Toronto-based software startup Ukko Agro has secured $5.1 million CAD in seed financing and the support of Canadian agriculture investors to fuel the growth of its AgTech platform.

The company’s all-equity seed round was led by Emmertech, and supported by Ag Capital Canada, Telus Ventures, Whitecap Venture Partners, and PIC Investment Group.

“The development and practical use of predictive analytics to support decision-making in agriculture is a gap in the digital ag market.”

-Jay Bradshaw,

Ag Capital Canada

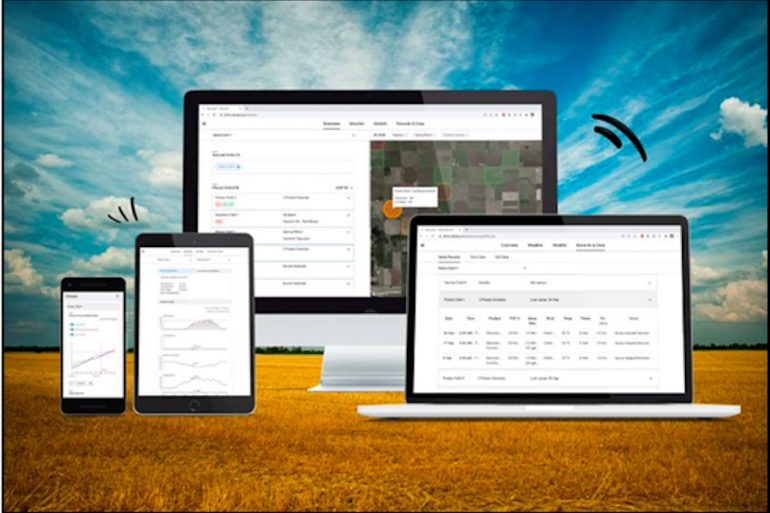

Through its plug-and-play, predictive analytics platform, Ukko aims to help farmers and other agriculture sector players determine when to apply water, nutrients, and pesticides to certain crops and geographies by leveraging IoT tech, machine learning, and data science.

Founded in 2017 by CEO Ketan Kaushish and CTO Avi Bhargava, Ukko Agro claims it has developed the capacity to rapidly build predictive models, in house, for disease, insect, crop growth, and irrigation forecasting. The startup aims to help agricultural companies make more informed crop management decisions.

This fresh capital brings Ukko Agro’s total equity financing to $6.5 million. The company has secured $7.9 million to date, including government grants.

Kaushish told BetaKit that Ukko Agro raised this funding to accomplish a few main goals: broaden its reach with new and existing customers; improve its data science capabilities; add more crops and geographies; and build more integrations with other agriculture platforms.

Kyle Scott, managing director of Conexus Venture Capital and Emmertech, said he sees Ukko Agro as a winner given Kaushish and Bhargava’s “perfect blend of Ag industry and machine learning experience.”

“Having just begun with its disease analysis and recommendation engine, Ukko is already seeing rapid growth as it moves into pest, irrigation and other recommendations,” Scott told BetaKit. “This will drive ROI for growers while driving sustainability on farms and in the supply chain. We believe Ukko will become the default recommendation engine of choice for value chain partners – from growers to retailers to the chemical and seed companies.”

RELATED: With $45 million close, new Conexus Emmertech fund aims to boost AgTech growth

Kaushish said that when it came to raising money for this round, Ukko Agro was “very strategic and targeted” agricultural expertise and connections. The startup has gained both through VCs like Emmertech, Ag Capital Canada, and Telus Ventures.

“It’s not just getting the money in,” said Kaushish. “They’re directly working with us in helping us expand the business as well.”

The CEO highlighted that Emmertech’s LPs in particular include big Prairies-based farms and retailers, adding that the Saskatchewan-based fund is already introducing Ukko Agro to its LPs, who he said “could be big customers for us.” Kaushish said that Jay Bradshaw, GP and managing principal at Ag Capital Canada has also played a “pivotal” role in making “key introductions” to potential clients.

Telus’ venture capital arm has also recently focused on expanding its reach into the agricultural sector, investing in a number of AgTech companies around the world. Kaushish said Ukko Agro sees opportunity in integrating with Telus’ portfolio companies.

RELATED: Semios secures $100 million to fuel acquisition strategy, become global AgTech leader

Ukko Agro first started testing its ForeSight platform for farmers in 2018. After spending over three years working with farmers to learn more about their operations and build and develop its tech solution, Bhargava told BetaKit that Ukko Agro has gotten to the point that it now understands “how to connect farmers with other players in the value chain.”

“There’s not a lot of companies out there that are solving that problem,” said Bhargava.

After spending years focusing on farmers, Ukko Agro is targeting its new version of ForeSight towards enterprise clients, including companies that sell pesticides, chemicals and fertilizers to farmers, and crop input manufacturers who make pesticides, fertilizers, seeds, and other agricultural products. The startup plans to roll out the new product in early 2022.

The Canadian AgTech space also features players like Vancouver-based Terramera and Semios, which like Ukko Agro, also focuses on crop management needs. The more than 10-year-old Semios offers an IoT network of sensors for farmers that monitor and predict insect, disease, water, and the frost risk faced by crops, and raised $100 million CAD in September to support its acquisition-focused growth strategy.

RELATED: Whitecap Venture Partners closes $140 million Fund V to invest across Canada

According to Bradshaw, “the development and practical use of predictive analytics to support decision-making in agriculture is a gap in the digital ag market.”

Kaushish described Ukko’s plug-and-play approach as a key differentiator from its competitors, adding that there are a lot of existing platforms that help farmers record data. “We’re trying to just add more intelligence to whatever they’re using,” said the CEO.

“Ketan and Avi bring the perfect blend of Ag industry and machine learning experience to make Ukko a winner.”

-Kyle Scott, Emmertech

The startup’s larger ambition is to provide predictions to growers as well as other players in the agriculture value chain.

Ukko Agro works directly with agri-businesses and enterprises, which pay a subscription fee to the startup to access its software and models, based on region, crops, and size. These businesses are the company’s primary users, and they provide Ukko Agro’s tech to farmers at a fee.

Today, Ukko Agro covers four different crops: canola, soybeans, wheat, and potatoes. With its seed funding, the company plans to build more models in these crops, and expand into new types of crops like corn and barley.

Most of the startup’s current business is in Canada and the United States. Going forward, Ukko Agro sees more room to grow in North America, as well as some potential in new geographies like South America and Europe.

Feature image courtesy of Ukko Agro