Venture funding in British Columbia (BC) reached $246 million over 50 deals in the first quarter of 2020, as Victoria emerged as a strong early-stage hub in the province, according to Hockeystick’s latest ecosystem report.

“The funding amounts have been very, very consistent, more consistent than other ecosystems.”

Hockeystick’s data is sourced through exclusive partnerships with organizations like the Canadian Venture Capital and Private Equity Association (CVCA) and the National Angel Capital Organization (NACO). Hockeystick also compiles data from startups using its platform, as well as public data sources.

For its Q1 2020 BC ecosystem report, Hockeystick surveyed venture fundings across the province, highlighting specific activity in Victoria and Vancouver, which contained the vast majority of deals and dollars.

The $246 million in funding across Q1 2020 represents a five percent decline from Q4 2019, but a six percent increase from Q1 2019. Deal quantity was down 22 percent from last quarter and 36 percent year-over-year, representing a five-quarter low across the province.

“The funding amounts have been very, very consistent, more consistent than other ecosystems like Toronto or Montreal,” said CEO of Hockeystick Raymond Luk. “Yes, the deal count is fluctuating, it is low. However, the quarterly funding has been in the $250 million mark with the exception of Q3 2019, [which had] a couple of huge deals. What stands out to us is that it’s been very consistent.”

Although deal volume appeared to increase quarter-over-quarter in all stages of rounds, Luk told BetaKit the decline in overall deal volume can be attributed to a number of companies finding new ways to classify their rounds, such as labelling traditional Series A rounds as seed extensions or pre-Series A rounds. Other companies simply did not disclose funding or the stage of financing.

“We feel that with very few exceptions, you should disclose your funding,” Luk said. “That’s an important signal to not only the investor community but your customer community.”

Luk added that the decline in deal volume in this quarter is not necessarily a cause for concern, as the region saw a healthy number of rounds in the seed and Series A stages during the quarter.

