The Canadian tech sector has seen a stampede of unicorns in recent years, with an ecosystem that struggled to create $1 billion companies a few years ago now having more than 20 companies surpass that valuation today.

While a billion-dollar valuation is just another step in a company journey, the increasing number of unicorns points to a maturing tech ecosystem. That maturity has been bolstered by an influx of foreign capital, increasing interest from corporate venture, and a growing angel ecosystem where successful entrepreneurs are putting more capital in the hands of new founders.

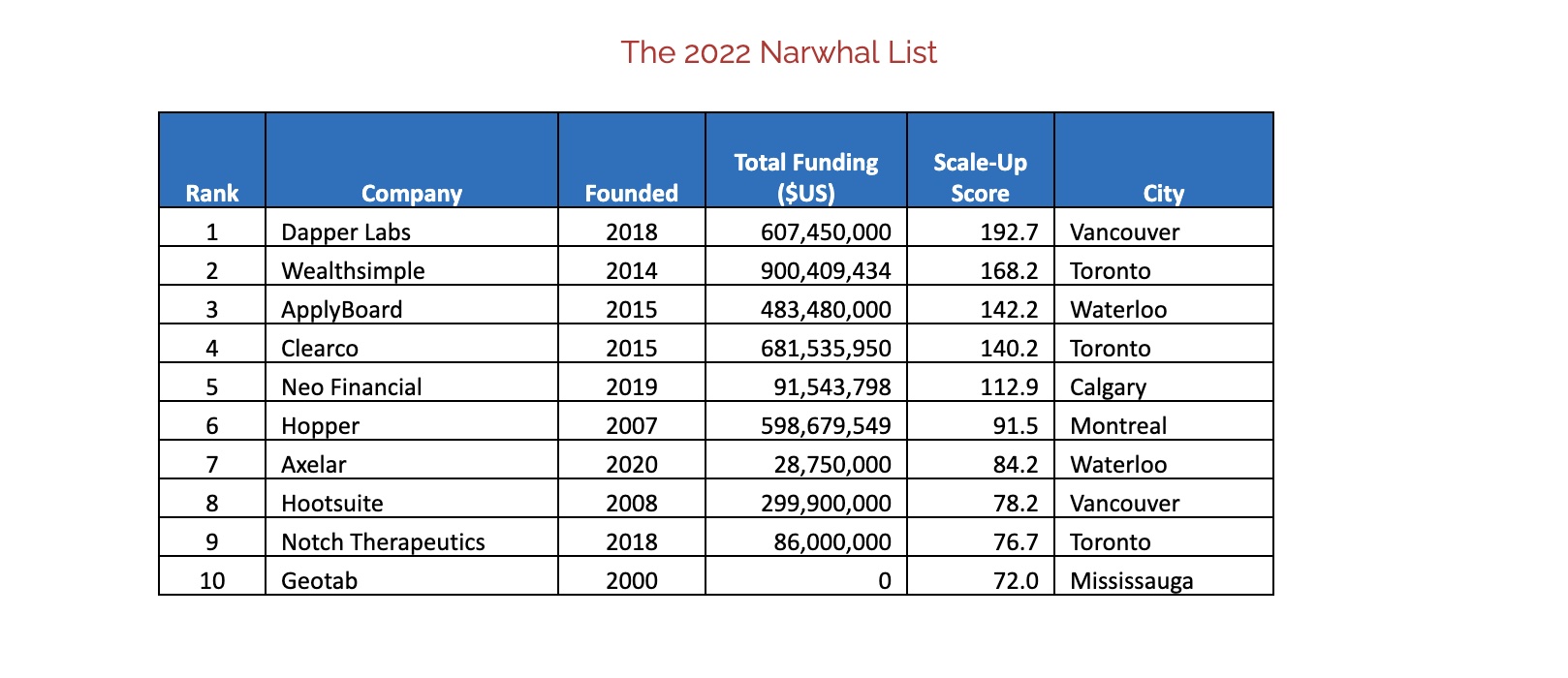

The 2022 Narwhal List is a reflection of that maturation, pointing to approximately one dozen private companies that reached or surpassed a $1 billion valuation last year – and that number doesn’t include the companies that have already done so in 2022.

Mirroring that ecosystem growth, the Narwhal List creators have also adapted their ranking to track more than just the companies with the potential to reach unicorn status. The new list focuses on Canada’s fastest scaling tech companies, unicorns and non-unicorns alike.

RELATED: Clio and Trulioo say not now to IPOs as CEOs discuss unicorn M&A strategies

Speaking with BetaKit, Charles Plant, the founder of the Narwhal Project, noted that he started collecting data on companies to find an objective way to track how Canada was doing, and figure out which companies were successfully scaling and which were not.

