A recent report from the Canadian Venture Capital and Private Equity Association (CVCA) has outlined stats for the VC investment deals occurring in Q4 2018. A total of $1.3 billion was invested in more than 165 deals in the quarter, bringing the year-end VC investment total to $3.7 billion.

The report, titled VC & PE Canadian Market Overview, was conducted by the CVCA, and only included completed equity or quasi-equity venture capital deals. The study did not include project-based government funding, angel financing, and venture capital-backed acquisitions.

The total dollar amount of VC investments made in 2018 is comparatively similar to 2017. Last year’s total investments were only two percent lower than 2017, where a total of $3.8 billion was invested. For the first half of 2018, CVCA reported total VC investments of $1.7 billion across industries.

A similar PwC Canada MoneyTree report found that Canadian tech companies raised a record $4.6 billion in VC funding over 2018, compared to $3.4 billion in 2017.

Investment hubs

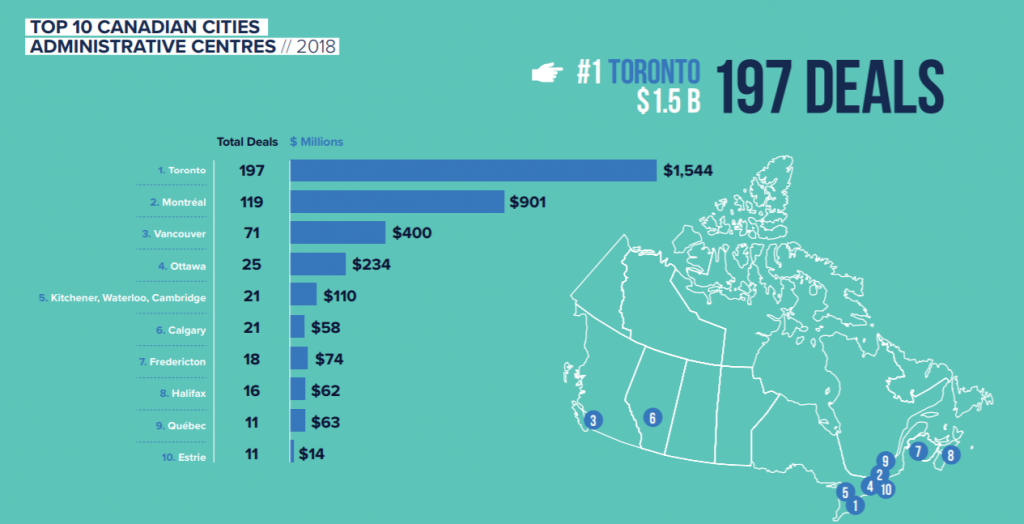

According to CVCA, in 2018, the majority of VC deals occurred in Toronto. A total of 141 of the 165 deals happened with Toronto-based companies, representing $1.5 billion of all deals Canada-wide. This means Toronto companies received 41 percent of total dollars disbursed. Following close behind was Montreal, which received 24 percent of all dollars disbursed, with a total of 119 deals, making up $901 million.

The next closest contender was Vancouver, which saw an 11 percent share of VC funding; this included 84 deals occurring in the city, representing $441 million.

Tech wins top investments

There were fifteen ‘mega-deals’ (investments of $50 million or more) in 2018. This accounted for a 30 percent share of total dollars invested, down from the 39 percent share in 2017. The report also looked at VC activity by deal size. About seven out of 10 deals in 2018 were under $5 million, however, the average deal size was $6.1 million, a three percent decrease from last year.

