PwC Canada’s latest MoneyTree report for Q3 2018 shows a drop in VC funding and activity across several areas.

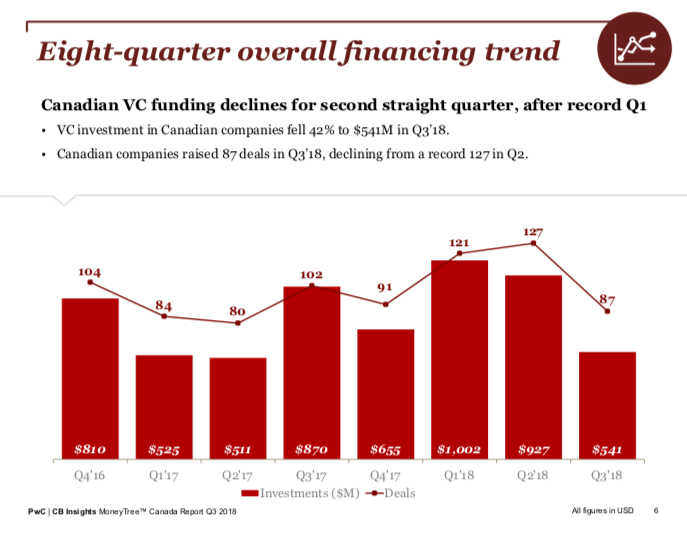

Completed in partnership with CB Insights, the report states that Q3 2018 saw funding drop for the second straight quarter after a strong start to the year. While 127 deals were raised in the previous quarter, deal activity fell to 87 in Q3. Total funding raised in Q3 2018 reached $704 million CAD ($541 million CAD), representing a 42 percent drop in funding compared to last quarter’s $1.2 billion CAD ($900 million USD).

The MoneyTree report doesn’t point to specific reasons for the decline, but PwC indicated the firm would be watching closely.

Looking back over eight quarters, Q3 2018 is the only quarter where VC activity in Canada didn’t increase year-over-year.

“The first half of 2018 was record-setting for Canadian venture capital investment,” Michael Dingle, national technology industry leader, said in the report. “This quarter’s notable drop off in deal activity is an interesting data point. While anecdotal evidence suggests there is no reason for concern, we will be keenly observing funding trends in the next few quarters as our tech sector strives to preserve funding momentum.”

Looking back over eight quarters, Q3 2018 is the only quarter where VC activity in Canada didn’t increase year-over-year.

By stage, early-stage VC deals actually increased 30 percent, up from 20 percent in the previous quarter. Expansion stage deals took up the next largest share of deals, making up 14 percent of deals in Q3. Seed stage deals declined to 25 percent of all deals, compared to last year’s 31 percent. Late stage deals made up two percent of deals in Q3, down from eight percent in the previous quarter.

In the past, a decline in early-stage deals has indicated a maturation of the Canadian startup market, as funding is more evenly distributed across stages. In Q3 2018, a rise in seed-stage deals spoke to a case of supply and demand from Dingle’s perspective.

“While there were fewer later stage deals this quarter, the first part of 2018 saw a substantial amount of later stage funding. So this doesn’t cause us concern at this point, as it may just be a timing issue,” said Dingle. “October has already seen two substantial funding announcements, indicating that Q4 is off to a great start.”

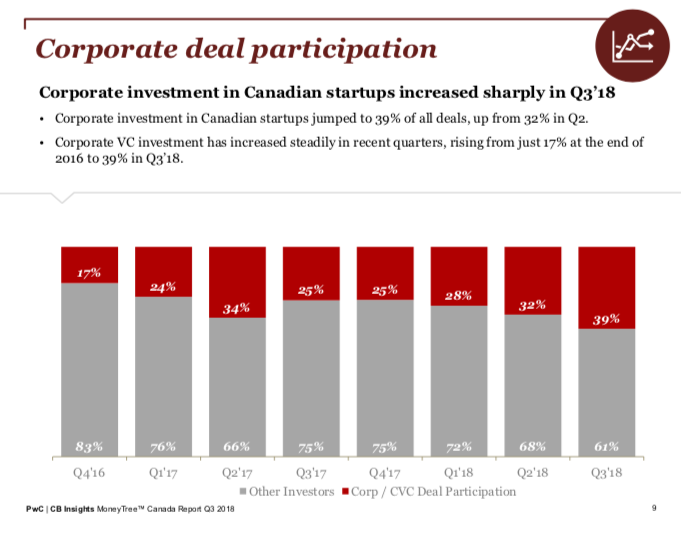

Notably, corporate participation, which has been steadily increasing for the past several quarters as a source of capital for startups, increased to 39 percent of all deals in Q3 2018.

