According to CB Insights and PwC’s Canada’s latest MoneyTree report, 2017 is off to a slow start for VC funding in Canada.

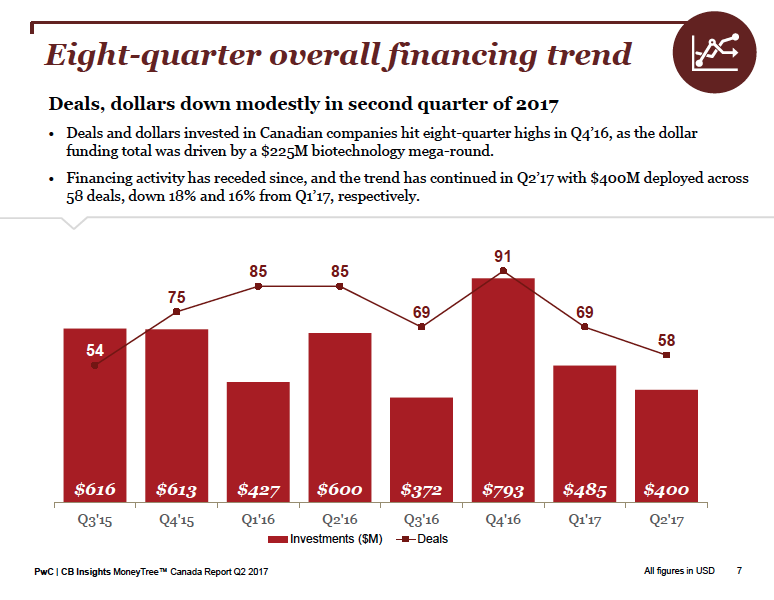

The report looks at VC activity in Q2 and provides perspective on the first half of this year overall (all dollar amounts in the MoneyTree Canada report are in USD, and have been converted to CAD throughout this article). Canadian VC-backed companies saw $504 million ($400 million USD) in total financing across 58 deals in Q2 2017, down 18 and 16 percent from Q1 2017, respectively. In Q1 2017, Canadian VCs invested $623 million ($460 million USD) in 64 deals.

Activity has also slipped since hitting a high in Q4 2016, when deal activity for VC-backed companies hit 91 deals.

Looking at annual financing trends since 2012, annual investment has been going up, but 2017 so far has been the lowest year since 2012. In the first half of this year, VC investments hit $1.1 billion ($884 million USD) through 127 deals, which puts Canada at half of 2014’s $2 billion ($1.7 billion USD) in 245 deals. Overall, 2017 to date is the second lowest year after 2012’s $1.03 billion ($825 million USD).

Deals and dollars hit an eight-quarter high in Q4 2016 thanks to BlueRock Therapeutics’ $295 million ($225 million USD) funding round. As this quarter has only seen $504 million ($400 million USD) deployed across 58 deals, it’s clear financing has receded. Q2 2017 is the second lowest quarter of deals and dollars since Q3 2015, when $776 million ($616 million USD) was deployed across 54 deals.

2017 is on pace to be the lowest in deals and dollars since 2014.

“While deal volume is down slightly this quarter, we’re encouraged by consistently higher average deal sizes, indicating Canadian companies are attracting larger investment from top VCs increasingly focused on the Canadian tech sector,” said Chris Dulny, national technology industry leader at PwC Canada.

There are a couple of trends to be optimistic about, according to this report: corporate participation and interest in the AI sector.