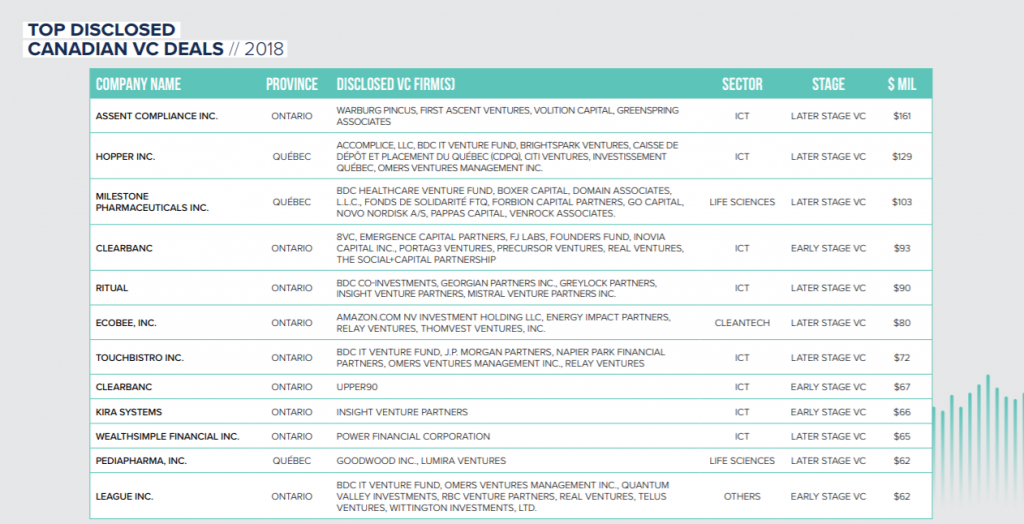

Many of the top disclosed Canadian VC deals in 2018 occurred in the information and communications technology (ICT) sector. The largest deal, $161 million, was secured by Assent Compliance, a supply chain data management company based in Ottawa. Last October, BetaKit reported Assent’s $131 million Series C funding round, which came after a $40 million Series B in 2017.

The second largest deal was received by Montreal-based Hopper, a travel app. The company raised $129 millionin one deal, after raising $82 million for its Series C funding round. Clearbanc, which provides funding for entrepreneurs’ marketing activities, appeared twice on CVCA’s list of largest deals. The company raised $93 million in November and $67 million a month later.

Toronto’s Ritual was also on the list on largest deals made, securing a $90 million Series C, along with TouchBistro, which closed a $72 million Series D last year. Robo-advisor Wealthsimple raised a notable $65 million early in 2018, bringing the company’s total investments to $165 million.

Overall, ICT secured the most amount of VC funding, with more than three times than the number of deals made in the life science sector, the second most VC funded industry in 2018.

When VCs are investing

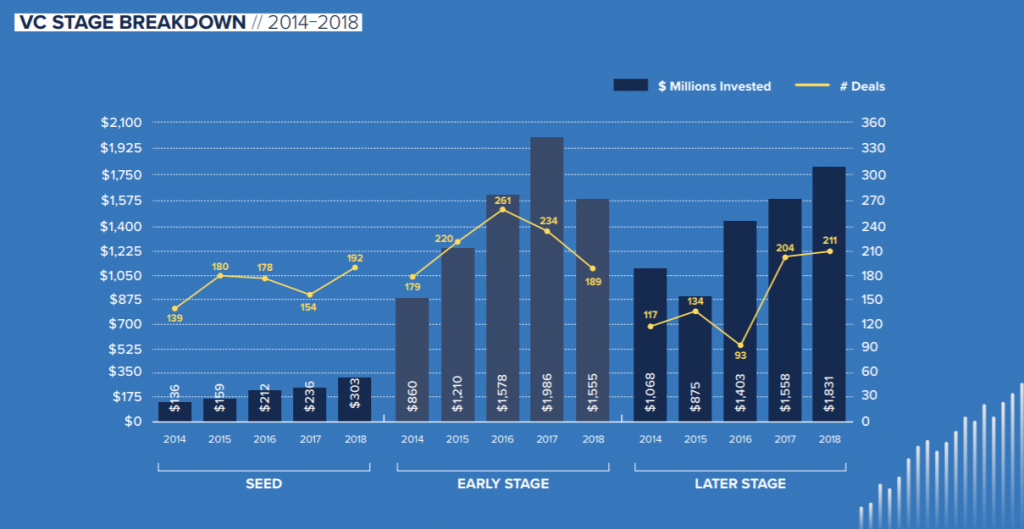

The report broke down the number and value of deals between seed, early stage, and later stage rounds. It found that the number of deals were fairly consistent across each funding stage, however, the most money was invested into later-stage rounds. About $1.8 billion was invested in later stages, with $1.5 billion was invested in early stages. Comparatively, only $303 million was invested in seed stages.

The number of rounds, as well as the size of the total rounds for VC firms, were also analyzed. Real Ventures was involved in the most rounds (59), which amounted to a total of $446 million. BDC Sector Funds, which includes BDC Healthcare Fund, BDC IT Venture Fund, and BDC ICE Fund, was involved in 30 rounds. The size of BDC’s rounds were the largest, however, at $533 million.

The CVCA report also looked at private equity investments in Canada. It found that the dollars invested tripled from Q3, hitting $6 billion in Q4. This brought the 2018 year-end total of private equity funding to $22.3 billion over 543 deals. The value of investments dropped 15 percent from 2017.

Featured image via Pixabay.