After the boom of 2021, Canadian venture capital investment is normalizing back to pre-pandemic levels, per the latest data from the Canadian Venture Capital and Private Equity Association (CVCA).

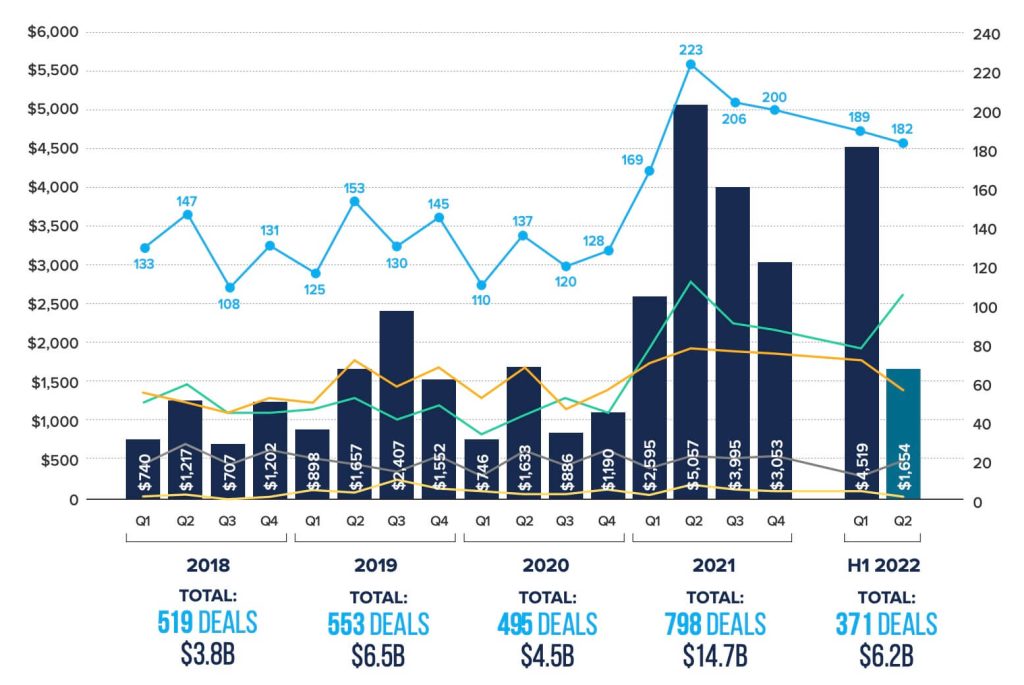

The amount of venture capital invested in Q2 2022 was $1.65 billion (all numbers CAD), a figure that closely mirrors the second quarter of 2020 and the second quarter of 2019.

The economic downturn is leading to investment themes that bear resemblance to early 2020, when investors were cautiously deploying capital and concentrating on their existing portfolio companies.

“GPs [general partners] are taking a cautious approach, deploying dollars more slowly and rethinking strategy,” said CVCA CEO Kim Furlong in the report. “The fundraising environment has shifted slightly. While institutional investors are staying the course, family offices [and] High Net Worth Individuals, who have seen their public portfolio value decrease, are treading lightly. We’re seeing the same trend lines around the world as market volatility, inflation and interest rate pressures are impacting the investment landscape.”

This normalization, as CVCA called it, has been in the works for a number of months now. Venture capitalists that BetaKit has spoken with have indicated that investment patterns began to change as far back as December 2021 as people foresaw the changing market conditions.

CVCA’s data reflects this. Despite the first quarter of this year being a record quarter, the amount of dollars being invested has been declining quarter-over-quarter since the second quarter of 2021, when venture funding reached an all-time high in Canada. Deal count has also been in decline.

The first quarter of this year turned out to be a record one because of mega-deals (investments of more than $50 million), which accounted for nearly three-quarters of all the investments. And, many of these deals were likely “residuals” from dealmaking activity in the previous year, said CVCA vice president of research and product Christiane Wherry.

It was also the first quarter that contributed to the first half of 2022 being the second largest amount of capital raised in a half year in Canadian venture history. In total, $6.2 billion was invested during the first half of this year.

Despite the strong showing, data is indicating that this year is set to more closely resemble 2020 than the boom year that was 2021.

Citing the public market slowdown, rising inflation, and a tightened monetary environment, Wherry agreed with that sentiment. “This trend may continue for the remainder of the year as investors closely monitor macroeconomic conditions,” she told BetaKit.

The CVCA’s findings are on par with what other reports have seen happening regionally across Canada. Briefed.in’s quarterly reports on venture funding have shown that almost every region in the country has seen the highs of 2021 stagger, as companies face massive layoffs and valuation markdowns.

