Following a sluggish start to the year, two of Canada’s largest tech ecosystems saw a resurgence in venture funding in the second quarter of 2023, according to new data from briefed.in.

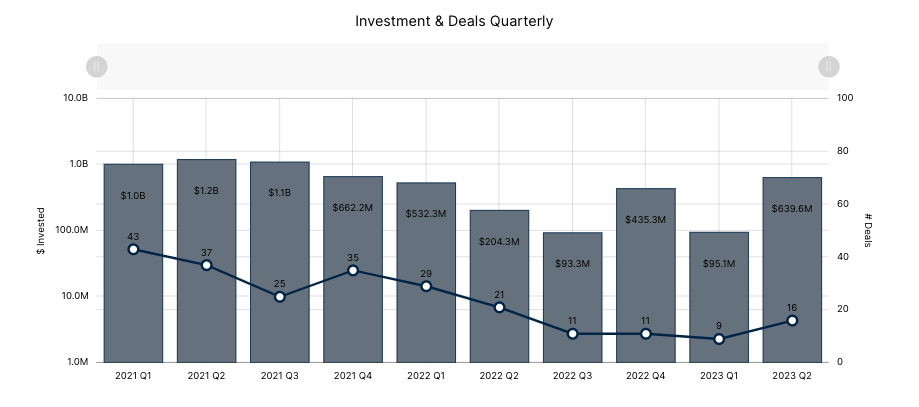

Toronto and British Columbia witnessed significant upswings in venture capital investment in Q2 2023. Mostly thanks to a handful of very large deals, tech startups in Toronto raised a cumulative $1 billion in Q2, up 733 percent from Q1 2023 and up 71 percent year-over-year. A similar story unfolded further west. BC’s tech startups raised $639.6 million in Q2, which represents a 573 percent increase quarter-over-quarter and a 213 percent increase year-over-year.

“Entrepreneurs across the country will continue to navigate an environment where capital takes longer to be deployed by investors.”

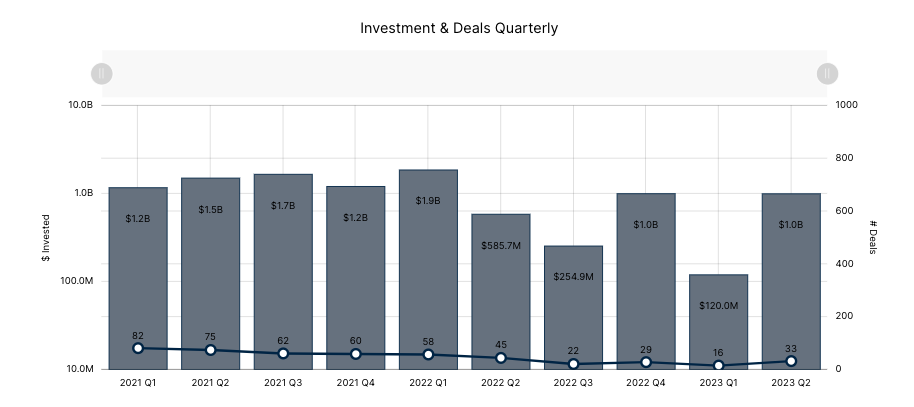

Toronto’s Q2 results follow a series of quarters marked by low levels of venture funding in comparison to the explosion in deal volume, mega-rounds, and high-profile exits seen in 2021. In fact, Q1 2023 represented a three-year low for the city in terms of dollars invested, with only $120 million tracked during the quarter.

Michelle Scarborough, managing partner of Thrive Venture Fund and Women in Technology Venture Fund at BDC Capital, the federal government’s development bank, said Toronto’s venture market saw a “subdued but healthy” Q2 with a modest rebound from Q1.

“Nevertheless, we’re starting to see a slowdown in VC activities at the earlier stages of development – a segment that was least affected in 2022, but that is now observing the delayed market reaction,” Scarborough added.

Marcus Daniels, founding partner and CEO of Highline Beta, still characterizes Toronto’s venture landscape as challenging.

“This turnaround from Q1 highlights the complex relationship between narratives in the ecosystem and the actual deal-making that occurs,” Daniels said. “Strong startups are still getting funded, but the bar is much higher.”

BC saw a similar trajectory, with briefed.in tracking several ten-figure quarters in 2021, before investment dropped significantly in 2022. The first quarter of this year marked one of BC’s lowest for investment in the last three years.

“Deal-making is happening. But the cadence has slowed down,” in Q2, said Brenda Irwin, founder and managing partner of Vancouver-based Relentless Venture Fund. “I believe we have yet to witness the painful attrition for companies that have not demonstrated objective value creation since their 2020 and 2021 rounds of funding.”

