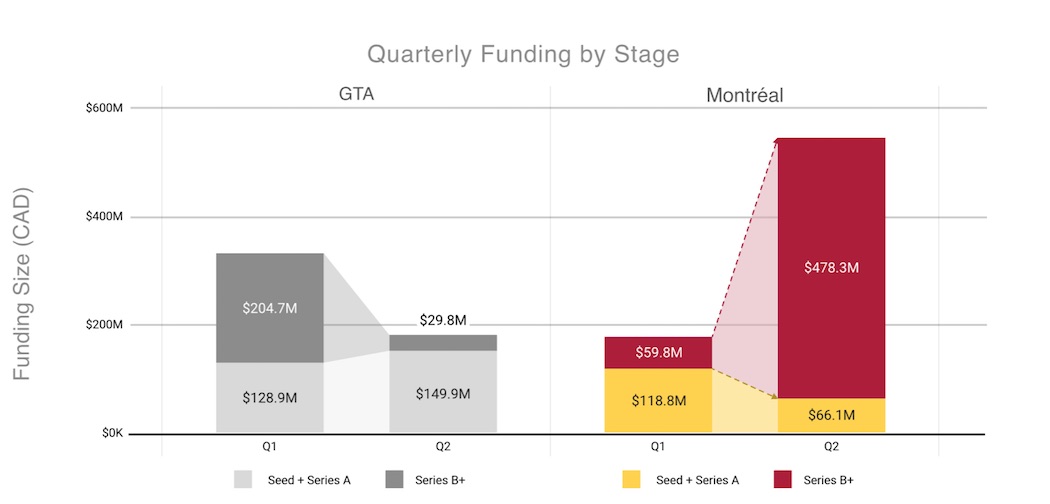

Following a strong start to 2020, Montréal tech companies raised a record $566 million in venture funding in the midst of the COVID-19 pandemic according to Hockeystick’s Q2 2020 ecosystem report.

Montréal’s record-setting quarter was fuelled by a surge in late-stage activity, punctuated by two mega-deals in travel tech. Sonder’s $230 million Series E round and Hopper’s $102 million Series E round accounted for almost 60 percent of all funding in Q2 2020, resulting in Montréal beating out Toronto in overall funding.

“The fact is that Montréal is not just an early-stage machine, they’re able to amass this funding at the late stage.”

“Montréal did actually pretty well for the first quarter of 2020, going into an uncertain, hazy future with respect to the possible impact of COVID-19,” said Raymond Luk, CEO of Hockeystick. “In Q4 2019, all Montréal companies only raised $140 million in the region. Q1 was $204 million, and that was actually a big increase, but I don’t think that we would have expected a $566 million quarter.”

Hockeystick’s data is sourced through exclusive partnerships with organizations like the Canadian Venture Capital and Private Equity Association (CVCA) and the National Angel Capital Organization (NACO). Hockeystick also compiles data from startups using its platform, as well as public data sources.

Although venture funding skyrocketed, Montréal deal count did not grow during the second quarter of 2020. Total venture funding represented a 277 percent increase from last quarter’s $204 million, and a total of 31 deals closed in Montréal over Q2 2020, a 16 percent decline quarter-over-quarter. However, deal volume in Q2 did not increase or decrease year-over-year. Fresh capital raised in Montréal has already exceeded the full year of 2019 in just six months, Hockeystick found.

Montréal’s venture activity also remained relatively steady throughout the two quarters of 2020, despite the COVID-19 pandemic and consequent economic lockdown. Deal volume in Montréal dipped slightly in May, Hockeystick found, but the 17 deals closed in the month of June represented the most of any month in 2020.

Travel tech gets a much-needed lifeline

One of the industries hardest-hit by the COVID-19 pandemic is tourism and travel. Yet Montréal travel tech startups received a total of $332 million in Q2 2020. Luk indicated although Q2 2020 had a net negative impact on travel tech, Sonder’s and Hopper’s deals served as a much-needed capital injection.

“One has to assume that it’s a vote of confidence into late-stage, travel unicorns that have both been severely negatively affected by COVID,” Luk added.

With nine deals, life sciences saw nine deals during Q2 2020, the highest number of all verticals. However, all life sciences deals were undisclosed, meaning it is impossible to estimate how the sector performed in terms of dollars deployed.

Advanced manufacturing saw the second-highest amount of funding activity with $54 million deployed in the vertical, after travel tech. Top deals included Vention’s $38 million Series B round, Eocycle’s $9.7 million funding round, and Sollum Technologies’ $3.9 million Series A round. Advanced manufacturing also saw the second-highest number of deals, after life sciences.

Late-stage deals dominate the quarter

Late-stage funding dominated over the second quarter of 2020, not only with two mega-deals, but a broader uptick in late-stage activity. In Q1 2020, only eight percent of disclosed deals were Series B and higher; in Q2 2020, Series B and higher disclosed deals accounted for approximately one-quarter of overall deal volume.

Those other late-stage deals included WorkJam’s $70.6 million Series C round, Vention’s Series B round, and GoSecure’s $27 million Series E round.

“Montréal as an ecosystem is showing that Montréal-based companies are able to hit that late-stage and are able to get funding able to grow, notwithstanding the survival capital,” Luk noted.

During Q2 2020, seed and Series A rounds comprised 54.9 percent of deal volume. Series A funding decreased from $118 million last quarter to $66 million this quarter, but Luk noted there was no trend indicating a broader decline, which indicated a healthy ebb and flow of early-stage activity.

“If there’s a lot of early-stage growth, that always raises a concern of that kind of phenomenon of: are you building bridges or piers, and where is that early-stage funding going to go?” Luk said.

“In a lot of regions in Canada, there’s this historical concern about companies reaching a certain stage and either having to move or having to get all their funding from outside Canada. So I think that there’s going to be peaks and valleys with early-stage,” he added.

Montréal flips script on Canadian venture funding

Montréal venture funding was double that of the Greater Toronto Area (GTA) in Q2, which is historically the ecosystem that dominates Canadian venture funding. Last year, venture funding in Montréal fell significantly behind the GTA in every quarter.

In Q2 2020, Toronto saw $213 million in total funding, the lowest funding amount in the last 18 months and the third consecutive drop over the last three quarters. Montréal venture funding has exceeded Toronto by 34 percent in 2020 so far.

“The fact is that Montréal is not just an early-stage machine, they’re able to amass this funding at the late stage, which I think is very healthy in comparison to Toronto,” Luk said. “Montréal has completely flipped the script this year.”

Not only did the Montréal region see two mega-deals, but the size of the largest deals vastly outperformed Toronto’s top deals. During Q2 2020, only one of the GTA’s top five deals (Ritual’s $29.8 million post-Series C round) was more than $20 million. During the same quarter, all of Montréal’s top five late-stage deals were over $20 million.

“It’s so unusual. It’s a smaller city and a smaller ecosystem in general, nobody would argue that,” Luk said. “But the fact that Montréal as an ecosystem has raised 34 percent more capital than Toronto is very unique.”

Those interested in receiving the full Montréal Technology Report can sign up for an English version here and a French version here.

BetaKit is a Hockeystick Tech Report media partner.