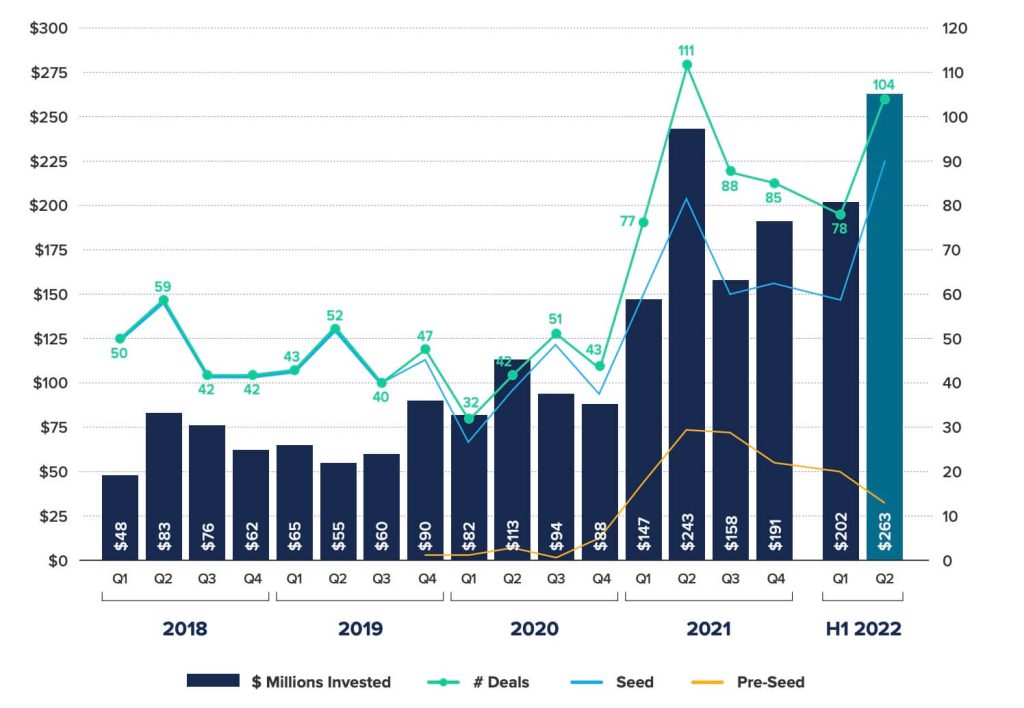

In addition to reflecting the overall market conditions, there were some notable findings from the latest CVCA report. This includes the fact that seed-stage companies have been “relatively insulated” from market conditions while later- and growth-stage companies have been more heavily affected by the public market slowdown.

This comes after concerns over the past year that later-stage deals were leaving the earlier-stage companies in the dust and with more limited access to capital. That has changed over the past few quarters, according to CVCA, as later-stage deals have declined while seed-stage investment has gone up.

Almost half of all transactions in the first half of 2022 were made at the seed stage, with Q2 setting a record for seed stage investment value in a quarter with $263 million. The second quarter also had the second highest deal count on record (104 deals) since Q2 2021, which saw 111 deals.

“Seed stage companies are the furthest from the public markets and its current volatility, and are therefore relatively insulated from the slowdown experienced by the rest of the economy,” said Wherry. “Investors in this stage are also likely to focus on seed-stage investments only.”

But while seed-stage deals are on the rise, that same can not be said for pre-seed investment. After a steady rise over the past couple of years, the number of pre-seed deals started to steadily decline after Q2 2021, according to CVCA data. However, they took a sharp dive after the record first quarter of this year.

Beyond pre-seed and seed, 34 percent of deals went to Series A or B, while 10 percent went to later and growth stages. In terms of deal value and size, nearly one-fifth of all deals were valued at more than $20 million. The average disclosed deal size in the first half of 2022 was $16.6 million, surpassing the five-year average of $10.9 million.

Venture debt on the other hand has increased amid the public market conditions. The CVCA report noted that with $317 million distributed across 62 deals in the first half of this year, venture debt is on track to have its most active year yet in Canada.

Private equity followed more of the venture capital trend line, normalizing to pre-pandemic levels, the CVCA stated.

“After an outlier 2021, investors are closely monitoring macroeconomic volatility and

public market trends which are impacting the private capital investment environment,” Furlong noted in the report.

“While the landscape is more challenging as we head into the second half of 2022, private equity investors continue to actively invest and largely invest in Canada’s SMEs,” she added.

The report stated that private equity activity remains on pace to return to pre-pandemic levels in 2019 and 2020.

The first half of 2022 saw 420 private equity deals totalling $4.96 billion, with $3.3 billion of that coming in the second quarter. This most recent quarter marked the fourth highest quarterly deal count on record in Canadian private equity with 202 deals.

There was a drop in overall deal value, which like the venture market was mostly felt in larger deals. The CVCA reported that this was due to the absence of deals valued above $1 billion in the first half of 2022, as well as declines in deals ranging between $100-500 million and $25-100 million.

Private equity also saw 63 merger and acquisition exits and 10 secondary buyouts totalling $2.53 billion in the first half of 2022. “This doubled 2020’s annual exit count but with only 15% of the total value,” CVCA noted.

The report added that exits through secondary buyout remains high so far this year, with the

second highest activity on record, “as PE acquire existing companies and consolidate fragmented sectors.”

This compares to venture capital, which saw exit activity in the first half of this year significantly decline from the previous year as there were no IPOs. Compared to 52 exits worth more than $5.2 billion in total, this year has seen just 16 exits, worth $206 million in total.

“The remainder of the year will likely see a continuation of the trends in the first half – normalization after an outlier year in 2021, and we will see numbers matching 2020-levels,” said Wherry.

Photo by Алекс Арцибашев on Unsplash