New data from briefed.in reveals that in Q4 2021, Toronto startups once again collectively raised over $1 billion in venture capital, closing out a watershed year for the city’s tech sector.

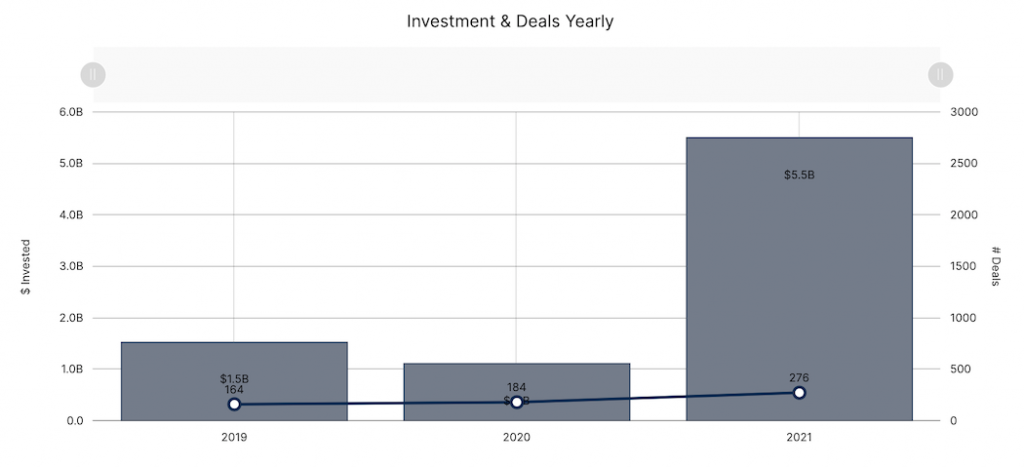

The fourth and final quarter of the year saw $1.18 billion raised through 60 deals, bringing the total venture funding raised in 2021 to $5.5 billion. Over the year, investment in the city’s tech sector surged 400 percent (or five-fold) from the $1.1 billion raised in 2020.

“The global market for venture capital has exploded over the last year and our ecosystem is no exception.”

– Jamie Rosenblatt, Golden Ventures

In every quarter of 2021, Toronto startups raised upwards of $1 billion, with a new quarterly record of $1.7 billion set in Q3. This level of scale and consistency was unheard of in Toronto before this year, signalling that the city’s venture capital market has never been hotter.

Jamie Rosenblatt, partner at Toronto-based Golden Ventures, believes the exponential growth of the Toronto ecosystem is mirroring a macro trend in venture capital globally.

“A rising tide lifts all boats,” said Rosenblatt. “The global market for venture capital has exploded over the last year, and our ecosystem is no exception. Investment rounds, particularly post-seed, have become enormous, with round sizes and valuations effectively doubling in the last 18 months.”

According to data from Crunchbase, global venture funding in 2021 totalled $642 billion USD, a 92 percent increase from 2020. When measured against the 400 percent funding surge in Toronto over the same period, the Canadian city outpaced the growth of venture globally by a significant margin.