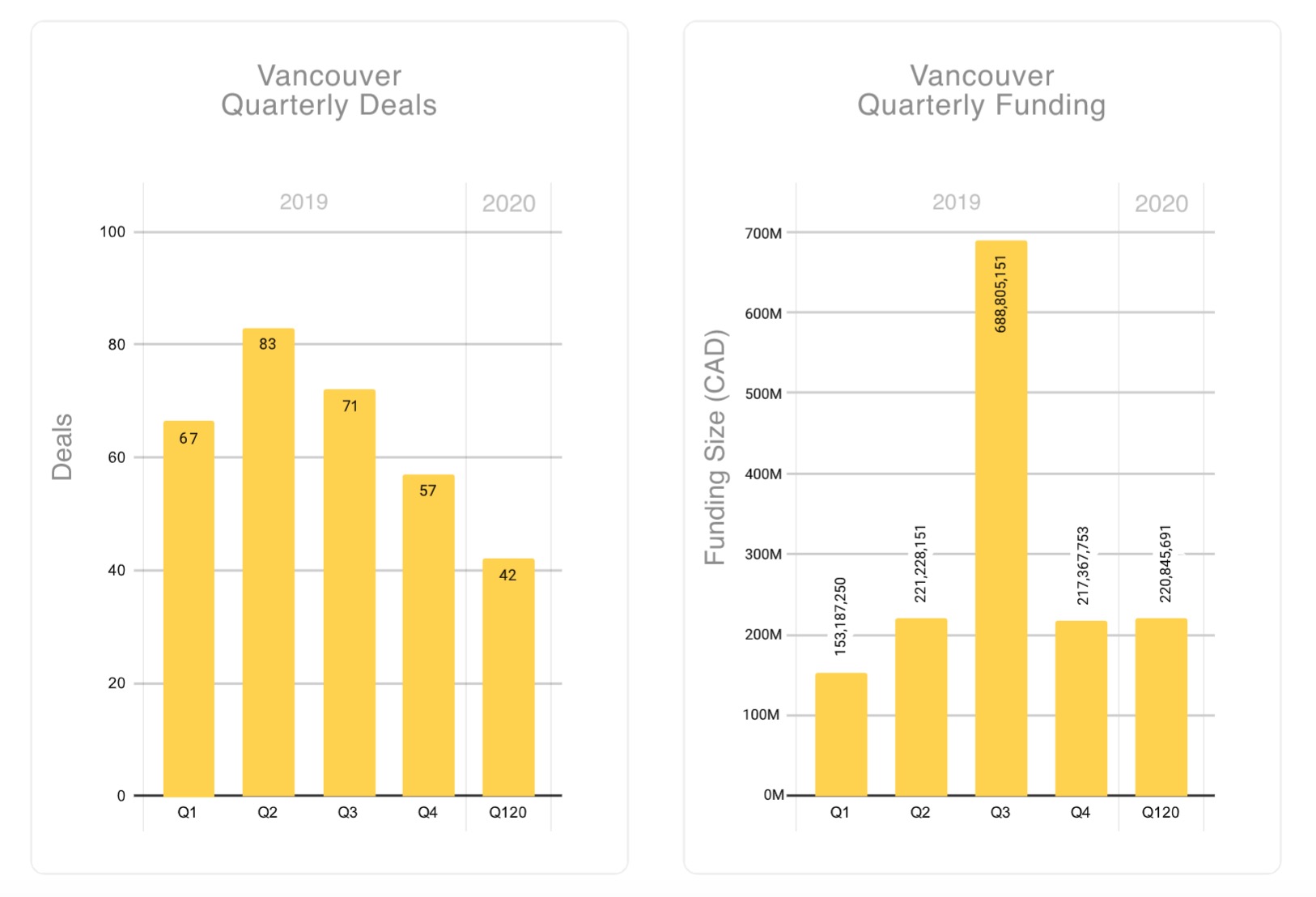

Vancouver consistently a quarter-billion-dollar ecosystem

Ventures in the Greater Vancouver Area raised a total of $220 million over 42 deals in Q1, representing a slight increase from last quarter’s $217 million. Deal volume represented a five-quarter low for the city.

“One thing that stands out to me is that without any doubt, Vancouver is a consistent quarter-billion-dollar quarter ecosystem, because it’s much more consistent than any other city,” Luk said. “I think that you can take to the bank.”

RELATED: Toronto tech venture deal count plummets in “unfortunate” first quarter of 2020

Shivam Kishore, manager of technology and partnerships at the Vancouver Economic Commission (VEC), told BetaKit the decline in deal funding could signify several investment trends, including the emergence of larger mega-funds, a focus on quality over quantity, investors pooling funds in venture rounds, and a more data-driven approach to investment, all of which could lead to fewer investments.

“The venture capital investment performance in Q1 2020 really demonstrates the health of the ecosystem in a pre-COVID-19 environment, which has been in a high-growth mode over the last 10 years, with an average annual growth rate of 38 percent,” Kishore told BetaKit.

Victoria sees five-quarter high in funding, deal volume

In Victoria, venture funding reached $24 million in Q1 2020 in seven deals, representing an increase in both deal count and overall funding quarter-over-quarter and year-over-year. All deals raised in Victoria during the quarter were seed and Series A rounds.

Dan Gunn, CEO of the Victoria Innovation, Advanced Technology and Entrepreneurship Council (VIATEC), told BetaKit Q1 2020 signifies the region’s sector is maturing.

“We do have a lot of companies that don’t take on venture capital by design, and they’re very much about growing to a larger valuation before they take that on,” Gunn told BetaKit. “But for some of those companies coming to a level of maturity and having a great growth opportunity in front of them, it’s the right time.”

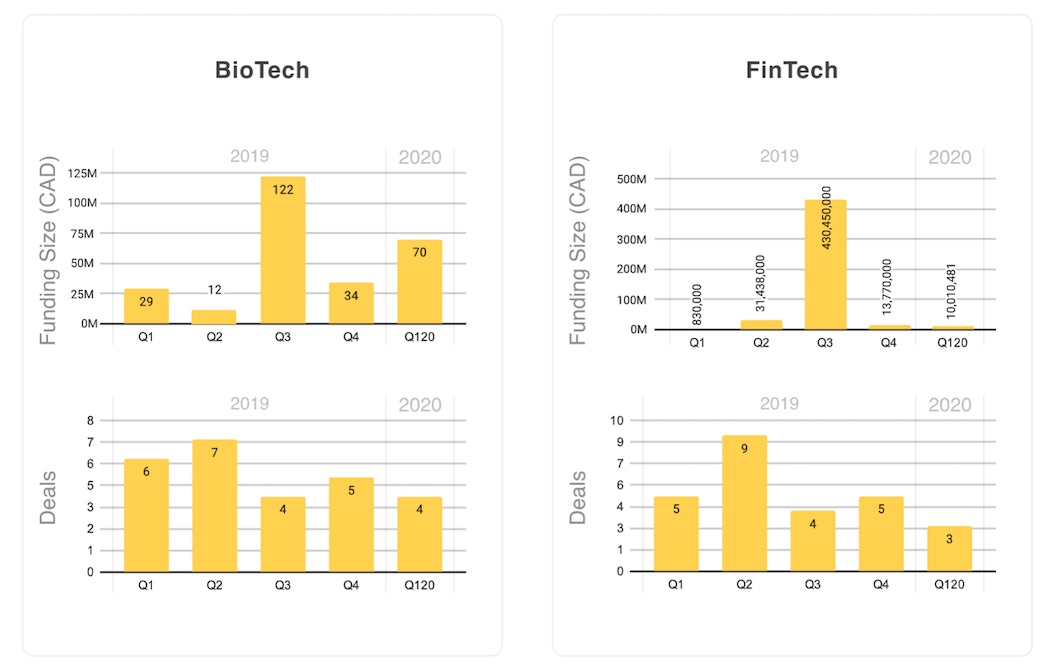

Biotech investments lead with $70 million in total funding

Across BC, biotech was the top vertical in Q1 2020 in terms of funding. Biotech companies in the province raised a total of $70 million in the quarter, including Zucara Therapeutics’ $28 million Series A round, and Aspect Biosystems’ $26 million Series A round. Luk noted that biotech is the most consistent vertical in terms of attracting capital, adding that cleantech and FinTech also tend to be consistently high-performing verticals in the region.

