all other stages stayed the same as Q1. CEO of briefed.in Rob Darling said on a quarterly basis, this decline is not a cause for concern, but is something to watch over the next two quarters.

A total of four Series A deals closed during Q2 2021, comprising approximately 13 percent of all deal volume. According to Hockeystick and briefed.in, there are also 27 companies in the ecosystem that raised seed over 18 months ago.

“We should, in theory, see an increase of Series A deals in the next two quarters along with the potential of seven Series A companies who could be ready to move to Series B,” Darling added.

The need for more scale-up funding has emerged as a theme in the BC tech ecosystem. Tipping has previously discussed this capital need and is lobbying the federal government for a Scale-Up program similar to that of Ontario.

“Where we now need to focus is making sure BC’s pipeline of tech companies is healthy and strong,” Tipping said. “Whether a company is bootstrapping or seeking venture investment, we want to support them to develop strong, resilient business plans that enable them to realize their full potential with customers and markets.”

Four of the fourteen investments were in companies focused on artificial intelligence, the leading vertical in these stages, but they were all undisclosed amounts. Although the lack of funding disclosures in BC has been tracked in previous quarters, Darling noted it is common for companies to not disclose funding rounds in their early stages.

Non-venture deals of note during Q2 included Thinkific’s IPO, which saw the Vancouver-based EdTech startup raise $184 million. In April, Kelowna, BC-based FreshGrade was also acquired by Higher Ground for an undisclosed amount. Hockeystick and briefed.in also tracked three private equity deals in BC during Q2 2021, including Tasktop’s $122 million raise, 7Gen $24 million deal, and PDFTron’s undisclosed raise.

During the second quarter, Vancouver-based Version One Ventures also secured approximately $125 million for two newly announced venture funds. Though the firm has recently shifted to a global thesis, its portfolio companies include several successful BC-based tech companies, such as Clio, Dapper Labs, and Unbounce.

Looking over the first half of 2021, BC has reached 65 percent of the 2020 deals and has already surpassed all of 2020 funding. Tipping said she expects 2021 to be a record year for BC tech and believes this momentum will continue in 2022.

“If we want to see this success continue, we must invest in the pipeline of tech companies for the future,” Tipping said. “That means ensuring BC’s tech companies have access to the programs and services they need to grow and scale.”

BetaKit is a Hockeystick Tech Report media partner.