The Narwhal List dates back to 2014, when experienced tech investor Brent Holliday, founder of Garibaldi Capital Advisors, began referring to Canadian tech companies that had reached a valuation of $1 billion as narwhals, a play on the typical unicorn reference. Holliday published data showing “the most valuable Canadian tech firms” and those identified as on their way to a $1 billion valuation. Plant, then a senior fellow at the University of Toronto’s Impact Centre, took over the list in 2017 and has since turned it into the Narwhal Project, which includes an accelerator and list that tracks Canadian accelerator progress in addition to scaling companies.

In the intervening years, the project tracked the Canadian companies with the potential to grow into unicorns in the near future, but it wasn’t until 2019 and 2020 that things started to change. PointClickCare became a unicorn company in 2019, followed by Coveo, and then ApplyBoard in 2020.

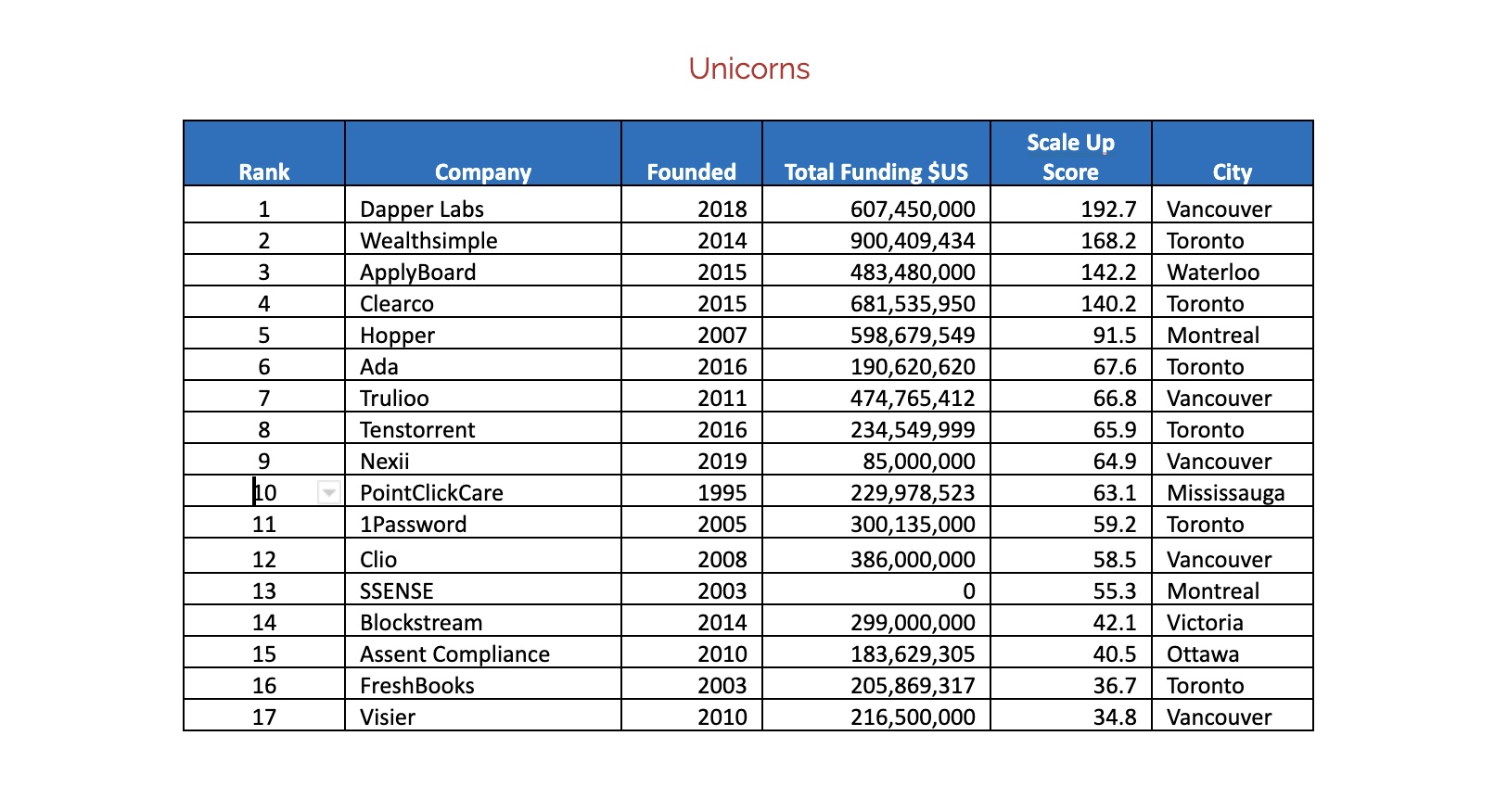

Companies that hit a $1 billion valuation or more last year include Dapper Labs, Clearco, Ada, Clio, Freshbooks, and Visier.

