Vancouver-based startup CocoNFT, which provides an NFT minting platform for social media posts, has been acquired by Tokens.com’s metaverse subsidiary.

Metaverse Group, a Tokens.com subsidiary, announced on Tuesday that it acquired Coco to advance the latter’s offering and integrate it with Metaverse’s virtual world B2B products.

NFT sales have dropped to a 16-month low.

Founded in 2019 as a joint venture between GDA Capital Corporation and Wolfest Woods, Metaverse consists of several firms focused on different areas of the metaverse industry including real estate development, metaverse capital markets, and other related services.

Metaverse, which has its global headquarters in the virtual world “Crypto Valley” from “Decentraland,” also offers additional services such as assistance in marketing and advertising in the metaverse.

With Coco, Metaverse aims to be at the “forefront of developing and expanding Web3 and NFT use cases,” according to Tokens.com CEO Andrew Kiguel, who is also the executive chair at Metaverse.

NFT sales skyrocketed in early 2021, ushered in by the climbing popularity of play-to-earn games like Dapper Labs’ CryptoKitties, and digital collectibles such as NBA Top Shot. This led to many popular brands like Nike, Balenciaga, and even public figures such Snoop Dog buying into the crypto craze.

As the sector saw more scams, theft, and tax regulations, the value of NFTs and activity within the space have gone down significantly. Bloomberg reported in December 2022 that NFT Sales have dropped to a 16-month low.

The overall decline in the crypto market has hit Toronto-based Tokens.com, which trades on the NEO Exchange and Frankfurt Stock Exchange. Its stock price is down 95 percent over the last year, trading at 0.10 USD by press time. In contrast, Tokens.com’s share price was hovering around $2.75 USD in November 2021.

RELATED: Amid NFT boom, Liquid MarketPlace aims to turn physical sports and Pokémon cards into tokens

When asked about acquiring an NFT minting company amid a drop in NFT sales, Metaverse said that it “believes there are still significant interest in branded NFTs that provide utility.”

“Brands will be interested in providing NFTs to loyal customers with different utility attached,” said Lorne Sugarman, CEO of Metaverse, citing use cases like loyalty programs and other fan engagement tools.

As part of the deal, Coco’s co-founders Mark Allen and Brody Berson will join Metaverse as chief technology officer and chief product officer, respectively. Coco’s third co-founder, Reid Robinson, will be moving into an advisory capacity with Metaverse while working on another opportunity in the AI space. Robinson remains as a shareholder in CocoNFT.

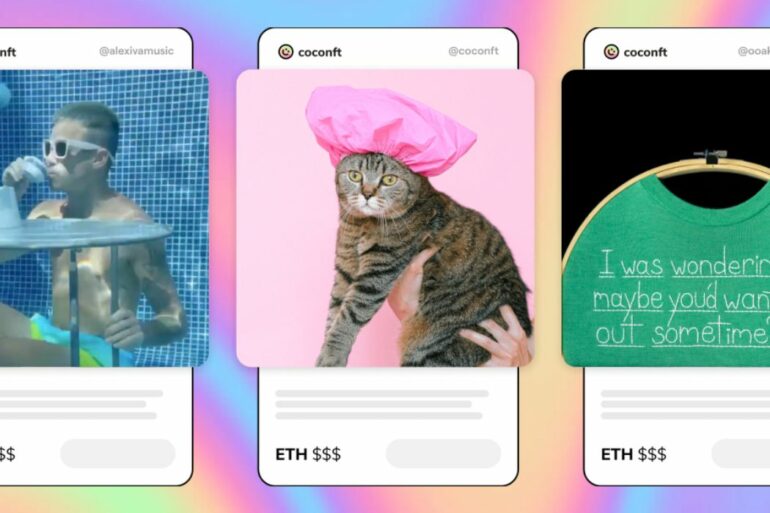

Established in 2021, Coco’s NFT generator allows users with no Web3 knowledge to convert Instagram posts into shoppable NFTs, with no up-front cost. Coco makes money through commission, collecting a five percent royalty for all initial and future sales. Coco’s partner, Rarible, also takes a 2.5 percent service fee if the NFT buyer checks out at Rarible.com. In addition to Rarible, Coco also has a partnership with OpenSea, the largest digital marketplace for NFTs and other crypto collectibles.

Berson made a statement on Twitter in February 2022 that mentioned Coco raised a round of pre-seed investments, but did not disclose the amount. BetaKit has reached out for details.

According to Metaverse, Coco will help in broadening the former’s reach within the creator economy. Metaverse said that it will use Coco’s platform to engage with creators and brands, and ultimately develop “one on one marketing strategies.” It will also enable Metaverse to “come to market” with its own proprietary NFT and virtual world products.