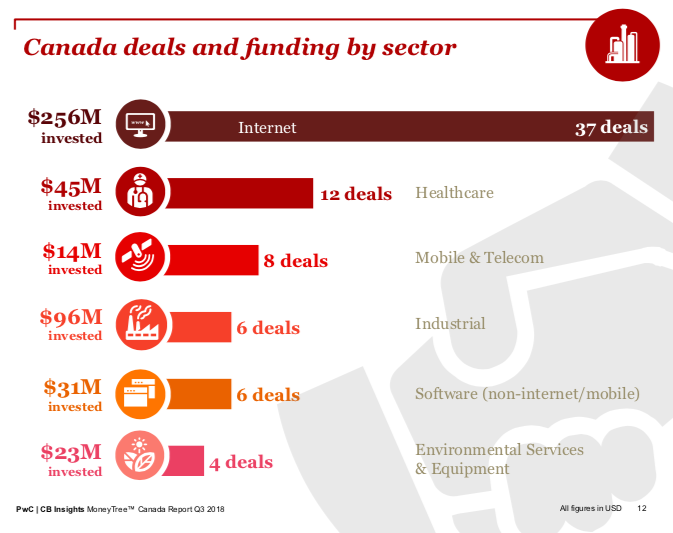

Despite the overall activity decline, bright spots could be found in specific sectors. PwC called out digital health and FinTech as the two industries that performed particularly well. This quarter, Canadian FinTech companies raised $150 million CAD ($115 million USD), a 31 percent increase from the last quarter. Digital health companies raised $108 million CAD ($83 million USD) in Q3.

“The digital health sector saw a 168 percent spike in funding — the third-straight quarterly increase in this industry and well above the funding range in recent years,” said Anand Sanwal, co-founder and CEO of CB Insights.

The report makes a point to distinguish between healthcare and digital health companies, with digital health companies providing software as a key part of their solution (genomics, pharmaceuticals, mobile health), and healthcare companies referring broadly to medical devices and equipment, pharmaceuticals, and biotechnology.

“Not only are we seeing an uptick in more healthcare deals but these companies are raising more post-seed rounds, meaning that they are maturing and demonstrating traction,” said Dingle. “This is promising to see as these Canadian companies prove their solutions can enable easier access to care, create efficiency in delivery, and ultimately impact healthcare outcomes.”

Healthcare companies saw a slight uptick in deal share from last quarter, making up 13 percent of all deals in Q3 2018. From an eight-quarter view, however, deal activity in healthcare has declined; its $59 million CAD ($45 million USD) raised is the lowest in seven quarters.

While AI has long been considered a bright spot for boosting activity over the past several reports, AI funding dropped significantly this quarter (35 percent) to $138 million CAD ($106 million USD). This drop comes after Q2 2018 experienced a surge with $222 million CAD ($169 million USD) invested across 13 AI deals.

However, a deeper dive into the data suggests that past quarters were driven by large deals, with Coveo’s $100 million USD round driving up numbers last quarter. Element AI’s $137.5 million mega-round in Q2 2017 also set the tone for AI funding throughout the year.

After normalizing for these deals, Q2 2018 drops down to $82 million ($63 million USD), and Q2 2017 drops down to $70 million ($54 million), showing a healthy growth curve up to $138 million ($106 million USD) this quarter. The largest deal in this quarter was also legal AI firm Kira System’s $65 million CAD round.

PwC indicated that Q3 2018 was still a period for commercialization in AI as more companies received funding. “This quarter, 50 percent of all early-stage deals were artificial intelligence (AI) companies,” said Christine Pouliot, deals partner at PwC Canada. “As we noted earlier in the year, Canadian AI companies have advanced due to their early funding and ability to attract talent to the ecosystem, supporting the commercialization of these transformational technologies into real-world use cases.”

Access the full report here.

BetaKit is a PwC MoneyTree Canada media partner.