PwC has released its latest MoneyTree report for Q2 2018, founding that the AI sector continued to thrive in Canadian venture capital.

AI experienced a 104 percent funding increase in Q2 2018 compared to the last quarter, with $222 million CAD ($169 million USD) invested across 13 deals. Total quarterly deals and investment reached an all-time high this quarter; the second highest quarter was Q2 2017, when $209 million ($159 million USD) was invested across 12 deals, boosted by Element AI’s historic Series A.

“Approximately half of the deal volume this quarter went to businesses that provide analytics tools to their customers,” said Dave Planques, national deals leader at PwC Canada. “These companies are supporting enterprises in making better data-driven decisions.”

“If you think of this industry as analytics on one end of the spectrum to artificial intelligence on the other, the Canadian tech sector is firing on all of those cylinders.”

Asked if there was a correlation between the increase in AI funding and the fact that half of deal volume this quarter went to companies providing analytics tools, Dingle answered in the affirmative. Internet-based companies took home the most deals and dollars this quarter with 40 deals and $402 million ($308 million USD) invested, and Dingle indicated that within this group, there were strong companies working on analytics. Particular examples include Quebec City-based Coveo, which recently raised $100 million, and Toronto-based Uberflip, which raised which raised $41 million.

“If we can call that the data economy and look at the last several years of the building of businesses focused on extracting user, economic, sometimes health outcomes from data, I think it’s an indication that the Canadian market is building expertise here,” Dingle said. “The expertise has comes in many forms, and what we’re seeing in this funding now is a series of businesses that have been building technology for several years that has been focused on extracting this value from data.”

Dingle continued, arguing that AI is the next generation of analytics, and because it’s still early days for AI commercialization, he doesn’t anticipate this investment trend slowing down. “If you think of this industry as analytics on one end of the spectrum to artificial intelligence on the other, the Canadian tech sector is firing on all of those cylinders and AI has shown up in this report for several quarters in a row,” he said.

Overall, financing to Canadian tech companies decreased seven percent from Q1 2018, with $1.2 billion CAD ($900 million USD) invested across 116 deals. However, this is still the second-highest total in eight quarters, only being beat by Q1 2018’s $1.3 billion ($971 million USD), and a 125 percent YoY jump from Q2 2017’s $504 million ($400 million USD).

Speaking with BetaKit, PwC national deals technology leader Michael Dingle agreed that there wasn’t too much to read into the quarterly drop in funding. “We’ve got to realize, the drop is $71 million USD in total funding, you have a slight raise in the total deal count—112 to 116 this past quarter—almost identical. So the drop is pretty small,” said Dingle. “I look at that small drop and say it’s cyclical, I don’t see that as a drop in productivity. I see that as the complexion of those 116 deals being balanced to the point where the funding just totals a little bit less than last quarter.”

“Approximately half of the deal volume this quarter went to businesses that provide analytics tools to their customers.”

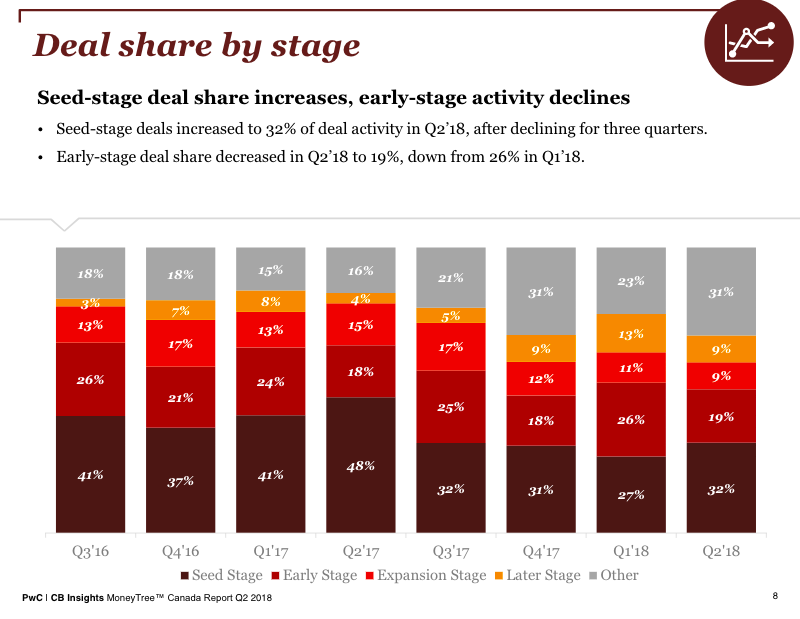

Seed stage deals increased by 32 percent in Q2 2018 after declining for three quarters in a row. Comparatively, in Q2 2017, seed-stage deals made up 48 percent of total deals in Canada. In this quarter, early, expansion, and later-stage deals all declined, with early-stage decreasing to 19 percent compared to Q2 2018’s 26 percent of deals. These percentages are nearly identical to Q4 2017.

In BetaKit’s Q4 2017 report story, Dingle noted the decrease as a sign that Canadian companies were maturing and moving beyond this stage. Dingle credited this seed-stage deal increase to a simple case of supply and demand, and an indication that the Canadian tech ecosystem is healthy.

Canadian investors were most active at the seed stage and later-stage, with a 62 percent and 61 presence in deals at these stages, respectively. Canadian investors made up 56 percent of early-stage deals, and 49 percent of expansion stage deals.