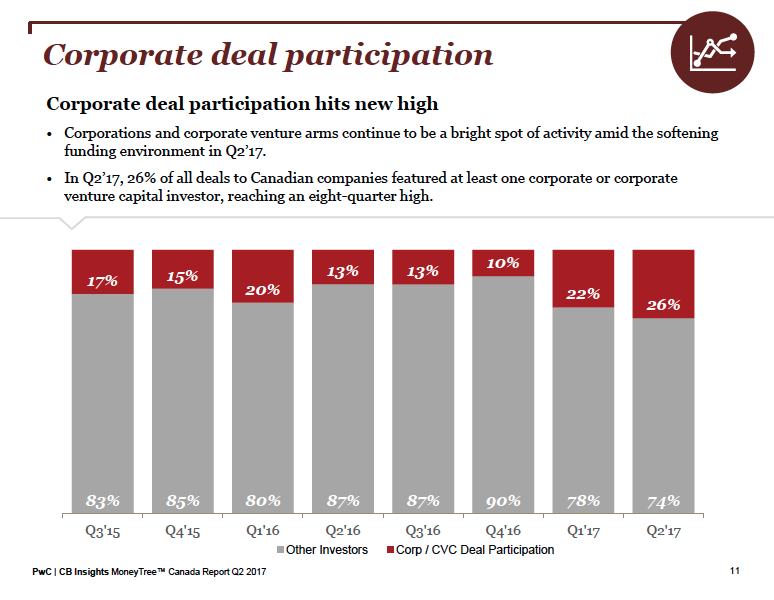

Corporations and corporate venture arms seem to be filling a gap in a softening funding environment in Q2 2017. This quarter, 26 percent of all deals to Canadian companies included at least one corporate or corporate venture capital investor, reaching an eight-quarter high since Q3 2015.

“Canadian technology companies continue to see strong interest from corporate investors,” said Michael Dingle, National Deals Technology Leader at PwC Canada. “This quarter’s corporate participation trend was driven by Element AI’s Series A mega-round, attracting heavy interest from several corporate investors and underscoring Canada’s opportunity to be a global leader in AI.”

The report references current AI interest from VCs as a “gold rush” led by Montreal-based Element AI’s $137.5 million ($102 million USD) Series A. Thanks to that Series A, annual funding to the AI space hit a record high through the first half of 2017, with $204 million ($162 million USD) across 12 deals. The prior year, only $44 million ($35 million USD) was invested in 16 deals. Element AI was also the largest funding round of Q2 2017 overall.

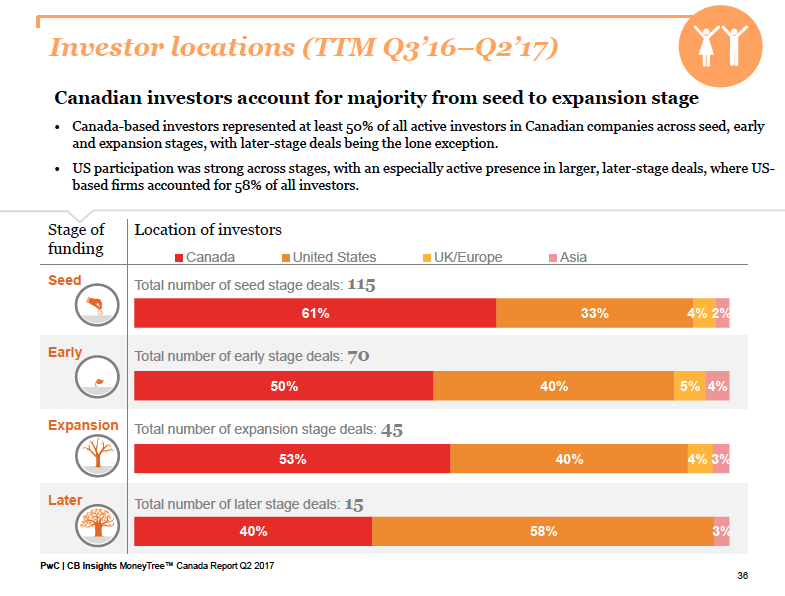

Overall, Canadian investors continue to be extremely active in seed, early, and expansion stages.

Digital health got a nod for being an industry on the rise in VC funding because of PointClickCare’s $111 million ($85 million USD) funding round in February. While this puts digital health at $133 million ($106 million USD) across six deals, the report said that at its current pace, annual digital health deal activity will fall short of last year’s $88 million ($70 million USD) across 15 deals, and decline for the third straight year.

So far, BDC is maintaining its place as Canada’s most active investor, with 12 deals in Q2 2017. 500 Startups followed with six deals, while Real Ventures invested in five deals in the quarter.

Overall, Canadian investors continue to be extremely active in seed, early, and expansion stages; Canada-based investors represented at least 50 percent of all active investors in Canadian companies across seed, early, and expansion stages. Canadian investors were particularly active at the seed stage, with 61 percent of participating investors in 115 deals hailing from Canada.

This is consistent with past trends, as Q1 2017 saw early-stage investing by Canadian investors reach an eight-quarter high.

The only exception was later-stage funding, where only 40 percent of investors in these deals were Canada-based. The US dominated this category at 58 percent, and in earlier stage categories, the US never surpassed 40 percent.

The full PwC MoneyTree Canada report in English can be downloaded here.

Pour lire en français, cliquez ici.

BetaKit is a PwC MoneyTree Canada media partner.