Canada has become fertile ground for venture capital investment in the last year, and a new report from briefed.in has identified trends that paint a more detailed picture of the country’s record-setting funding performance in 2021.

According to briefed.in’s annual tech report, Canadian startups raised a total of $14 billion across 698 deals through 2021. This represents a 218 percent increase in investment dollars and a 31 percent increase in deal volume from 2020. briefed.in’s CEO and founder, Rob Darling, described 2021 as an “amazing year” for the Canadian tech sector.

All five of the major ecosystems tracked by briefed.in (Calgary, Toronto, British Columbia, Montréal, and the Waterloo Region) managed to break their own yearly records for venture investment last year.

Canadian startups raised a total of $14 billion across 698 deals through 2021.

Jamie Rosenblatt, partner at Toronto-based Golden Ventures, has noted that the record-breaking results are part of a global explosion in venture capital. While global venture funding in 2021 increased 92 percent, Canadian funding significantly outpaced the growth of the tech sector globally.

briefed.in gathers its data from a wide variety of public sources, as well as founders who self-report deal information. briefed.in’s methodology and data may differ to some degree from that of other sources with access to non-public information.

Round sizes balloon at all levels

In 2021, the total amount invested across all stages was up significantly from 2020, increasing by 103 percent for seed-stage deals; 90 percent for Series A deals; 367 percent for Series B deals; and 305 percent in Series C deals. This was also the case for deal volume: Series B deals, for example, doubled in 2021 compared to the previous year.

The report also identified a positive trend for the country: funding rounds, on average, are getting bigger. “Investment rounds, particularly post-seed, have become enormous, with round sizes and valuations effectively doubling in the last 18 months,” Rosenblatt said.

Several VCs have attributed this growth to abundant dry powder in the venture capital market, as well as low interest rates, which have led to favourable valuations for technology firms, which can lead to them raising more money per round.

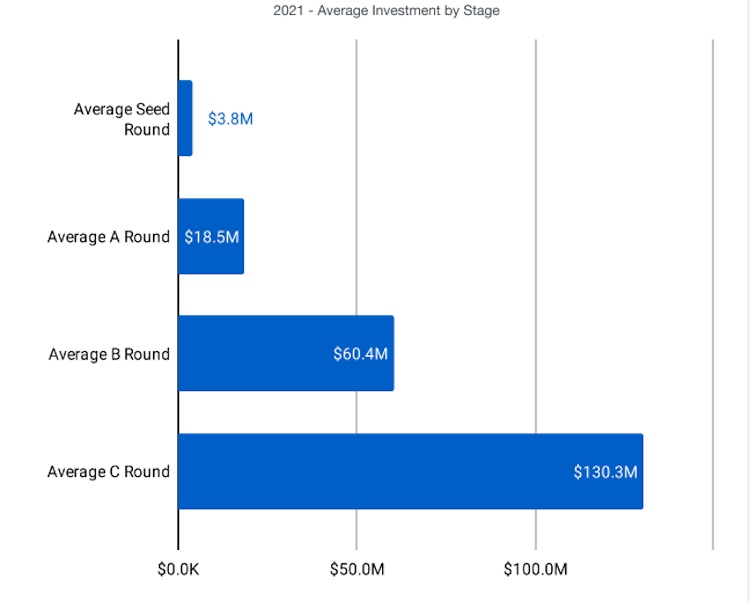

Per briefed.in’s analysis, the average size of seed-stage deals increased by 65 percent to $3.8 million. The average Series A deal size in 2021 totalled $18.5 million, a 52 percent increase from 2020.

In the later stages, the growth in average sizes was even more notable. The average Series B funding round totalled $60.4 million in 2021, a 115 percent increase year-over-year. For Series C deals, the average deal size totalled $130.3 million, nearly triple that of 2020.

The largest venture rounds of the year included Faire’s $500 million Series G round of funding, Trulioo’s $476.1 million Series D funding round, and Dapper Labs’ $385.2 million round of funding (Dapper Labs raised another round in 2021 that exceeded $300 million).

Mega-rounds, meaning deals totalling $100 million or more, were once a rarity in the Canadian tech sector. In 2021, they were far more frequent. According to briefed.in’s data, more than 40 Canadian startups secured at least one mega-round last year.

Early-stage activity rebounded, but gap far from filled

In 2020, there was a growing concern about the low number of early-stage investments in Canada. This was particularly true in western ecosystems like those of BC and Calgary.

It appears most tech ecosystems in Canada, including BC and Calgary, managed to buck this trend in 2021. A total of 239 seed-stage deals closed across all of the five tech ecosystems last year, up 19 percent from 2020. Pre-seed deals nearly doubled from their 2020 levels.

In BC, pre-seed and seed-stage deals increased by 62 percent and 41 percent, respectively, while Calgary saw a 220 percent increase in pre-seed deals. Further east, Montreal’s pre-seed and seed-stage deals decreased by a minor three deals, while Toronto’s pre-seed and seed-stage deals both increased by a minimum of 20 percent over 2021.

RELATED: As 2021 breaks records, can the Canadian tech sector sustain its growth in 2022?

The story was different for the Waterloo Region, which saw seed activity nosedive in 2021. This dramatic decline was a surprising result for the region, which is typically known for its strong network of early-stage startup hubs.

Some ecosystem members have noted that while the increase in early-stage investment is a positive trend for the country, this gap is far from filled. Chris Neumann, BC-based partner at Canadian early-stage firm Panache Ventures, told BetaKit many Canadian firms are forced to raise larger amounts of capital from angel investors, which can be more challenging.

“Credit to all of the angel investors across the country who are at the foundation of our ecosystem, but we must not be under the false illusion that there is ‘enough’ early-stage capital in Canada,” Neumann added.

US dollars fuelled Canadian startup growth

For many, the Canadian tech sector’s record-busting venture activity in 2021 will come as no surprise. But briefed.in’s report highlights an interesting contributor to this growth: US firms. “We are seeing significantly more US investment firms involved in Canadian tech rounds,” Darling said.

For the first time since 2019 (when briefed.in began tracking investment), US investment firms involved in Series A deals outnumbered Canadian investment firms, and continued to outnumber Canadian firms in B and C stages.

Nearly 60 percent of the investment firms involved in Canadian deals were from US investors, which is almost double the representation of Canadian firms. Several Canadian investors also observed this trend last year.

“Global investors are becoming comfortable with the idea of supporting companies that build primarily for the Canadian market,” said Ameet Shah, partner at Golden Ventures.

This observation is also in line with other reports on 2021 investment. L-SPARK’s State of SaaS report, released in the fall, also found the growth of US investors in Canada outpaced that of Canadian investors.

With interest rates expected to soar in the next few months, several experts expect the VC market will cool this year. While it’s not clear whether Canadian tech will beat its funding records again in 2022, there is a general consensus that the sector reached an inflection point in 2021.

Feature image source: Romain Dancre via Unsplash.