Canadian VCs invested $623 million ($460 million USD) in Canadian companies in Q1 2017, according to a new MoneyTree Report from PwC Canada and CB Insights. The second joint report containing Canadian data, this latest edition examines Canadian VC deal activity for Q1 2017 (all dollar amounts in the MoneyTree Canada report are in USD, and have been converted to CAD throughout this article).

Deal activity dropped 25 percent through the quarter from Q4 2016, with deals in Q1 2017 hitting the lowest figure since Q3 2015, down 19 percent year over year. However, deals and dollars into Canadian companies had hit eight-quarter highs in Q4 2016, with investment figures fuelled by BlueRock Therapeutics’ $295 million ($225 million USD) biotechnology mega-round. Overall, total deal investment was up 10 percent over Q1 2016’s total of $567 million ($419 million USD).

“Encouraging year-over-year increases in total funding dollars and average deal size in Q1 indicate growing confidence and capacity within the venture capital community as well as the continuing solid fundamentals of the Canadian technology industry,” said Chris Dulny, National Technology Industry Leader at PwC Canada.

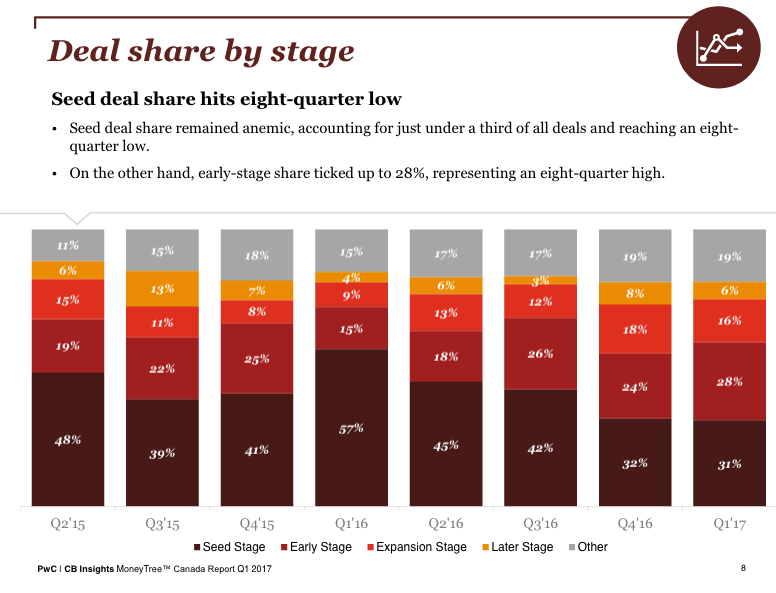

Seed deal share remained low in Q1 2017, accounting for just under a third (31 percent) of all deals and reaching an eight-quarter low, while early-stage funding ticked up to 28 percent, representing an eight-quarter high.

In a deep-dive on Canadian VC activity in 2016 following the 2016 MoneyTree report, PwC’s Shivalika Handa told BetaKit that seed stage funding took a majority of dollars (56 percent) in 2016. In Q1 2016, 54 percent of Canadian VC funding was dedicated to early stage startups; by Q4 2016, that number dropped to 37 percent.

“The growth of post-seed investments in recent quarters supports anticipation of greater exit activity in 2017 as Canadian tech companies mature and become attractive to public markets and strategic buyers,” said Dave Planques, National Deals Leader at PwC Canada.

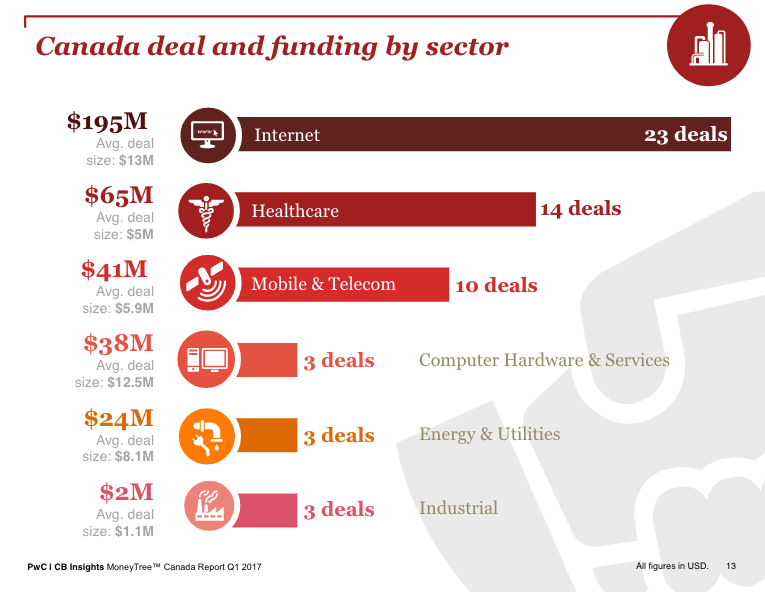

The Q1 2017 MoneyTree report also analyzed the top sectors that received the most VC attention. Internet companies were the most active at 23 deals and a total of $264 million ($195 million USD) invested. Healthcare companies came second at $88 million ($65 million USD) invested, with healthcare deals reaching an eight-quarter high; deal count in this sector also rose for the second consecutive quarter, reaching a two-year quarterly high of 14. Mobile and telecom came third with $55 million ($41 million USD) invested.

