Venture deal volume in the Waterloo Region reached a three-year low in the second quarter of 2023, but unreported deals could be shaping an unfair perception of the local tech sector.

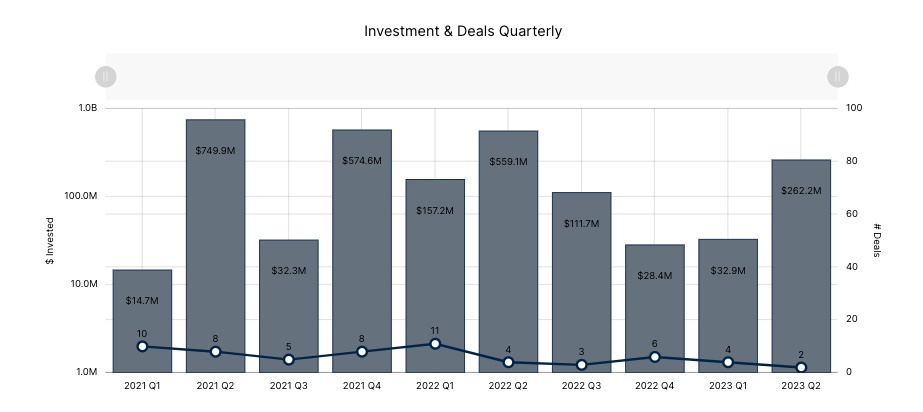

According to a new report from briefed.in, startups in the Waterloo Region raised $262.2 million in the second quarter of 2023. This represents a 698 percent increase from the first quarter of this year, and represents a three-quarter high for investment. However, investment declined by 53 percent compared to the second quarter of 2022.

Dwindling deal volume has been an ongoing narrative for the Waterloo Region in recent years.

While the Waterloo Region’s venture funding results might appear strong relative to its small size, briefed.in tracked only two deals in the second quarter, which represents a 50 percent decline both quarter-over-quarter and year-over-year. Q2 2023 represented the Waterloo Region’s slowest quarter for deal volume since at least Q1 2019, when briefed.in began tracking local investment.

Dwindling deal volume has been an ongoing narrative for the Waterloo Region in recent years. While investment has ebbed and flowed on a yearly basis, deal volume has trended downwards every year since 2019. The drop has been gradual, starting at a high of 57 deals tracked in 2019, to 44 deals in 2020, 31 in 2021, and 24 in 2022. As of the end of Q2 2023, briefed.in has tracked just six deals in the region this year, only 25 percent as many deals as were closed in 2022.

However, Evan Clark, executive director of the Waterloo-based Golden Triangle Angel Network (GTAN) believes the region’s second quarter was not likely as dire as briefed.in’s data suggests.

“There are a number of deals that have closed, which have not made this listing,” Clark told BetaKit. “GTAN invested in four Waterloo-based companies in the past quarter, which are not on this list. If these were counted, the region would be considered to have had a “robust” quarter, he said.

briefed.in collects its data from founders who submit their deal information directly, or from online, public sources, and not all companies or investors publicly disclose deals. But even if activity in the Waterloo Region was robust in Q2 2023, it is worth probing why so few deals in the region are public knowledge.

One reason could be related to how the changing macroeconomic landscape has impacted tech deals in the last year. Since the end of 2021, interest-rate hikes have restricted access to easy capital, and rising inflation significantly lowered the valuations of unprofitable companies. For the last year, tech companies have gone from growth mode to survival mode—cutting costs, freezing hiring, trimming staff, and closing the door to IPOs.

These conditions have created a much frostier fundraising environment for companies. Canadian investors have observed in recent quarters that many of the companies managing to raise capital are doing so by accepting unfavourable deal terms, such as restrictive board control covenants or conditions, significant dilution of existing shareholders’ equity, or onerous contingencies tied to future funding. These terms could also be discouraging companies from drawing public attention to fresh funding rounds.

Canadian investors have also pointed to an increase in internal bridges and down rounds— meaning rounds raised at a lower valuation than a company’s previous round—in the last year. These deals usually fly under the radar, since disclosing a down round could signal to the market that the company’s growth prospects are not as promising as previously thought.

The Waterloo Region is significantly smaller than most other ecosystems tracked by briefed.in, which means that even a few undisclosed deals could disproportionately affect the overall perception of the ecosystem.

Still, Clark acknowledged that capital in the region has become more patient and that investors have become more selective in deploying it in the second quarter. “Our investors are still investing ambitiously, though deals are taking a little longer to close. This is a good thing,” he added.

briefed.in’s tracked zero pre-seed or seed-stage deals in Q2 2023, and the two deals tracked were not classified under a specific stage. Accounting for 99 percent of all funding in the quarter was Miovision Technologies’ $260-million raise in April. The company’s last round, raised in 2020, was classified as a Series C round of funding.

The only other deal tracked by briefed.in in Q2 2023 was Fairly AI’s $2.2-million raise, which was also not classified by stage. At the time of the announcement, Fairly’s COO and co-founder Fion Lee-Madan told BetaKit she believed the company was seeing product-market fit and was ready to scale its sale and marketing efforts, which aligns with the characteristics of a Series A funding round.

The lack of early-stage deals in Q2 2023 could offer another reason briefed.in tracked so few deals in the Waterloo Region: newer companies often do not announce pre-seed or seed-stage funding rounds, since they may not yet have a market-ready product and may be waiting to meet specific milestones before going public.

“Early-stage tech companies come in all types,” Clark added. “Many of the companies we invest in are focused on technology development over market execution.”

While Clark believes the more cautious pace of capital deployment is a positive for the ecosystem, it’s not clear whether venture funding activity in the Waterloo Region will return to levels seen in 2019 or 2020. Several local stakeholders have acknowledged this problem and have suggested how the region can rekindle activity.

Jesse Rodgers, co-founder of Eigenspace, for example, has suggested the region isn’t lacking capital. Instead, he said the Waterloo Region needs a “bigger group of picks” for investors, which means increasing local company creation and keeping Waterloo’s large pool of post-secondary graduates from building their companies elsewhere. For local investors, Clark said the current priority is to keep capital flowing within the region, while staying open to opportunities across a wide spectrum of verticals.

“While tech and market conditions are connected, in times of economic uncertainty, startups in deep tech, medtech, and other similar industries become more attractive to us,” Clark added. “The goal is to keep investments occurring while diversifying the startups we commit to. There is always a market worth pursuing.”

briefed.in is owned and operated by Communitech. BetaKit receives data from briefed.in as part of a media partnership with Communitech and retains full editorial control of all articles that reference the data produced by briefed.in/Communitech.