Venture firm White Star Capital has released an updated report outlining developments in the Canadian tech ecosystem over the past several years.

The report provides an overarching view of the Canadian tech space based on third-party studies from organizations like CB Insights and the CVCA. The international firm—which raised a $232 million fund in June—released a report last year to showcase why it was bullish on the Canadian ecosystem.

“We have doubled our team in Canada since our last report with the addition of a new principal and CFO in our Montreal office, and completed two new investments in Canada this year,” said Sanjay Zimmermann, associate at White Star Capital. Zimmermann noted that the firm has made several new investments and follow-ons this year, including Drop, Vention, and Dialogue. “As a result, Canada is a core market for us and we want to keep sharing our excitement for the market domestically and internationally with this report.”

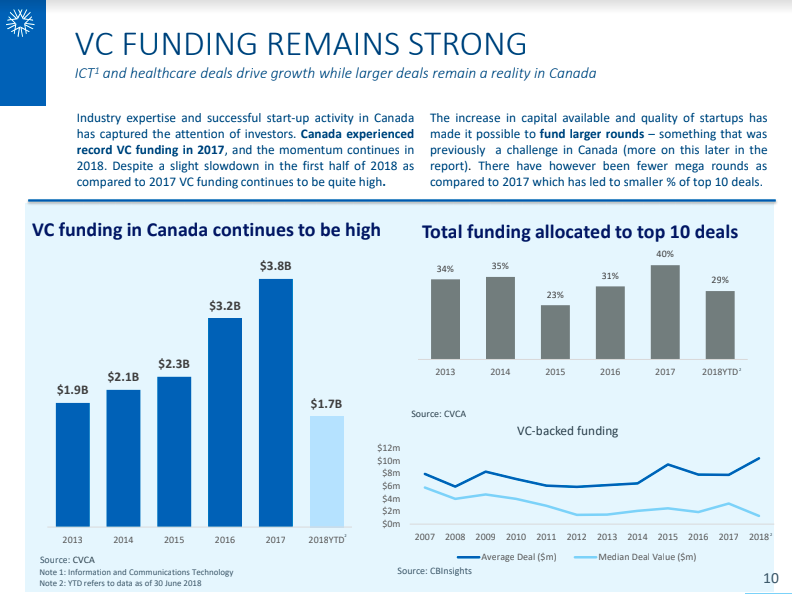

White Star notes that there’s been a 50 percent increase in seed-stage deals over the past 10 years, and that VC funding in the country remains strong after hitting a record last year. At the same time, White Star notes that there has been a lower percentage of seed stage deals over the past three years, a sign that the economy is maturing.

Georgian Partners topped the list of biggest funds closed thus far with $714 million CAD, while BDC came in second with a $130 million spin-out fund. Golden Ventures ($72 million), MKB ($50 million), and Panache Ventures ($25 million) were among the top five.

“The increase in capital available and quality of startups has made it possible to fund larger rounds – something that was previously a challenge in Canada,” the report reads.

AI, ecommerce, IoT, and FinTech were called out as industries with the most activity over the past three years. Though there have been no IPOs for VC-backed companies to date, White Star notes that rising interest rates at the start of the year drove companies to stall their IPOs until next year.

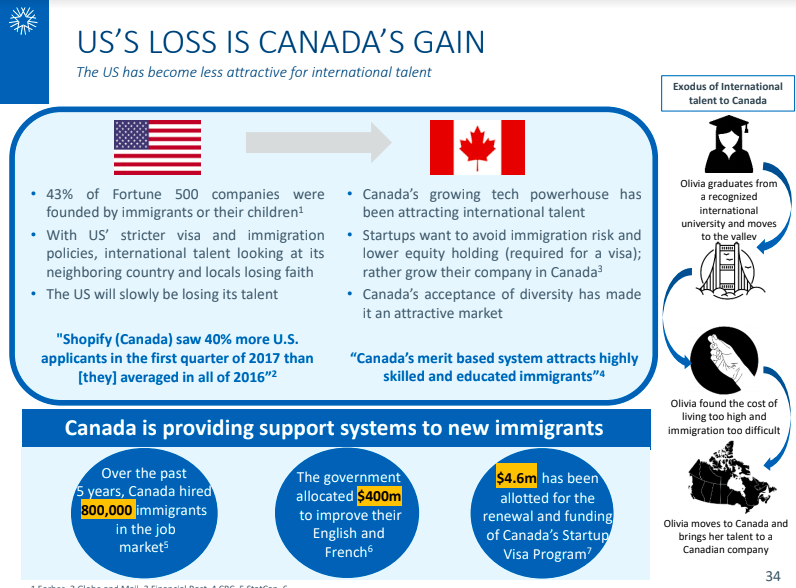

In its Canadian public sector breakdown, White Star includes the Canadian government’s efforts in the area of diversity, such as the Women Entrepreneurship Strategy and dedicating $1.4 billion to women-led companies through the BDC.

Deep diving on VC and angel investor activity, White Star breaks down the largest VC funds in each region. Vanedge Capital takes the top spot in BC; Georgian Partners was the lead for Ontario; Enertech Capital led in the Prairies, and White Star named its own firm as one of the largest fund in Quebec. The angel investor landscape is particularly strong in Ontario and Quebec, with the average deal size in 2017 sitting at $1.09 million across the country.

“One interesting trend we observed is that while we are seeing growth in mega rounds over $100 million, there still seems to be a funding gap in the $20 million to $100 million rounds which have been flat over the last few years,” said Zimmermann.

Download and access the full report here.