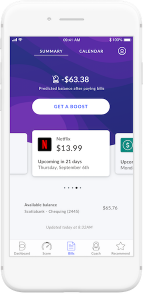

Toronto-based FinTech Borrowell has launched Borrowell Boost, a new suite of digital tools to help consumers track, manage, and pay bills on time. Borrowell Boost is currently in beta testing and is expected to become available in early 2020 on a monthly subscription.

“We’re really excited to be tackling what we know is a big pain point for many of them.”

– Andrew Graham

Borrowell Boost, created to target the 53 percent of Canadians living paycheck to paycheck, links to a member’s existing bank account, enabling them to track their bills and notifying them of upcoming payment due dates. The tool then uses predictive technology to determine the likelihood of insufficient funds and offers the member an interest-free advance to prevent ‘non-sufficient funds fees’ and help safeguard credit scores.

“We’ve spent a lot of time over the last year speaking to [customers] and trying to understand their financial needs and their pain points. What we heard, again and again, is that it can be very challenging to pay bills,” said Andrew Graham, CEO and co-founder of Borrowell, told BetaKit. “Fifty percent of families in North America live paycheck to paycheck without a lot of wiggle room, and ensuring that bills get paid on time is so important in terms of maintaining and improving your credit score. It’s also important to just relieve the financial stress that so many people feel.”

Boost signifies a new push for Borrowell into what Graham called the “income streaming” category, which refers to the process whereby people can stream a percentage of their earned wages into their bank account before their payday. Graham called this “the biggest new direction” for Borrowell since it launched its free credit score tool in 2016.

Companies like Dave in the United States and Wagestream in the United Kingdom are doing similar things; with Dave providing interest-free advances and Wagestream helping employees take out a percentage of their income for a small, flat fee. Graham said the emergence of these sorts of companies signifies a great deal of interest in this income streaming or paycheck to paycheck space, which he said has been left untapped in Canada.

“This is a really new category for us and it’s a new category in the Canadian market,” Graham said. “It sets us up to be able to offer a tier of more premium services that will help solve problems beyond [those that are] just credit-related. We’ve got great engagement from our users, and they look to us for many kinds of financial advice and assistance. We’re really excited to be tackling what we know is a big pain point for many of them.”

Borrowell, founded in 2014, offers free credit score and report monitoring, automated credit coaching tools, educational resources, and AI-driven financial product recommendations, as well as a fixed-rate personal loan. The startup generates its revenue through a loan service as well as by referral fees each time a customer uses one of its recommended products. The startup’s app, which gives users free access to their Equifax credit score and report, as well as access to customized product recommendations, became available earlier this year.

This launch closes out a big year for the FinTech startup, the highlights of which include a $20 million Series B, the release of its AI-powered free credit monitoring app called Molly, and reaching one million users.

Image courtesy Borrowell