Cleantech was also one of the top verticals for BC in Q1 2020, with its largest deal being Minesense Technologies, which raised a $32.5 million Series D round for its advanced sensor technologies for the mining industry.

RELATED: Vancouver’s Aquatic Informatics acquired by Danaher’s Water Quality Platform

FinTech funding reached $10 million in Q1 2020, a slight decline from last quarter’s $13 million, but an increase from Q1 2019’s $830,000. Although FinTech startups have comprised the largest share of deals in previous quarters, Luk noted the vertical doesn’t often raise large funding rounds, with one notable exception being Clio’s $337 million Series D round in Q3 2019.

Other verticals that saw large amounts of funding in Q1 2020 included human resources technology, agritech, and travel tech.

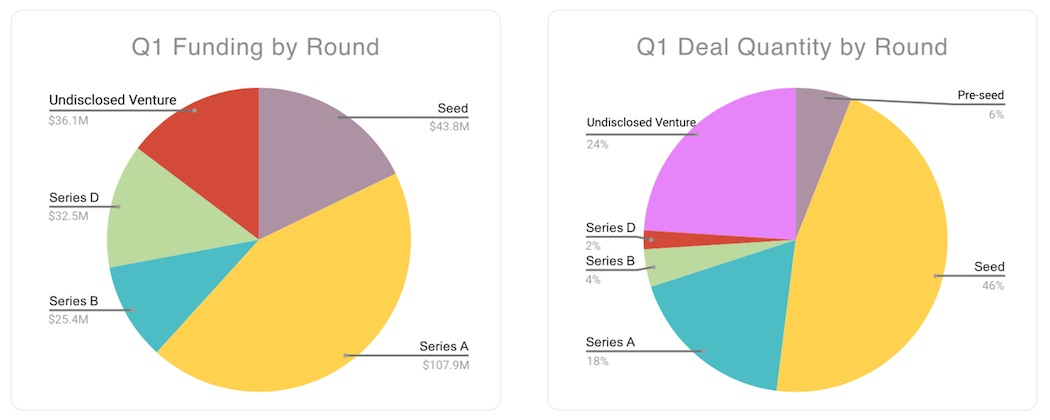

Early-stage funding remains healthy

While the majority of funding continued to go into later-stage deals in Q1 2020, seed deals in BC made up the largest share of deals that took place over the quarter at 46 percent, or 26 deals. Seed deals accounted for $44 million in funding, a notable increase from Q4 2019’s $27 million. Series A deals also increased in BC, reaching a five-quarter high with nine Series A deals total, higher than any other regional ecosystem in the country.

“As long as the Series A number continues to be strong, then that means that companies in the region are getting that initial start.”

– Raymond Luk, Hockeystick

“It does indicate a vibrant earlier-stage community there,” Luk said. “We’re keeping an eye on that number, because as long as the Series A number continues to be strong, that means companies in the region are getting that initial start [and] they’re going to keep growing.”

Speaking on the state of Vancouver’s tech community, VEC’s Kishore highlighted VANTEC and the Vancouver Angel Forum as part of the city’s strong and active angel investment community, both of which were listed as top investors by Hockeystick in Q1 2020.

Last year, Startup Genome indicated Vancouver lacked a strong ecosystem of early-stage funding. Members of Vancouver’s tech community agreed, but Kishore said Q1 results could indicate that is changing.

RELATED: Gerri Sinclair named BC’s new innovation commissioner

“We, as a tech community, continue to work to improve access to both early and late-stage funding,” Kishore said. “Startup and investor education programs that proactively engage investor networks are highly effective in facilitating this conversation. Highline BETA, Female Funders, and NACO Canada are a few organizations doing great work in this area.”

BDC Capital was listed as a top investor in BC for Q1 2020, and was very dominant in later-stage deals. Other top investors during the quarter were Panache Ventures, Pallasite Ventures, and 7 Gate Ventures.

COVID-19 expected to slow investment in Q2

Despite the onset of the COVID-19 pandemic and ensuing lockdown mid-way through the quarter, Hockeystick found no discernible effect on deal volume on BC’s Q1 2020 deals. Luk said it is too soon to tell the full impact of the pandemic on BC venture funding. VEC’s Kishore said that although Vancouver’s ecosystem was in high-growth mode, he expects to see a drop in venture funding in the second quarter, and potentially the third and fourth.

“The COVID crisis has slowed the overall venture investment in the Canadian innovation sector, and we are seeing investors increasingly reserve their funding for existing portfolio companies,” Kishore noted.

“That said, companies with potential and proven ability to contribute to the pandemic response will continue to score some of the biggest financings,” he added. “AbCellera’s $144 million finance closing is a good example.”

Hockeystick’s full BC Technology Report can be found here.

BetaKit is a Hockeystick Tech Report media partner.