Internet deal share recovered slightly following several downward quarters, jumping up to 36 percent in Q1 2017. This figure is still significantly lower than the peak of 52 percent seen in the same quarter last year. Looking at eight-quarter financing trends for internet companies, funding rose 23 percent on a quarterly basis to $264 million ($195 million USD) in Q1 2017, although deal count slowed to 21 percent, the lowest figure since Q3 2015.

Toronto and Montreal maintained their position as Canada’s top two markets for deals in Q1 2017.

Ontario took a vast majority of deals and dollars (34 deals totalling $387 million, or $286 million USD) in Q1 2017, while Quebec came second (15 deals totalling $121 million, or $90 million USD) and BC followed ($108 million, or $80 million USD in 11 deals). This is consistent with an overall 2016 trend seen in last year’s MoneyTree report, where Ontario, Quebec, and BC took the vast majority of deals and dollars, respectively.

Toronto and Montreal maintained their position as Canada’s top two markets for deals in Q1 2017, though in Toronto, deals and dollars generally trended downwards. Investment rose on a YoY basis, with deals up four percent and dollars up 239 percent from Q1 2016, sitting at $307 million ($227 million USD). Deal count and total dollars invested have both tumbled after rising to highs in Q4 2016, although last quarter’s funding was boosted by BlueRock Therapeutics’ $295 million CAD round.

In comparison, Montreal deal activity rose by 56 percent, though dollar activity was down 29 percent to $104 million ($77 million USD). Ottawa and Waterloo both cooled down in terms of deal activity; Ottawa’s deal activity ticked slightly upwards with four deals, in comparison to three in Q4 2016. Waterloo deal activity slowed to an eight-quarter low, with $18 million ($14 million USD) across two deals. In 2016, Thalmic Labs’ $158 million round boosted the city’s total funding for the year to $333 million ($253 million USD), though Waterloo-based companies only saw 16 deals that year.

PwC Canada described Vancouver as “modest,” relative to its eight-quarter range, with $108 million ($80 million USD) invested in Vancouver-based companies across nine deals in Q1 2017.

“The presence of international firms continues to complement Canada’s home-grown investor ecosystem.”

– Anand Sanwal,

CEO and co-founder,

CB Insights

The largest deals in Q1 2017 so far include Mississauga-based PointClickCare, which raised $115 million ($85 million USD); Vancouver-based Visier, which raised $60 million ($45 million), and Mississauga-based CSDC Systems at $40 million ($30 million USD).

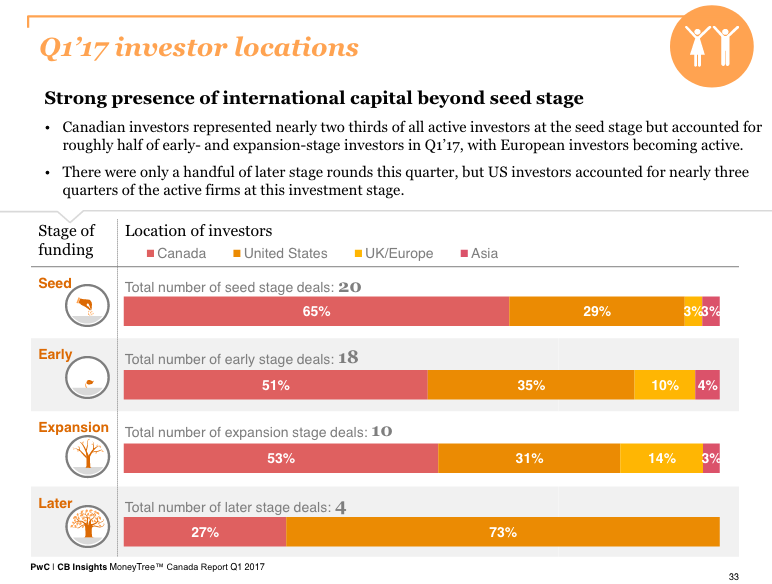

Canadian investor participation in early and expansion stage startups hovered around 50 percent in Q1 2017, while US participation never surpassed 35 percent. PwC noted that European investors are becoming active in Canadian later-stage rounds, as UK and European firms represented 14 percent of active investors in expansion-stage financings, versus just three percent for seed-stage rounds.

In PwC Canada’s 2016 deep-dive, a significantly larger percentage of Canadian VC deals were in the seed stage, compared to the US. Q1 2017 also speaks to this trend; Canadian investors represented nearly two-thirds of all active investors at the seed stage (65 percent), but PwC Canada was optimistic about Canadian investors becoming more active beyond the seed stage.

“Despite a few larger late-stage deals funded by international players, Canadian investors are staying active in deal activity beyond seed stage—an interesting trend to monitor as Canada’s technology industry continues to scale,” said Christine Pouliot, Deals Partner at PwC Canada.

There were only four later-stage investments in Q1 2017, but US investors accounted for nearly three-quarters of the active firms at this investment stage (73 percent). Canadian investors made up 27 percent of later stage deals.

Twenty-three percent of all deals to Canadian companies featured at least one corporation or corporate venture capital arm participating; the participation rate matched Q2 2015 for an eight-quarter high.

“Although quarterly funding saw a pullback to start the year, there were a number of positive indicators for the Canadian financing environment,” said Anand Sanwal, co-founder and CEO of CB Insights. “Namely, the presence of international firms continues to complement Canada’s home-grown investor ecosystem, and the influx of corporate backers this quarter also represents a growing source of capital.”

The full PwC MoneyTree Canada report in English can be downloaded here.

Pour lire en français, cliquez ici.

BetaKit is a PwC MoneyTree Canada media partner.