Québec City-based LeddarTech has received warnings from the Nasdaq stock exchange, including one indicating that its share price has fallen below the $1-USD minimum required to maintain its listing on the Nasdaq Global Market.

In a statement issued today, LeddarTech said the Nasdaq’s notices advised the company it failed to meet certain Nasdaq listing requirements, including maintaining a minimum bid price of $1 USD, a minimum market value of publicly held shares of $15 million USD, and a minimum market value of listed securities of $50 million USD.

LeddarTech said it has been given 180 days to comply with these requirements to remain listed on the Nasdaq Global Market.

LeddarTech’s common shares have fallen by over 80 percent in roughly seven months.

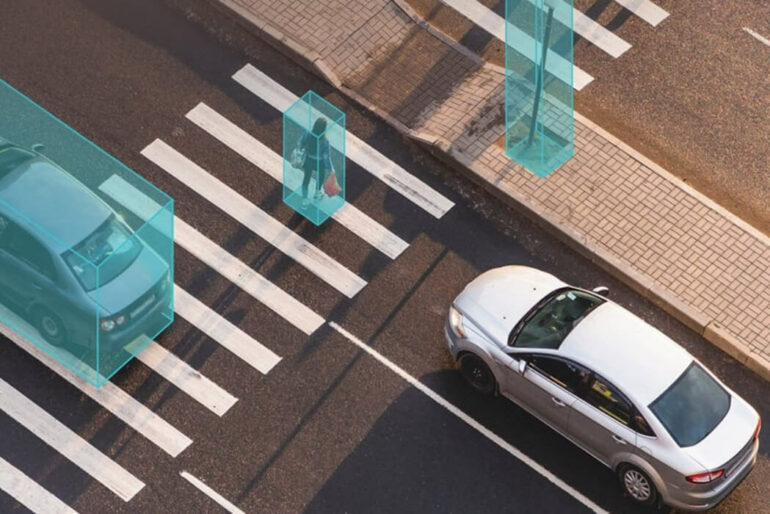

Founded in 2007, LeddarTech builds systems that help autonomous vehicles understand their surroundings. The company has developed artificial intelligence-powered sensor fusion and perception software solutions for the deployment of advanced driver assistance systems as well as autonomous driving and parking applications.

LeddarTech raised a fair amount of capital during its run as a private company, with its February 2022 Series D round totalling $140 million USD.

In December 2023, LeddarTech became a publicly traded company on the Nasdaq, following a merger with special purpose acquisition company Prospector Capital Corp. LeddarTech was one of the very few companies to go public at a time when the initial public offering market had ground to a near halt.

Following the business combination, LeddarTech’s common shares commenced trading at $4.19 USD on Dec. 22 of this year, but have since fallen to $0.65 USD as of press time, an 84-percent drop in roughly seven months.

LeddarTech said these new notices from the Nasdaq will have “no immediate effect” on the listing of its common shares on the Nasdaq Global market. The company noted it plans to actively monitor its closing bid price, as well as its minimum market value of publicly held shares and minimum market value of listed securities.

RELATED: Copperleaf Technologies to join wave of #CDNtech go-privates in $1-billion deal with IFS

LeddarTech is one of several Canadian tech companies that have struggled to maintain their minimum share value on the Nasdaq over the last few years. Companies like Mogo and mCloud received similar notices that their stock price plunged to below the $1-USD minimum.

A large swath of other companies have recently delisted from public exchanges and taken themselves private, including BBTV, Copperleaf Technologies, MDF Commerce, Nuvei, and Q4 Inc., among others.

LeddarTech also announced today that it has entered into its eleventh amending agreement regarding a credit facility the company has with Desjardins. This latest agreement lowers the minimum cash LeddarTech needs to keep on hand to $250,000 CAD until Aug. 14, 2024. After that, the amount will gradually increase until it reaches $5 million CAD by Nov. 15, 2024.

Desjardins has also agreed to delay interest payments for several months, giving LeddarTech more time to secure funding from investors.

“We are pleased to have the continued support of our partner and lender, Desjardins, as we continue to make solid progress on securing the funding we need to achieve our goals in both the short and long term,” Frantz Saintellemy, president and CEO of LeddarTech, said in a statement.

Saintellemy noted the firm plans to provide an update upon the release of LeddarTech’s third-quarter financial results on Aug. 14.

UPDATE (08/20/2024): On Aug. 19, LeddarTech announced it had secured agreements for up to $9 million USD in bridge financing from its shareholders FS Investors, Investissement Québec, and lender Desjardins.

This financing includes the option for FS and IQ to convert their loans into common shares at a premium of $5 USD per share. FS has also agreed to convert $1.5 million USD in existing convertible notes into shares at $2 USD per share, which reduces LeddarTech’s outstanding convertible note balance.

The company announced it had entered into its 13th amending agreement regarding its credit facility with Desjardins to harmonize that agreement with the terms set in the recent bridge loan agreements.

In the statement announcing these new agreements, LeddarTech said its board determined the firm is “in serious financial difficulty,” and that these bridge financing agreements are hoped to improve the company’s financial condition.

Feature image courtesy LeddarTech.