“Consistent growth in funding to artificial intelligence and Internet of Things companies shows strong support for the data economy,” said Shivalika Handa, director of deals at PwC Canada. “Canadian venture-backed companies continue to lead the way on both ends of the device-to-cloud journey.”

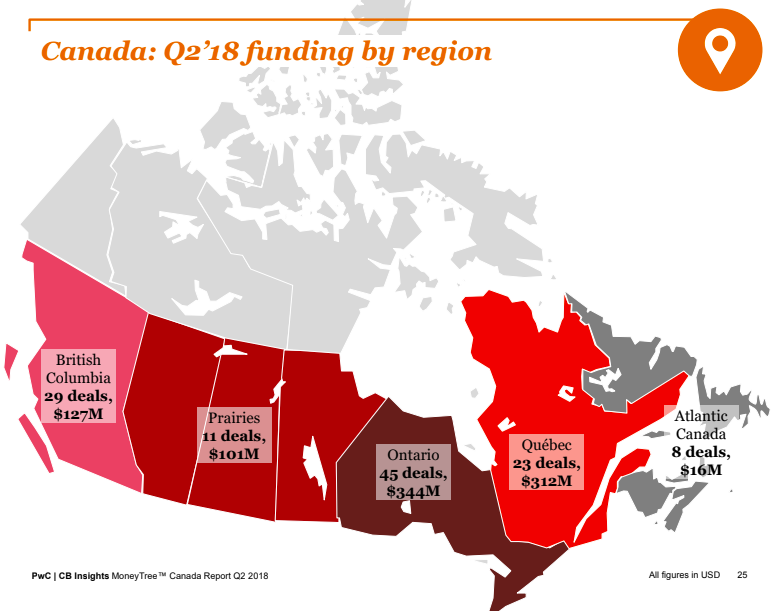

While Toronto, Montreal, and Ottawa saw a funding and deal activity decline, Toronto and Montreal were still among the top three cities in deals and dollars. Toronto received $381 million ($290 million USD) across 33 deals—a decline from $513 million ($390 million USD) across 42 deals—while Montreal saw funding decline by 74 percent at $135 million ($103 million USD) across 16 deals. Last quarter, Montreal raised $512 million ($389 million USD) across 17 deals, fueled by Enerkem’s $287 million ($224 million USD) round.

Vancouver followed Toronto in terms of deals and dollars, with $166 milion ($126 million USD) across 28 deals. The amount was an eight-quarter high, and the second quarter in a row that deals have increased.

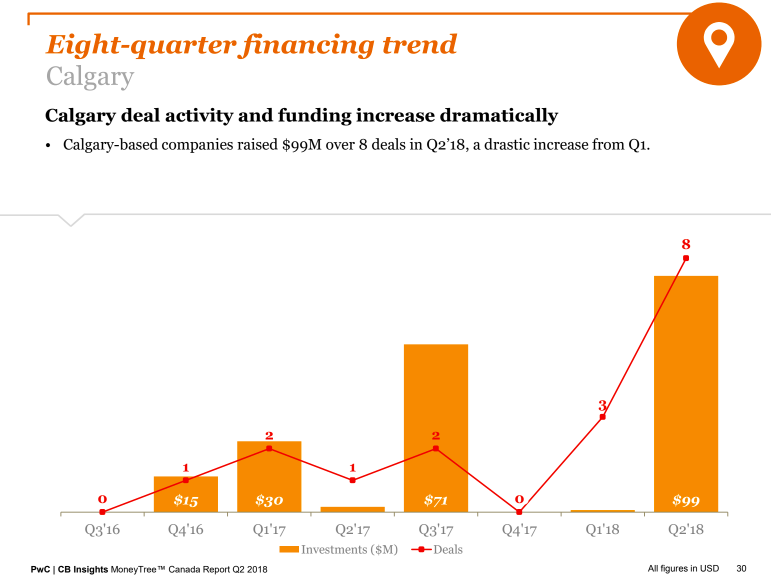

Calgary and Quebec City were also among in the top five markets reported in Q2 2018. Calgary saw $130 million ($99 million USD) across eight deals, while Quebec City saw $193 million ($147 million USD) across five deals. Both of these markets saw an eight-quarter high in both deals and dollars.

The uptick in dollars was driven by largely by the energy sector in Calgary, with wind energy company Greengate Power securing $100 million ($78 million USD), a “mega-deal” relative to Calgary, Dingle said. Last quarter, the city raised $900,000 over three deals.

“It’s high time these tertiary markets receive a bit of the limelight,” said Dingle. “Calgary obviously [is] often in the media and recognized in Canada as an oil and gas centre, but there’s a ton of tech activity happening in that market; there’s a ton happening in Edmonton mostly centred around AI. Quebec City is not a small city or a small centre with respect to tech, it just doesn’t typically hit the national radar.”

While Kitchener-Waterloo and Ottawa have historically taken these spots on the list, PwC noted that a lower volume of deals this quarter knocked them out of position.

Another trend that continued throughout the quarter was the rate of corporate participation in venture deals. Corporate venture capital and minority investment accounted for 29 percent of deals for the second quarter in a row. Dingle said that, historically, corporate participation has come and gone in cycles, so this points to a change in how corporates see investment.

“What I see here is corporations are seeing investing as a critical component to their innovation strategy,” he said.

BetaKit is a PwC MoneyTree Canada media partner.