Because Canada is seeing more tech companies surpass a $1 billion valuation, Plant has now turned his attention back to tracking the fastest scaling companies overall.

“My focus is on companies that are succeeding and scaling,” said Plant. “So whether they’re unicorns or not really shouldn’t matter.”

The Narwhal List ranks companies based on their employee growth and the size of the team, as well as financial velocity, which is measured using public data from Crunchbase and equals the total amount of cash raised divided by the number of years in existence.

As the list relies solely on public data, it does not track Canadian tech companies that may have reached a $1 billion valuation but have not disclosed that fact. It is also important to note that a unicorn company specifically refers to a private company that has surpassed a $1 billion valuation, so the metric does not include publicly traded companies like Shopify and Nuvei, both of which have far surpassed $1 billion valuations.

RELATED: Narwhal Project creator looks to apply unicorn research with new accelerator

The team behind the Narwhal Project determines successfully scaling companies by reviewing data from companies that have raised capital, reached unicorn status, or gone public. Based on its methodology and data, the group has concluded that a firm with a “scale-up score” of above 25 is one that is on the path to becoming a unicorn or going public if it maintains or improves its score.

The 2022 Narwhal List is based on year-end 2021 data and does not track the companies that have since become unicorns like League, Axelar, eSentire, and Paper.

The 10 fastest scaling Canadian tech companies, according to the list, are a mix of unicorns and non-unicorns. The list includes Dapper Labs, which secure more than $500 million last year alone; Wealthsimple, which reached a $5 billion valuation last year and now has $18.8 billion in assets under management (a 97.9 percent year-over-year increase); ApplyBoard, which recently made its first acquisition after securing $545 million last year; and Clearco, which has both expanded its platform and become a global presence.

Others on the list, like Hopper and Hootsuite, have also had notable years, with the former overcoming a tumultuous year to reach a $5 billion valuation and the latter eyeing the public markets.

Of the non-unicorn companies, the list notes Neo Financial, Hootsuite, Geotab, Apollo Insurance, and AlayaCare among the fastest scaling.

The list also includes blockchain startup Axelar, which has since claimed to have reached a unicorn valuation, and Benevity, which is reported to have reached unicorn status in 2020.

The Narwhal List also breaks down companies by sector, tracking healthtech and cleantech in addition to general computer tech companies.

Notch Therapeutics tops the healthtech list as the fastest scaling, followed by Field Trip Health and Deep Genomics. The list also includes Optina Diagnostics and Nicoya Lifesciences.

When it comes to cleantech, Amp Solar Group comes out on top, with Eddyfi, Enerkem, GHGSat, CarbonCure Technologies, General Fusion, and Carbon Engineering also making the list.

“You are now seeing that really good companies are getting money a lot sooner than they used to, and in greater amounts, which is fueling their growth,” said Plant. “And that’s what’s necessary to create world-class companies.”

RELATED: Why Trulioo’s Steve Munford thinks “we don’t need more unicorns”

Challenges – like ensuring there is not a reliance on government funding – remain, however the amount of investment activity from early to late stages has led to positive growth.

Since mid-2020, startups have been inundated with options when it comes to raising capital, as foreign investors take a greater interest in Canada and corporate investors start to buy in. This has led to significantly higher valuations for companies, with Osler, Hoskin & Harcourt LLP noting in a recent venture capital report that tech companies on average saw a 235 percent increase in valuation between 2019 and 2021.

While this may not last, as public market valuations drop and inflation soars, some venture capitalists BetaKit have spoken with remain optimistic about the sector’s outlook. And the Narwhal List points to many startups on track to scale.

Whatever the outcome, Plant is focused on how this list impacts companies that are looking to successfully scale, calling it a benchmark to help others. The Narwhal Project website also has a calculator that allows users to measure their own scale-up score and compare it to companies on the list.

“People have a sense that they’re doing well when I meet them, and I look at them and I say, ‘well, you’re not,” noted Plant. “And they go, ‘well, how do I know?’ – You don’t know – and a really key thing is to be able to know how well you’re doing and what you should be doing to do better.”

Photo by Juliana Araujo the artist on Unsplash