Toronto funding rounds grow in frequency and size

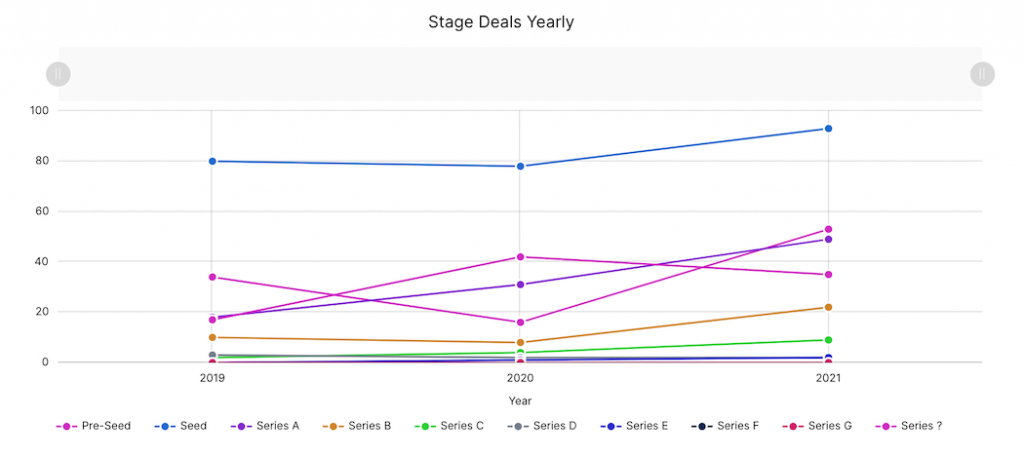

With 276 deals closed in Toronto last year, the region managed to also set a new yearly record for funding activity. Though deal volume ebbed and flowed across all stages from quarter to quarter, Toronto saw an increase in all investment stages from pre-seed to Series E from a yearly perspective. briefed.in’s report said this demonstrates a healthy balance of investors and startups at all stages.

Pre-seed and seed-stage deals both increased by a minimum of 20 percent this year, while Series A deals increased from 31 in 2020 to 49 in 2021. For Series B and higher deals, activity more than doubled to 35 investments from 15 in 2020. Ameet Shah, partner at Golden Ventures, believes three factors are contributing to the surge in deal flow.

“First, we have more company builders than ever before,” Shah said. “Second, there is more capital than ever before. Third, global investors are becoming comfortable with the idea of supporting companies that build primarily for the Canadian market.”

As a whole, Canada has grown increasingly attractive to foreign investors in the last year. Foreign interest in Canadian tech is nothing new, but due to the country’s sustained track record of successful companies and a more concerted effort to corral global investors on the part of Canadian founders, foreign investment is skyrocketing, and there are few places in Canada where this is more prevalent than Toronto.

Softbank, which runs the world’s largest tech-focused investment fund, participated in Clearco’s $268 million funding round and Deep Genomics’ $226 million Series C round of funding, both in Q3 2021. TCV, another world-renowned venture firm, led Trulioo’s $476 million Series D round, one of the largest venture rounds closed in Canada last year.

Another factor that drove Toronto’s explosive year was that investors placed bigger bets on local startups. Not only did the number of mid-and late-stage rounds increase in 2021, but so did the sizes of these rounds.

Per briefed.in data, the average Series A deal size doubled from $10 million in 2020 to $21 million in 2021. For later-stage rounds, the growth was even greater. The average Series B or higher deal almost quadrupled from $26 million in 2020 to over $97 million in 2021.

Toronto startups raising larger mid- and late-stage investments could indicate a strong conviction from local and foreign investors who are looking to take part in the ecosystem’s growth. Shah believes pricier rounds are the result of a “huge lift” by stakeholders to get the city’s tech sector to where it is today, in addition to Toronto’s high concentration of talent.

“Combine that with the increasingly global lens of venture capitalists, and it’s no surprise to find Toronto in the hearts and minds of investors from across the globe,” Shah added.

Will ten-figure quarters continue in 2022?

Though 2021 was a landmark year for Toronto’s tech ecosystem as a whole, not every quarter saw total investment grow. Q4 was the only quarter in 2021 in which investment declined from the previous quarter. Total funding in Q4 fell 29 percent from Q3 2021, yet increased 513 percent year-over-year. Notable rounds from Q4 2021 included GaN Systems’ $189 million round of financing, Wrapbook’s $100 million Series B funding round, and Clutch’s $100 million Series B funding round.

Though Rosenblatt said the quarter-over-quarter decline is not surprising, it could be seen as a foreshadowing for the “unease” markets face in Q1 2022.

“Public markets have been getting their butts kicked,” Rosenblatt said. “This typically leads to some pullback in later stage valuations, though Seed and Series A tend to be largely unaffected.”

While public markets appear to be going through a rough patch, several Toronto companies have still managed to secure significant rounds in 2022. Undeniably, the most significant is 1Password’s $744 million Series C round of financing last week, putting Toronto’s Q1 investment more than halfway to $1 billion before the end of January.

With ten-figure quarters becoming increasingly common for the Toronto tech ecosystem, Shah’s hope is that local founders will continue to secure that capital they need “to build something massive.” Rosenblatt said companies should expect upward wage pressure as more well-capitalized companies compete to attract and retain the best talent.

“Compensation, benefits, and employer brand need to be top of mind for companies looking for great talent to help put those dollars to work,” he added.

BetaKit is a briefed.in Tech Report media partner.