More eggs in fewer baskets

The recent increase in investment in Toronto and BC was less a product of ecosystem activity. According to briefed.in’s data, Toronto saw twice the number of deals in Q2 2023 compared to Q1 2023, but deals decreased year-over-year. Similarly, BC saw the highest deal count in the last few quarters, with 16 deals in Q2. However, the region saw a 24 percent decrease in deal volume year-over-year.

What could be propelling the investment recovery is the resurgence of megadeals, or deals valued at more than $100 million. In Toronto, briefed.in tracked two such deals: Cohere’s $360.3 million Series C funding round and Kepler Communications’ $124.3 million Series C funding round, which together accounted for nearly half of all funding raised by Toronto companies in Q2.

Since the end of 2021, megadeals in both Toronto and BC have crept down quarter-over-quarter in both regions and in Q1 2023, deals of this size were entirely absent from both ecosystems. Nine-figure rounds made an apparent comeback in the second quarter of 2023, which Daniels takes as a sign that startups with real market momentum are still getting funded. Still, he noted that expectations around these deals have changed and that diligence is now “more comprehensive, and deals are taking longer to close.”

“VCs are putting more money to work in a number of deals aligned to a more concentrated portfolio construction,” Daniels added.

In BC, briefed.in tracked several megadeals, including AbCellera’s $300 million raise, Abdera Therapeutics’ $142 million Series B funding round, and LayerZero’s $120 million Series B funding round. These three deals alone accounted for 87 percent of all funding raised in BC during Q2.

Irwin said BC’s recent megadeals indicate there is confidence in the local tech sector’s quality of innovation and depth of talent.

”Too much uncertainty and risk remain in the market to take big shots without confidence in the foundational assets and teams,” she added.

The company creation conundrum

Since the conclusion of 2021, investors in Toronto have noted a dramatic decline in early-stage deal volume. According to briefed.in’s data, Toronto saw a quarterly average of 22 seed-stage deals between Q1 2019 and Q2 2022. In the second quarter of 2023, Toronto saw only five seed-stage deals close, which is the average quarterly volume tracked in the city since the third of quarter 2022.

BC has experienced a similar reduction in early-stage deal volume since Q3 2022. While this number has fluctuated from quarter to quarter in the province, the average quarterly seed deal volume dropped from 11 deals between Q1 2021 and Q2 2022, to just three between Q3 2022 and Q2 2023. In the second quarter of 2023, briefed.in tracked four seed-stage deals in BC.

“Considering the number of early-stage funders in BC, and the diversity of tech verticals and mandates, that is not a strong showing,” Irwin said, adding that there are fewer active pre-seed investors and the revenue goalposts for seed investments have moved higher.

Other local VCs have weighed in on what factors may be contributing to the substantial decline in seed-stage activity in recent years, with many pointing to a lack of company creation across Canada. Daniels believes there is still a very limited number of company-creation platforms and institutional pre-seed VCs in Canada, including in Toronto, and for many investors, early-stage deals do not appear to be the priority.

“A lot of emerging fund managers are trying to raise funds, and LP investors are primarily focused on their existing relationships, who are in turn focused on building a concentrated portfolio around their core investment model, versus coming into pre-seed deals earlier,” Daniels said.

Attractive deals in an ugly market

The second quarter may have represented a turnaround for Toronto and BC’s venture ecosystems, but it’s not clear what the second half of 2023 will look like. While dry powder is still abundant and many VCs have managed to close capital for new funds in recent months, reports have predicted that the pace of capital deployment will continue to slow as the Canadian tech market resets to pre-pandemic levels.

“Entrepreneurs across the country will continue to navigate an environment where capital takes longer to be deployed by investors,” Scarborough commented. “That said, we’re optimistic to see that despite current market conditions, strong management teams with competitive, disruptive technologies are still getting funded.”

Daniels expects Q3 to be slow for Toronto “given the limited summer investment activity.” He argued that while activity should rise again in the fourth quarter, many startups will have weak cash positions at that point, and may struggle to win the support of investors.

“Signs point to deal-making and fundraising conditions to continue to be challenging, especially with exit opportunities limited and VCs predominately focused on their current portfolio,” Daniels added.

Irwin expects BC venture funding to trend up in Q3, particularly given the size of BC-based venture funds, but noted BC’s post-2021 “reset and recovery” is still underway.

“Firms that were caught in the hype of ridiculous valuations, ‘diligence light’ deal-making and a focus on volume will be licking their wounds,” she said.

“Fortunately, many venture funds in BC have management teams with deep experience,” Irwin added. “We are comfortable with the long-term lens of the asset class and know how to get attractively priced fair deals done, even in an ugly market.”

briefed.in is owned and operated by Communitech. BetaKit receives data from briefed.in as part of a media partnership with Communitech and retains full editorial control of all articles that reference the data produced by briefed.in/Communitech.